The effects of OPEC’s production controls on pricing

The major news last week was the conclusion of the ballyhooed meeting by the Organization of the Petroleum Exporting Countries (OPEC) in Vienna, Austria. In September, OPEC said it was going to cut production to support crude prices and that it would have the details of the plan by its regularly scheduled meeting, which concluded Nov. 30.

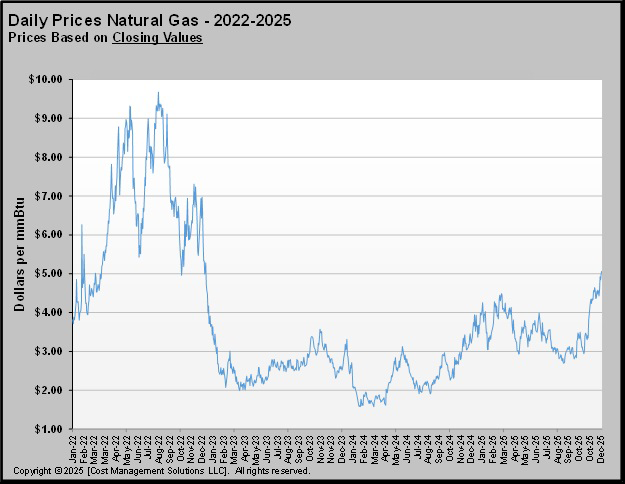

Of course, in September, after OPEC announced its intentions to cut production, crude prices rallied. West Texas Intermediate (WTI) ran about $43.44 per barrel before the proposed agreement was announced. Prices rallied to $51.60 by Oct. 19.

After the Oct. 19 high, crude prices drifted lower as traders and analysts doubted OPEC members could overcome political differences in order to agree upon individual member production quotas. Crude prices dropped to $43.32 by Nov. 14, as the doubts about OPEC’s resolve grew.

Prices began to recover on short covering and other defensive measures by traders as the OPEC meeting neared. But prices then retreated over the Thanksgiving holiday as comments from OPEC suggested a deal might not get done.

In the end, OPEC managed to hammer out expectations for each of its member countries concerning production quotas that will reduce their combined output to 32.5 million barrels per day (bpd). That will be a reduction of about 1.2 million bpd.

This was the first cooperative agreement by the cartel since 2008 to reduce output. In November 2014, OPEC abandoned efforts to use production controls to support prices. OPEC’s reason for abandoning those efforts was that any measures it took to support prices would simply be offset by new crude production from shale formations in the United States. Instead, OPEC’s strategy became to maximize production and gain market share at the expense of higher-cost producers, thus maintaining needed revenues while hurting its primary competition, U.S. producers. Essentially, OPEC had begun to see itself simply subsidizing high-cost U.S. producers, and that was a practice it was unwilling to continue.

OPEC expected to destroy U.S. producers with its new strategy, then see global demand increase. This would allow it to greatly increase revenues over the long term, thus offsetting the short-term losses from implementing the strategy. However, U.S. producers were not destroyed and global demand has yet to catch up to the new production levels, causing a major glut of crude oil globally.

The result was a collapse of crude prices far below what OPEC had envisioned. It imagined crude finding a floor around $50 per barrel, believing U.S. production would fall much more rapidly than it did. The result was WTI crude hitting a low of $26.40 in February of this year. Global benchmark Brent crude posted a low close of $27.88 in January. Consequently, OPEC nations and other major crude exporters, all of whom are highly dependent on oil revenues to balance massive government social programs, suffered the most from the global glut of crude.

Through much of the year, OPEC has considered resuming its role of artificially supporting prices through production controls. Those considerations culminated with the Nov. 30 agreement. Under the agreement, Saudi Arabia will cut production by 500,000 bpd, leaving its production just over 10 million bpd. Iraq, OPEC’s second-largest producer, will cut production by 200,000 bpd but will still have production of around 4.3 million bpd. The other major cuts will come from the Gulf Arab states of Kuwait, United Arab Emirates and Qatar. Combined, those three countries will cut 300,000 bpd. Other OPEC nations will chip in the other 200,000 bpd. Iran was exempt from cutting production but will cap its production at around 4 million bpd. It is reported that Russia was very instrumental in helping major rivals Saudi Arabia and Iran come to an understanding that would allow the production agreement to be completed. It shows the growing influence of Russia in the region.

Russia and other non-OPEC producers from the old Soviet Union have agreed to slowly cut a combined 600,000 bpd from production during the first half of next year in support of OPEC’s efforts. Russia is expected to contribute half of that cut but will still be producing at about 11 million bpd. In total, if all producers meet expectations, production will be cut by 1.8 million bpd by the middle of next year. It is the first time Russia has cooperated with OPEC since 2001.

Crude prices increased over 9 percent on Nov. 30, when the details of the agreement were announced. Prices have continued higher since. On Nov. 29, WTI closed at $45.23. Brent crude has had a similar increase and is at $54.15. We would expect Brent crude to move to $60 per barrel. However, major commodities giant Goldman Sachs does not believe crude prices are sustainable above $55 per barrel, even with the production cuts.

Part of the reason is that U.S. shale crude producers not destroyed by OPEC are waiting in the wings to increase production. Crude in the $55 range will be adequate for increasing U.S. drilling activity. The rally in prices will also allow producers to hedge future production at favorable prices.

Obviously, propane traders and retailers are all affected by the movement in crude. At least at this point, it seems appropriate to base planning around a high of $57 WTI and $60 Brent, and the likelihood of a settling in around $52 WTI and $55 Brent later in the winter. Improving global demand could push crude back toward the $60 by the middle of next year.

Consequently, the bulk of the longer-term impact on propane prices from this crude production agreement may already be baked into propane prices. But don’t be surprised by another 7-cent gain before the crude rally taps out and propane prices settle back to near where they are today. However, it is important to note, all of these price projections are based on no change in propane’s own fundamentals. In other words, it assumes propane remains valued at around 50 percent of WTI crude.

If U.S. propane fundamentals become more bullish as the winter progresses, as they likely will, propane prices will increase in relative value to crude, making them higher than the numbers mentioned above. Essentially, our discussion here gives some analysis on what we could expect from propane prices simply from the impacts of the crude producer production agreement. However, it does not consider the impacts of propane fundamentals such as production, domestic demand and export demand.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.