A rising tide lifts all boats

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews propane fundamentals.

Catch up on last week’s Trader’s Corner here: Propane inventory just keeps building

In last week’s Trader’s Corner, we looked at how strong propane fundamentals are to this point in the winter. They got even stronger during the week that ended Nov. 25. For that week, the Energy Information Administration reported U.S. propane inventory increased another 1.604 million barrels. That is a shockingly high number for this time of year and pushed total U.S. propane inventory to 90.633 million barrels.

Its already well into winter, and inventory stands at 17.021 million barrels, 23.1 percent higher than last year and 12.7 percent above the five-year average. Production is high, and domestic demand is weak. Even if demand suddenly turns, it’s hard to see a scenario where propane inventory gets stressed before the end of this winter. The perceived lack of threat to supply has prices falling. From a fundamental perspective, that is what should be happening.

While everything is rosy for propane, it is not so much in other parts of the energy industry. It is still possible for propane prices to be lifted higher by a general rise in energy prices. John F. Kennedy is credited with popularizing the aphorism, “A rising tide lifts all boats,” when he used it in a speech in 1963. For the boat of propane, the tide is crude.

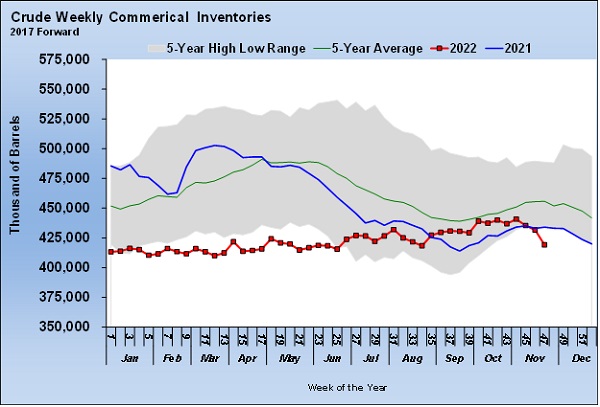

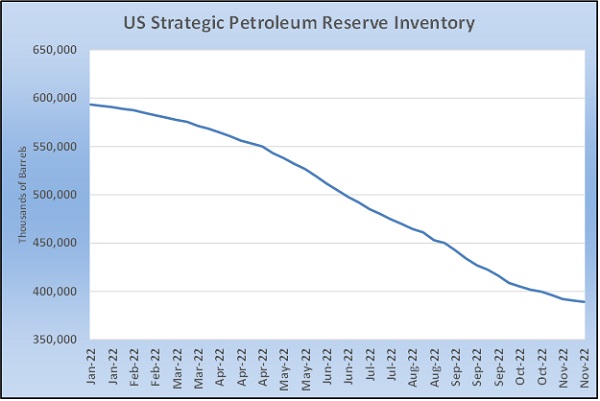

While propane inventory was making its surprising build last week, U.S. crude inventory fell 12.581 million barrels, far exceeding expectations. That put inventory at a new five-year low for this time of year. Particularly worrisome is that crude commercial inventory is in this weak of a position after millions of barrels were released from the Strategic Petroleum Reserve (SPR) this year. The target was a release of more than 180 million barrels.

The U.S. has transferred 204,566,000 barrels, or about 35 percent, of the reserve over to commercial inventories since the beginning of the year. That is around 620,000 barrels per day (bpd). The reserves releases are supposed to end this month.

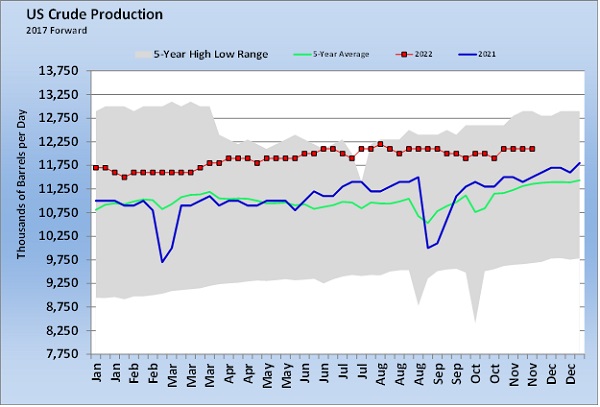

Over the year, U.S. crude production has increased about 400,000 bpd, from 11.7 million bpd to 12.1 million bpd.

