Declining crude oil supply supports higher propane prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains how current trends in crude drilling and production are impacting propane buyers.

Catch up on last week’s Trader’s Corner here: How to use swaps as price protection

OPEC+ is a group of crude-exporting countries that work together to balance crude supply with demand to maintain a price that is fair to both crude-importing and crude-exporting countries. At least, that is the official line. But in practice, the group just wants to make the most money it can from its crude oil.

OPEC+ originated from OPEC, a group of 13 member countries that was formed in 1960. That core group of 13 countries signed a cooperation agreement with 10 other crude-exporting countries to form OPEC+ with a total membership of 23 countries. OPEC is led by Saudi Arabia, and the key non-OPEC participant is Russia. The cooperation agreement among all 23 countries began in 2016.

The group establishes benchmark production rates for each country based largely on its capacities and history of production. When the group believes crude supply needs to be limited to support prices, it will establish a production quota for each member that is below each country’s benchmark production rate.

Through 2024, OPEC+ produced around 5.86 million barrels per day (bpd) below benchmark rates. That included 3.66 million bpd of cuts set by quotas and an additional 2.2 million barrels that were voluntary cuts by some of its members. The group announced earlier this year that the members making voluntary cuts would begin raising production to eliminate the voluntary cuts.

The increases began in April at a modest 138,000 bpd. From May through July, increases of 411,000 bpd per month were made. This month, the increase jumped to 548,000 bpd. The group just announced last week that it would make another 547,000-bpd increase in September. Combined, that is nearly 2.5 million bpd since April, which will have eliminated all the voluntary cuts and then some. It is certainly possible that OPEC+ will continue to increase production to the point that all its members are producing at their benchmark rates.

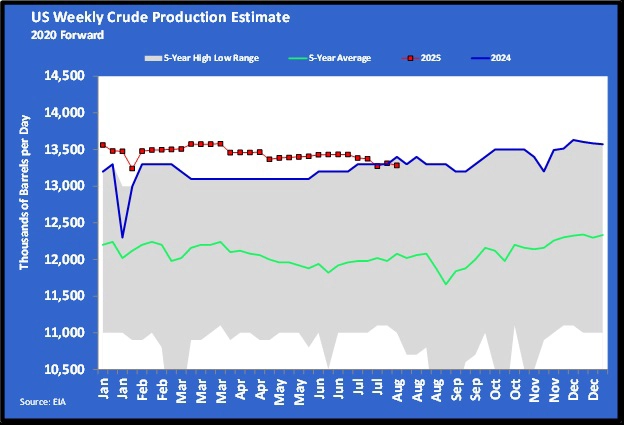

When OPEC+ cooperates by reducing supply, it lifts prices, which encourages countries that aren’t in OPEC+ to increase production, counteracting what OPEC+ hopes to accomplish. The United States is the biggest pain in the neck for OPEC+ in this matter. The United States increased its production from an average of 11.102 million bpd in 2021 to 13.442 million bpd so far this year.

That is an increase of 2.340 million bpd during the time that OPEC+ has been limiting production. Essentially, increased U.S. production offset the voluntary cuts of OPEC+ members. That doesn’t sit very well with those voluntarily cutting production and losing revenue.

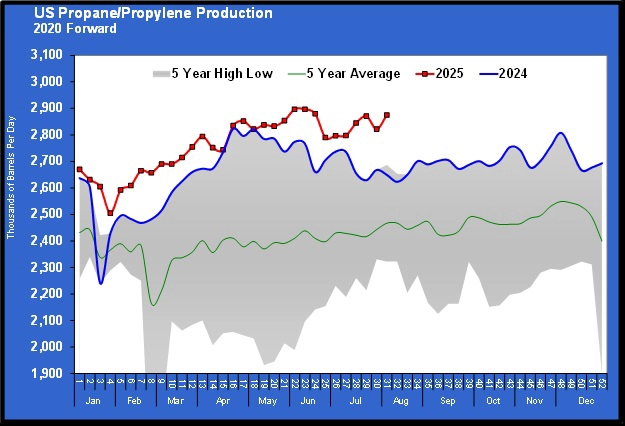

U.S. propane supply comes from oil and gas wells. Much of the fantastic growth seen in propane supply has been a result of more crude production. The associated production of propane from that increase has helped keep propane prices relatively low.

OPEC+ is pushing back now with its production increase. That increase has kept crude prices low, which is helping propane buyers. In fact, propane prices are at their best value of the year currently. Usually, the best values are at the beginning of summer, but this year, the actions of OPEC+ have changed the annual pricing dynamics.

However, the benefit to propane buyers is likely to be short-lived, and the remainder of this analysis will show why.

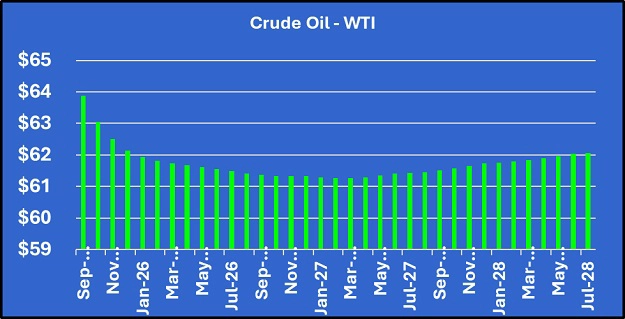

Most U.S. crude is coming from shale formations, which is more costly than conventional production from OPEC+ members. The cost to produce crude from shale formations is about $47 per barrel, or at least four times that of conventional production. The current crude price is $64.15.

