High prices, low inventories shake up distillate market

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the current state of distillates.

Catch up on last week’s Trader’s Corner here: Retailers await weather, rail labor strife outcomes

Recently we have had inquiries about the state of diesel, heating oil and distillates in general. Some of our readers market heating oil, and others are refined fuels distributors. But there have been plenty of inquiries from propane dealers as well. Everyone is hearing the claims that the U.S. will be out of distillates by the end of the year. And, of course, we all see the high price of distillates and know something is up.

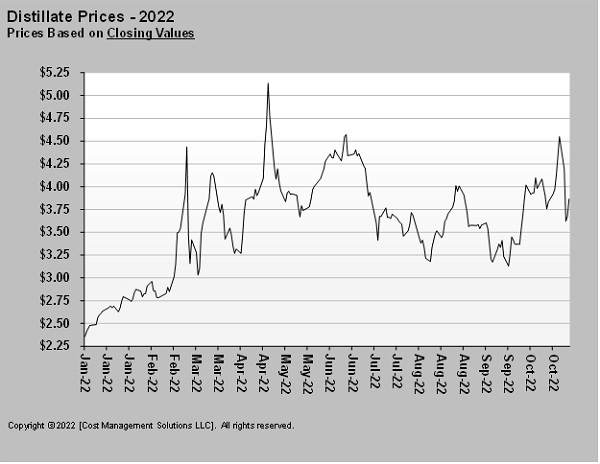

Currently, the price of heating oil/distillates is $3.83 per gallon. That is the equivalent of $2.53 per gallon propane, which is trading at 88.5 cents as we write. It has been as high as the equivalent of $3.39 per gallon of propane this year. When we see the price of a commodity that out of whack with the comparable energy sources, we know something is up. Even though we may not be a heating oil retailer or a refined fuels distributor, we know the high cost of distillates is hurting our economy, a major contributor to inflation, and stands in the way of more economically secure times. So, there are good reasons we are all concerned and asking questions.

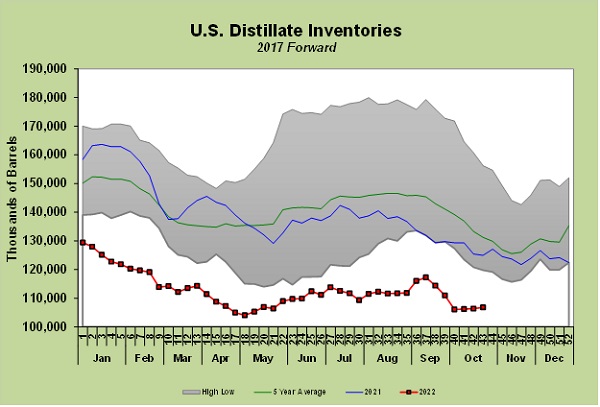

Chart 2 looks at total distillates inventory for the U.S. It is easily setting five-year lows. Its low level is why some are predicting we will “run out” before the end of the year. We focus on all distillates rather than heating oil because heating oil is less than 10 percent of the total.

When refiners had to change processes to meet new over-the-road diesel specs several years ago, they started yielding less high-sulfur distillates. Heating oil has more than 500 parts per million of sulfur. Refiners simply provided lower-sulfur product to their heating oil customers. Heating oil inventory used to run more than 50 million barrels, but is now at around 8 million barrels. Thus, the focus on total distillates now.

There is a shortage of distillates globally for many reasons. Hydrocarbon production has become taboo in the West, and there has been a lack of investment in it generally. Still, the West did not slow its use and instead became more dependent on countries like Russia for supply. In addition to crude and natural gas, Russia also built refineries and provided refined fuels. With the war in Ukraine, supply chains are disrupted. Europe is seeking supply from other countries to supplant what it once got from Russia. The U.S. also ended its importation of crude and refined fuels from Russia.

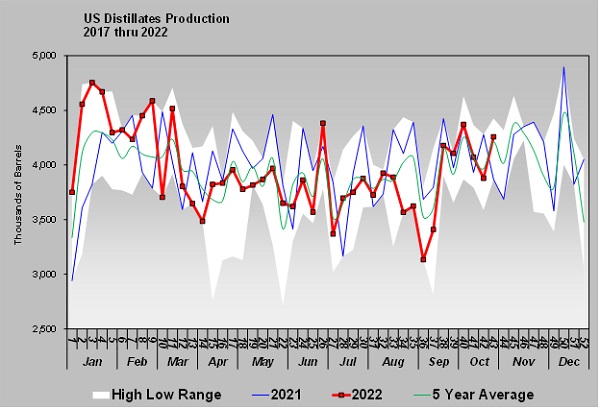

Even though the U.S. decreased imports from Russia, its production of distillates has only recently improved. Distillate production has so far this year averaged 3.947 million barrels per day (bpd). During the same period last year, production averaged 3.991 million bpd.

Import and export numbers show a bullish picture as well.

Chart 4 allows us to compare how distillate imports and exports were trending in 2021 before the Russia/Ukraine war, and during 2022 while the war has been underway.

Since Russia’s invasion of Ukraine, the U.S. has increased its exports. So far this year, distillate exports have averaged 1.240 million bpd compared to 986,000 bpd during the same period last year. It is important to note that last year’s export rate was lower than normal. The average over the last five years to this point in the year was 1.173 million bpd.

We had increased imports during 2021 to 288,000 bpd compared to 172,000 bpd in 2020 and a five-year average of 186,000 bpd. Like much of Europe, our focus was on getting more supply from elsewhere (in most cases Russia) rather than producing our own. Our imports are down this year from 2021 at 180,000 bpd after we embargoed Russian imports. However, as we showed prior, our distillate production hasn’t improved – instead we have lived off inventory both for our own demand and in providing increased exports.

It is an all-too-common story since Russia invaded Ukraine. The countries that have needed to increase production of energy, such as the U.S. and Europe, have done precious little in that regard. Instead, they have lived off inventory, and now things have gotten extremely critical for global distillate supplies and to a lesser degree crude supply. We are fortunate in the propane business that propane supply has trended differently, and we are blessed with one of the cheapest Btus available.

Rarely do we run out of a commodity. The market – through high prices – will preserve at least some buffer for the most critical of needs.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.