A drop in crude imports this past week was the primary culprit in the higher-than-expected drop in U.S. crude inventory. However, with U.S. production growth still below the rate of releases from the SPR, when those releases end, the potential for more large draws on crude inventory is present. That means there is the potential for being short commercial crude, much less replacing the SPR inventory.

Crude prices have been in a general downtrend since central banks started raising interest rates in the middle of summer to cool inflation. But Federal Reserve Chairman Jerome Powell said this week that data suggests the Fed can start slowing the pace of its interest rate increases. Also, demand may have been hurt by all of the COVID-19-related lockdowns in China. It looks like the protests that have been going on there are having an influence on government policy that could result in fewer restrictions. That could increase energy demand and help relieve pressure on supply chains for other goods, with the potential for lowering inflationary pressures. At the same time, OPEC+ is sticking to production cuts they made recently that took somewhere between 1 million barrels and 1.5 million barrels of supply off the market. There has even been talk they could cut production more.

The European Union is supposed to impose a full embargo on waterborne crude imports from Russia, starting Dec. 5. If that happens, crude supply chains will be in scramble mode. Russia will be looking for new buyers for its crude and Europe will be looking for new suppliers. Essentially, crude supply chains will play musical chairs, which could tighten supply while buyers and sellers deal with the new reality. However, there is potentially positive news on this front. The European Union is considering a price-cap on Russian crude rather than a full embargo. The price-cap would be $60 or 5 percent below market prices, whichever is lower. Theoretically, this price cap would keep waterborne crude flowing from Russia to Europe, assuming Russia wants to play along.

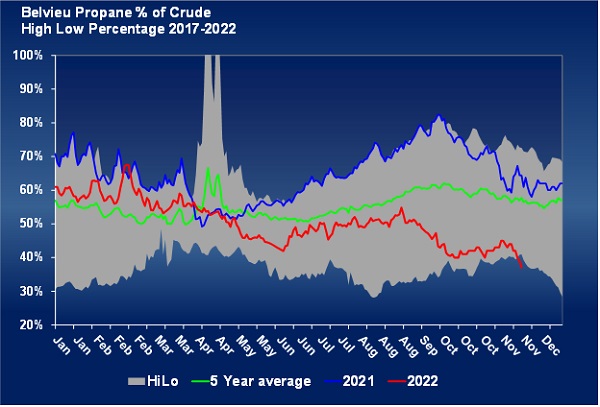

If the price-cap deal gets done, it could limit the upside for crude in the short term, but there are still plenty of concerns about crude supply that could see crude’s price rise. The good news is that propane fundamentals are putting enough pressure on propane’s price that it is separating from crude now.

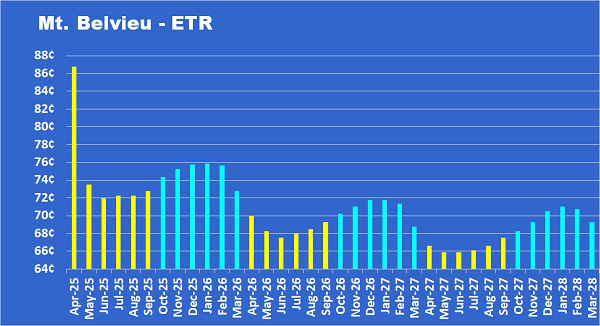

Chart 4 reflects this separation. Mont Belvieu propane is currently setting a five-year low in value for this time of year relative to WTI crude. Mont Belvieu is valued at 37 percent of WTI, compared to 64 percent at this time last year and a five-year average of 58 percent. With propane already at such a low value, any change in propane’s fundamental picture will allow propane prices to rise with crude, and prices could rise with crude even if the fundamental picture doesn’t change.

No doubt, propane markets are in great shape, far better than we ever could have imagined coming out of last winter. Prices are about 28 cents below what we thought might be the best case for this winter. We need to be looking for low tide here. Most of us were hedged (in the boat) with the tide unexpectedly falling this year, so there is the feeling of wanting to come ashore and forget boat riding for a while. But it is exactly these types of low tides in the market that can create the best opportunities for down the road. Obviously, it is never easy to predict where wholesale prices are going to be in the future, but if we focus on the value proposition to our customers, this could provide the opportunity to keep the cost of propane at a comfortable level, even in a rising tide.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.