Below-normal temperatures a test for propane supply

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates how the recent weather changes could impact propane supply.

Catch up on last week’s Trader’s Corner here: High prices, low inventories shake up distillate market

Propane infrastructure, logistics and pricing are finally getting a little test from the weather. It has been slow in coming, but there is a little here now.

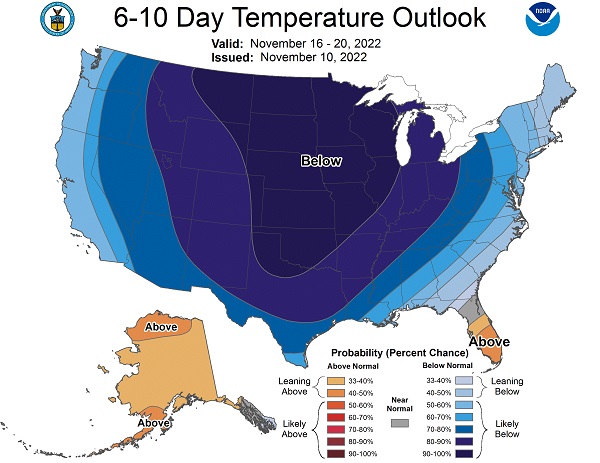

Map 1 is from the National Oceanic and Atmospheric Administration (NOAA) of the U.S. Department of Commerce. The map does not show actual temperature prediction, rather the probability of whether temperatures will be normal, above normal or below normal. If the color is gray, temperatures are expected to be normal in that area. When they are blue, the probability is they will be below normal. The darker the shade, the greater the probability. Browns indicate probability of above normal with the darker shades being the higher probability.

The prediction in Map 1 was released Nov. 10, predicting the period between Nov. 16-20, and shows high probability of below-normal temperatures for most of the nation, especially the Midwest. So, this is where our fears and concerns about the health of supply get tested. You will recall that we have expressed concern that there may be pent-up demand for propane that would not reveal itself until the first significant cold of the year presented itself.

We monitor domestic propane demand. It has run below last year through the summer. There was a little less use by petrochemicals but not enough to account for all of the year-over-year difference. Our fear has been that family budgets are strained dealing with inflation. Limited dollars were going to cover higher gasoline, food and rent/mortgage payments, etc. Out of necessity, buying propane for winter could have been put off. There was no quantifiable evidence this was the reason for the lower domestic demand, but the logic seems sound.

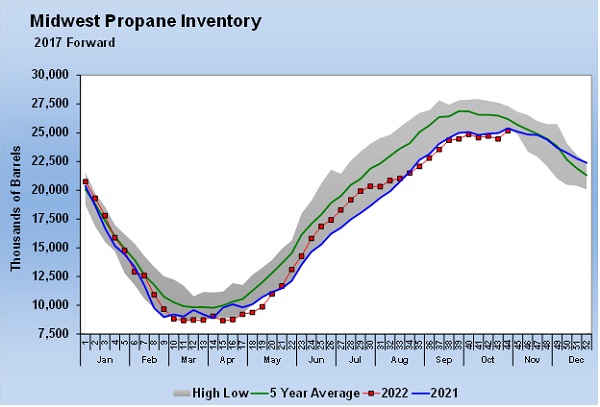

If that fear exists, then it is exacerbated by the inventory in Chart 1. For Midwest inventory to not be any healthier than what it is given lower demand adds to the concern.

We received concerning news on the Midwest supply front. In an earnings call earlier this month, ONEOK, the owner of the Medford, Oklahoma, fractionator that had an accident in midsummer and has been offline since, said it has not made a decision to repair the facility. It is considering the repairs, among other options. It is also considering building a new one at Conway, Bushton or even at Mont Belvieu. The unit produced about 60,000 barrels per day (bpd) of propane, or about 20 percent of midcontinent supply. If it is not rebuilt or its capacity is transferred to Mont Belvieu, it could have a long-term impact on Midwest supply security.

We can see the market in general sharing our concerns as the weather becomes more of a factor.

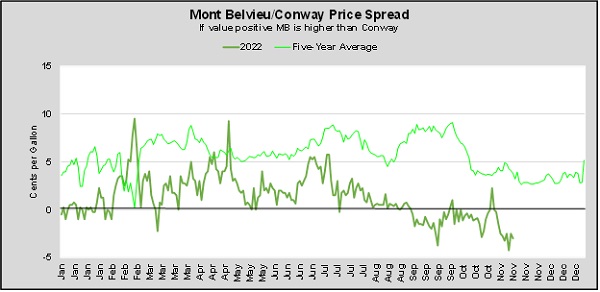

Chart 2 shows the difference or spread between Mont Belvieu ETR’s price and Conway’s prices. The lighter green is the five-year average and the darker represents this year. When the line is above zero, ETR’s price is higher than Conway’s price. When it is below zero, Conway is higher. Mont Belvieu is normally higher, but the spread often tightens during the winter months. However, we can see this year that the spread started coming down after Medford went offline and Conway started carrying the premium in early September. Weak crop-drying demand and a late start to winter caused a course reversal in October, but now Conway’s premium is increasing again.

What makes the current situation particularly concerning is that in the past, when Medford was operating, as Conway became higher valued relative to Mont Belvieu it would encourage spec product from the Midwest fractionators to be retained in the Midwest rather than going to the Gulf Coast. But with Medford down, the NGL mix that was processed at Medford is being shipped to ONEOK’s fractionator in Mont Belvieu. Therefore, despite Conway’s price getting higher, there is still less spec product available to retain in the Midwest.

We must hope other fractionators can take up the slack and the higher price encourages more exports from Canada.

In our view, propane prices have been remarkably stable and reasonably valued in the Midwest given the situation. The current Conway premium is no doubt justified. We can only hope the overall strong propane inventory position and production is going to be enough to maintain the status quo.

We still advise very strongly for Midwest retailers to take every measure to secure supply and consider price protection. We are not out of the woods just yet. Even though the news about Medford was bad, the Energy Information Administration provided an upbeat inventory report for the Midwest. Midwest inventory was up 714,000 barrels in a week that has averaged a draw of 517,000 over the last five years. So, everything remains good, but upside risks do remain.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.