Understanding perplexing propane demand

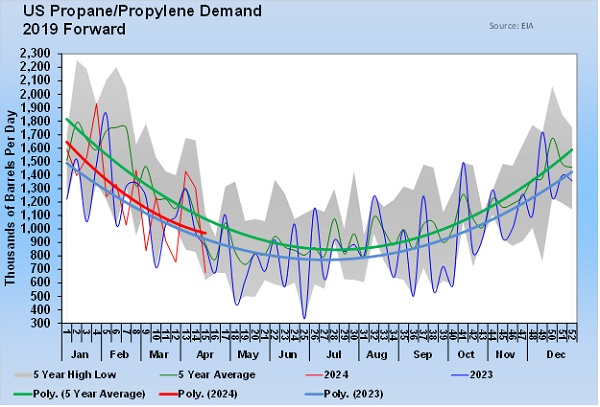

For the week ending March 25, the Energy Information Administration (EIA) reported U.S. propane/propylene demand at 1.069 million barrels per day (bpd), a number considerably higher than the 893,000 bpd for the same week in 2015.

Expanding the year-on-year comparison from the last week in February until March 25, propane/propylene demand was 1.302 million bpd. The demand for the same period last year was 1.256 million bpd. It is perplexing that U.S. heating degree-days were 21 percent less this year compared to last year during that period.

Those demand numbers include propylene, which is only used by petrochemicals. Removing the propylene makes the numbers more retail-demand specific. Last year, propylene production was at 236,000 bpd. The latest data has it at 293,000 bpd. Deducting propylene puts last year’s fuel-use propane demand at 1.020 million bpd and this year’s at 1.009 million bpd.

In addition to the propylene, petrochemicals consume spec or fuel-use propane. During March 2016, we estimate petrochemicals consumed 400,000 bpd of spec propane compared to 329,000 bpd in March 2015. Deducting the petrochemical spec propane use, EIA numbers would suggest retail demand of 902,000 bpd in March 2016 compared to 927,000 bpd in March 2015. Yet the difference in heating degree-days suggests this year’s demand should be around 712,000 bpd.

Demand is an implied number, meaning EIA collects data on imports, exports and inventory changes and then calculates demand for its weekly estimates. If EIA is off on these inputs, then demand can be incorrectly estimated.

We often see corrections when EIA reports official figures about three months after the weekly estimates. One thing we have to consider is that EIA is understating exports, which could result in demand being overstated. Currently, EIA is estimating exports at 632,000 bpd, and they have been at that rate for five weeks in a row.

In February, EIA estimated exports at 702,000 bpd at a time the industry was reporting 960,000 bpd in propane exports. The difference between the EIA estimate and the industry estimate was 252,000 bpd for February.

In our calculations above, we deduced that retail demand could be overestimated by as much as 214,000 bpd based on the light number of heating degree-days. It is possible those barrels should be showing up in exports rather than domestic demand.

Interestingly, during March 2015, propane inventory increased 2.290 million barrels compared to a decline of 240,000 barrels this March. We are fairly certain it is the increase in petrochemical use and increased exports – not retail propane demand – that is accounting for the difference. It should be fairly interesting in a few months to compare the official export number from EIA with the current weekly estimates.

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.