Year-end data sheds light on supply and demand trends

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, addresses propane supply and demand.

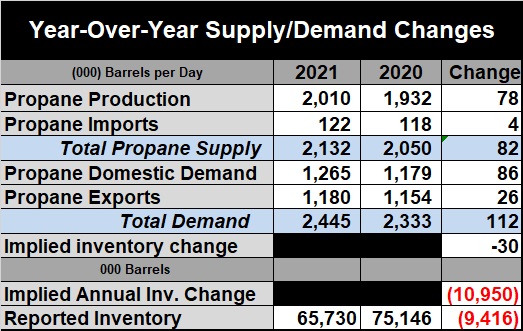

With the end of 2021, we were curious to take a look at year-over-year changes in propane supply and demand.

In its last report of 2021, the U.S. Energy Information Administration (EIA) reported U.S. propane inventory at 65.730 million barrels, compared to the last report of 2020 at 75.146 million barrels. That is a 9.416-million-barrel decline in inventory position.

Throughout the year, the EIA provides weekly estimates on inventories and all of the data points that affect supply and demand. It is important to know that these are estimates. The official numbers for the year will not be available until the end of March. Table 1 is built from the weekly estimates provided in the Weekly Petroleum Status Report.

Even though all of these numbers will be adjusted in about 2 ½ months, they are still useful in giving us an idea of how propane supply and demand are trending.

Before we start delving into these numbers, let us remind you the EIA process in providing this data. The most important part of the process is that it does not collect data from retailers and petrochemical companies on how much they are selling or consuming. It gets reports from propane producers (refineries and gas plants), propane importers and exporters, and propane storage operators. It takes all of those numbers and then calculates what domestic propane demand must have been given those numbers. Typically, it is domestic demand that will see the largest adjustment when the official numbers come out, and that adjustment is usually lower.

U.S. propane production fared far better than one might have hoped in 2021 given the significant drops in crude and natural gas production. We believe there was a backlog of Y-grade (NGL mix) available that allowed increased fractionator capacity to help propane production outpace both crude and natural gas production during the front half of 2021.

Propane imports were up slightly and fared better than we feared. Canadian producers are focused on the Asian and Mexican markets via ship and train, leaving the U.S. as the market of last resort. However, shipments to Asia were impacted by COVID-19, and Canadian inventories were very high at the beginning of the year. That encouraged more exports to the U.S. during extreme cold at the beginning of 2021. But imports were lagging through the second half of the year.

Propane exports were up less than we expected, but this is an area that is likely to see an upward revision when the official data is released at the end of March. Propane dehydrogenation plants continue to be built around the world. That should keep global demand growing.

There is no doubt that the biggest surprise is domestic demand. Petrochemicals consumed 281,000 barrels per day (bpd), according to industry data, which was up 20,000 bpd over the previous year. That means retail demand was up a whopping 66,000 bpd. Again, this is a number that likely gets revised down when the official numbers come out, but there will almost certainly be a net gain.

Of course, a big factor was the high heating demand during the second half of last winter. It’s hard to forget the bone chilling cold last February. On the other hand, the slow start to this winter has offset that a lot. We still contend that the pandemic has had a positive impact on U.S. propane demand for home consumption. Workers and students normally at businesses, schools and industrial facilities that likely used natural gas as heat have been stuck at home where propane is more likely used. Home thermostats that may have been turned down during the day before may not have been during the pandemic. Plus, there would likely be more demand for cooking, water heating and grilling.

The bottom line is that the weekly data from the EIA showed that demand exceeded supply by 30,000 bpd, resulting in around a 10-million-barrel draw in propane inventory. That helped support higher propane prices. Of course, if the trends from 2021 were to continue in 2022, inventory would get even tighter and prices would go even higher. But the market has an amazing ability to respond to imbalances. Imbalances cause changes in prices, and those changes in price cause the market to respond.

We saw a small example this week. Propane prices went on a run, prompting buyers of U.S. propane for export to sell the barrels they had accumulated back into the U.S. market instead of loading for export. That killed the rally in propane and drove prices back down. At some point, those cargoes will start loading again, and prices will likely stabilize. Of course, winter weather will have a lot of impact on how prices move for a couple more months.

As that demand fades, inventories will likely build at an above-average pace at current propane prices. That should take some of the price pressure off of the market. Then, it will become a balancing act between production and exports to determine where we stand on inventory to start next winter. There should be more crude and natural gas production this year, which will help propane supply. How demand goes will be largely determined by how the global economy fares. If central banks raise interest rates and stop accommodative monetary policies, it could hurt the global economy and thus propane demand. But there are plenty who still believe energy demand will increase in 2022 as the world claws its way back from the impacts of the pandemic.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.