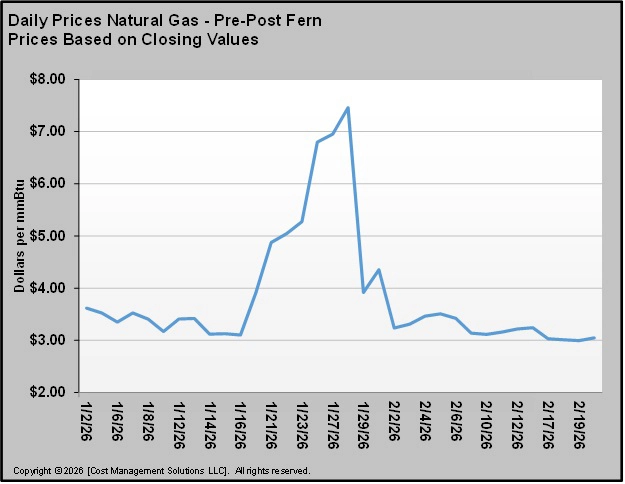

But to justify increasing production in the future, production companies will sell future production to make sure they can cover costs and make a profit. Below is the crude future’s price curve from last week.

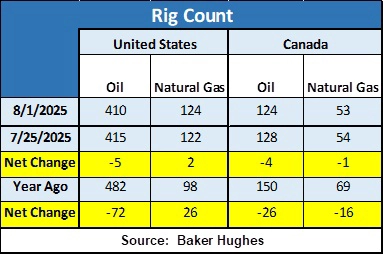

A producer trying to hedge future production would get even less than the current market. Given the high cost of borrowing money these days and what is needed on an investment to offset other high-yielding investment opportunities, drilling a crude well in a shale formation is having a tough time stacking up. As a result, production companies are reducing drilling activity in the United States.

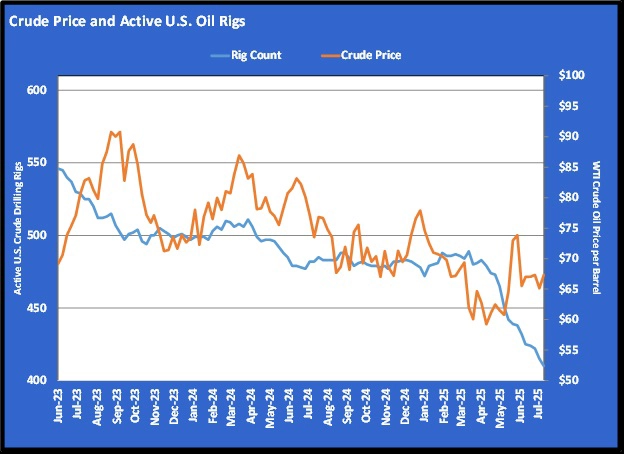

Chart 2 plots U.S. crude drilling against crude’s price. Drilling in the United States had already been on the decline as crude’s price trended lower, but note how the decline has dramatically increased since OPEC+ started unwinding its production cuts in April. U.S. producers are getting out of the way, making room for the increases in OPEC+ production. That is why crude prices have only been held in check by OPEC+’s increases but have not collapsed. This encourages OPEC+ to continue increasing its production, discouraging U.S. drilling.

There is a lag between drilling activity and production, so to this point, the decline in U.S. crude production has not been as dramatic as the decline in drilling activity. Still, the decline is underway.

According to estimates from the Energy Information Administration, U.S. crude production peaked in December 2024 at 13.631 million barrels. Since then, production has been trending lower. What prompted this Trader’s Corner was the fact that U.S. crude production fell below the same week the previous year for the first time since 2021, during the week ending Aug. 1.

So far, this decline is not showing up in propane production.

More drilling for natural gas is helping propane supply, but it is unlikely to completely stop propane supply from declining at current production rates. At this time last year, there were 482 rigs drilling crude wells and 98 drilling natural gas wells. Active crude rigs have dropped by 72 to 410 over the last year. Natural gas rigs have increased from 26 to 124.

Propane markets are already talking up the possibility of tighter supply in the future, and that is likely going to cause propane futures prices to rise. So far, the upward pressure hasn’t been bad, and the further-out winters are valued at good prices for buyers. But buyers need to be aware that the current drilling and crude production trends are working against them. The propane price curve has been shaped with future prices lower than current prices, known as backwardation, for a while. That is the normal shape of a commodity’s price curve. But buyers should probably not get complacent and assume that is going to continue. They probably shouldn’t be overlooking the current opportunity to set pricing for some part of their future supply below the 10-year price average.

As U.S. crude production declines, refiners will simply import more of what they need to keep their refinery throughput at the same rates. The amount of propane from the refining process won’t change as a result. But that is only 10 percent of the propane supply.

What will be harder to replace is the associated propane supply that has been coming from record-high domestic crude production. That replacement will have to come via more propane production from natural gas wells. The growth in natural gas demand could come from increases in electrical power generation due to artificial intelligence energy requirements domestically and continued growth in exports.

Producers prefer dry natural gas (which contains fewer natural gas liquids) for fulfilling LNG export requirements since it requires less processing. Consequently, the offset in the potential decline in propane from crude wells may be directly related to increased natural gas production to meet electrical generation needs for AI.

That is a lot of whats, ifs and ands. The simple response for propane buyers is to take advantage of lower propane futures prices and not gamble with all the unknowns concerning supply. What we know is that the current trends in crude drilling and production are against the buyer. Whether that will have an impact on propane supply or not will likely depend on increased demand for natural gas. Whether that will happen or not remains unknown.

Charts and table courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.