Supports spark rally in crude prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores the various factors behind the current spike in crude prices.

Catch up on last week’s Trader’s Corner here: Propane pricing reflects oversupplied market

During the second half of 2025, crude prices have generally been subjected to downward price pressures. WTI reached an intraday high of $78.40 on June 23. By Oct. 20, WTI set an intraday low price of $55.96 with talk of prices of $50 or even lower as a possibility.

Crude was driven lower on two primary factors. OPEC+ rapidly took production restrictions off its members. Some of those restrictions had been in place since the COVID-19 pandemic amid concerns about weaker demand. But during the period of restriction on production to support prices, OPEC+ had seen its market share decline. In April, OPEC+ took measures to end the market share erosion by aggressively lifting production controls.

The lifting of production controls was to allow OPEC+ members to aggressively recover market share they had lost to higher-cost producers. The expected lower price would hurt those higher-cost producers and cause their production to decline, hopefully offsetting the increase in OPEC+’s production.

The lower price resulting from OPEC+’s production increase did slow down drilling by higher-cost producers, but the decline in non-OPEC+ production has not been as fast as the rise in OPEC+ production, contributing to the decline in crude prices.

Further pressuring crude’s price has been the uncertainty about the global economy. Expectations have been for weaker growth, blamed primarily on the United States increasing tariffs on trade partners. Many responded to the U.S. tariff increases by increasing tariffs on U.S. goods. The trade wars and negotiations continue.

The combined impact has been the expectation of a high surplus of crude in 2026. Recently, the International Energy Agency said that crude production could exceed demand by as much as 4 million barrels per day (bpd) next year.

More recently, the ceasefire in Gaza, though tentative, took geopolitical pressure off prices. Also, a scheduled summit between President Donald Trump and Russian President Vladimir Putin gave hope for an end to fighting in Ukraine that would ensure Russian crude would continue to flow freely. The downward pressure on crude, along with high inventories and low demand, helped keep propane prices low.

However, since Oct. 20, crude prices have surged higher. Several developments are behind the increase. Initially, crude increased on reports that China was processing more crude. China has been putting about a million bpd into its storage this year, taking advantage of low prices. Its purchases had been the key reason that crude prices did not fall even lower during their downtrend. It appeared China had decided to start monetizing some of the crude it had been storing by making more refined fuels and exporting them.

Then the U.S. government announced it was going to buy a million barrels of crude for its Strategic Petroleum Reserve (SPR). The barrels are to be delivered into the SPR during December and January.

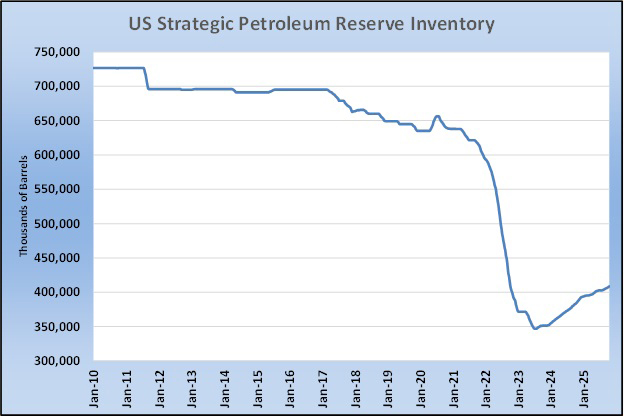

The U.S. SPR can hold over 700 million barrels. On Jan. 1, 2010, it was at what appeared to be capacity at 726.617 million barrels. Small draws on the SPR began during the Obama administration to help fund certain programs related to health care and renewable energy. Congress made annual sales from the reserve mandatory to maintain ongoing support for these programs.

By the time Russia invaded Ukraine on Feb. 24, 2022, the SPR was down to 582.384 million barrels. After the invasion by Russia, there was upward pressure on energy prices. With an election pending, the Biden administration authorized a significant release from the SPR to keep energy prices in the United States down with the promise that the withdrawals would be quickly replaced. By July 7, 2023, the SPR inventory had fallen by 253.626 million barrels, leaving a remaining 346.758 million barrels.

By the time the Biden administration had left office on Jan. 20, 2025, the SPR was at 394.566 million barrels. That was an increase of 47.808 million barrels above the July 2023 low point. The Biden administration had replaced just over 20 percent of the reserves it had withdrawn.

As a presidential candidate, Trump criticized the Biden administration for using the drawdown of the reserve for political purposes to keep gasoline prices down during an election year, not for lack of supply. Trump promised to fill the reserve to the top if elected.

As of Oct. 17, 2025, the SPR was at 408.564 million barrels, having increased just 13.998 million barrels since Trump took office. Perhaps this latest announcement is the beginning of a sustained program by the administration to replenish the reserve and keep its campaign promise.

But keeping that promise will be a tall order. It will take 318.053 million barrels to put the SPR back to capacity. As we’re writing this on Oct. 24, Trump has 1,184 days left in office. That means during the remainder of his administration, an average of 268,626 bpd of crude would have to be added to the SPR to completely refill it. That is a tremendous financial commitment. At crude’s current price of around $62 per barrel, it would take an outlay of more than $16.6 million per day to fill the reserve. And that is if the filling began today. The deliveries just ordered won’t begin until December, with average daily delivery of 16,667 bpd, a far cry from the 268,626 bpd needed to refill the SPR by the end of Trump’s term.

Despite what appears to be a woefully inadequate attempt to meet the long-term objective of filling the reserve, the government purchase will provide a minor increase in demand in the short term, which provided a lift in crude’s price this week.

The final factor lifting crude’s prices this week was the canceling of a meeting between Trump and Putin to discuss peace in Ukraine. The breakdown of peace talks between the United States and Russia concerning Ukraine and the subsequent announcement by the United States that it would put more sanctions on Russia has been a key contributor to the gains in crude’s value.

The developments take off the table the possibility of a peace deal that would allow Russian crude to flow untethered. That possibility had been getting priced into crude leading up to the now-canceled talks.

The new sanctions are another matter for traders to consider. Though previous sanctions by the United States and European Union to stop the flow of Russian crude have been largely ineffective, there is always the possibility that the latest efforts will work. Until the market sees Russia overcoming these political maneuvers, they could provide support.

We are not confident the three factors that have lifted crude prices this past week are enough to sustain a rally. The Fed is likely to lower interest rates by 25 basis points this month, which should add price support for crude. Also, U.S.-China trade talks are pending. A positive outcome from those talks would alleviate concerns about crude demand and be a support for crude’s price. Perhaps all these factors combined will be enough to sustain a rally for a while.

If crude prices are running higher, it will put upward pressure on propane markets as it has done this week. But again, the sustainability of the rally is questionable until the market sees hard evidence that the expected oversupply in crude markets is being reduced.

Further, propane inventories are at record-high levels. History has shown that when propane is well supplied, pricing in November and December is often lower than it is during October. Propane buys remain favorable for buyers despite this week’s run higher. But if the rally continues, propane buyers need to be careful not to overreach when buying price protection, especially for supply in the last two months of the year. That caution stems not only from the doubts concerning the sustainability of crude’s rally, but also the tendency for propane prices to drop in a well-supplied market.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.