Calling propane businesses to prepare for the road ahead

Propane businesses, as well as leaders from the Propane Education & Research Council (PERC) and the National Propane Gas Association (NPGA), are grappling with how to prepare for the propane industry’s future.

How do we plan when daily challenges consume the leader’s time and energy? Peter Drucker’s comment that “executives give neither sufficient time nor sufficient thought to the future” rings true. It is much easier to focus on short-term problems, where we can make an immediate difference in the bottom line, our employees and our customers’ lives, than it is to plan and implement a long-term strategy to address issues that are often unknown or uncertain. In spite of the challenge, and in spite of the uncertainty, planning for the propane industry’s future must be a priority.

Here we provide a list of factors that create both a threat that may reduce industry gallons and an opportunity to grow gallons, as well. We also provide a forecast of the industry’s gallons based on the ability to develop and execute the right strategy for the future.

The past is still driving the future

The oil and gas shale boom has made propane more cost competitive with electricity. Photo by Harris Baker

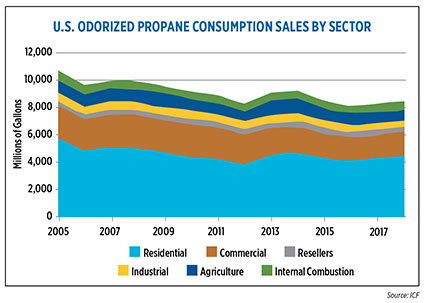

The past provides a clear view into the propane industry’s potential future. Between 2007 and 2017, propane sales declined by about 1.2 billion gallons, or 15 percent.

The major factors driving the market during this period will continue to shape our readiness for the future:

1. The oil and gas industry shale boom. U.S. propane production increased by 76 percent, moving the United States from being a propane importer to an exporter. These added supplies of domestic propane significantly lowered wholesale costs, which helped propane gain an advantage against its biggest competitor, electricity. Also, propane’s price spikes have largely disappeared during the past four years. Having propane domestically sourced helps the marketing message.

2. The climate change movement. Climate change became mainstream in the past decade. Legislation, primarily at the state levels, along with public perception, are on the rise. The emphasis on zero net energy construction, renewables and clean energy should advantage propane as a clean, low carbon emissions fuel. Yet, the propane industry has not capitalized on the climate change movement. The commonly held perception by policymakers, clean energy advocates and the public is that propane is a dirty fossil fuel.

3. Energy efficiency’s impact on eroding gallon sales. Improvements in propane furnace and water heater efficiency, combined with more energy-efficient building standards, have resulted in an 11 percent decline in the number of gallons sold per customer in the residential sector in the last 10 years.

4. Increased competition from electricity and natural gas. The propane industry has faced increased competition for residential and commercial space heating customers due to improvements in electric space heating technology and aggressive marketing practices by electric and natural gas utilities.

5. The low number of propane marketers engaged in organic gallon-growth practices. Too few marketers sell appliances, have partnerships with builders and HVAC contractors or grow autogas. Too many marketers look to PERC to grow their business. Further, too few use PERC resources and tools to help them grow gallons. Who’s left to tell propane’s story? We’ve entrusted others, such as HVAC contractors and homebuilders, to tell propane’s great story. We need to change this condition.

6. Slow progress in the autogas market.The autogas market remains an insignificant 2 percent of the propane industry, growing only 70 million gallons in the past decade. We should not expect to see autogas market growth until the propane marketer begins to adopt the fuel in their fleets on a broader scale.

7. 2014 polar vortex. The 2013-14 winter exposed our industry’s supply vulnerability, leaving lingering questions about how much better off we are at protecting our customers from severe price spikes and the fear that as an industry we cannot deliver product when needed in the most adverse conditions.

8. Industry consolidation. Industry consolidation stalled in the last decade as the top 10 marketers’ share declined from 39 percent to 36 percent. Further, the consolidators who increased their financial leverage this past decade could see their ability to grow through acquisitions limited. The entry of European companies DCC and SHV into the U.S. market and Canada-based Superior Plus’ interest in U.S. market growth created new consolidators.

The most important factors shaping the next 10 years

What are the most important factors NPGA, PERC and propane companies must address for the industry to survive and thrive in the next decade?

1. The climate change movement. It does not matter what you believe about climate change. The reality is that you should expect climate change legislation to dramatically alter energy markets in the next decade. The new energy market being created by the climate change movement will likely be the defining issue for our industry in the next decade. In order to position propane in the emerging new clean energy economy, the industry must begin to change how it thinks about climate change and its approach for reaching policymakers with propane’s clean energy message. NPGA, PERC and state association leadership must collaborate to change the common perception by policymakers and clean energy advocates that propane is a dirty fossil fuel. Our message must be compelling to be competitive. Meeting the requirements to be called a “renewable” fuel must be a priority. Propane marketers need to promote high efficiency propane applications and new technologies. Propane’s green energy message needs to be told by credible third parties.

2. The revolution in North American oil and natural gas resource development. Growth in North American oil and natural gas production is expected to continue unabated, leading to continuing growth in North American propane production. The increase in domestic propane production will continue to hold down and stabilize propane prices. However, the increasing amount of propane production committed to the export market likely will also increase the complexity of propane supply planning for retail marketers.

3. Propane sales per customer. We expect steady improvements in propane appliance efficiency to continue to erode per-customer gallon sales. In fact, given the expected importance of the climate change movement, it is critical that the propane industry promote these improvements. To offset the decline in gallon sales due to efficiency improvements, the industry must become more successful at increasing the number of propane applications used by each customer.

4. The propane marketer’s ability to market. We expect propane’s declining gallons and the next generation of propane leaders to spur propane marketer interest in becoming marketers of burner tips and developing relationships with homebuilders and HVAC contractors. PERC and state associations must play a more engaged role in providing that roadmap for marketers on how to organically grow gallons.

5. Industry consolidation. Industry consolidation over the next decade will accelerate due to: 1) the increasing complexities of operating a propane business and 2) the increased percent of family businesses without a family succession. Superior Plus and the entry of SHV, DCC and other new players will provide enough competition to support the current multiples being paid.

6. Consumer awareness and service expectations. The next generation of propane consumers and energy decision-makers will become increasingly sensitive to using energy that is efficient, affordable and clean while delivering comfort and lifestyle choices. To capitalize, propane needs to brand itself effectively. PERC should invest in research that simplifies and lowers the cost of propane installations, a longtime market barrier. If propane’s benefits are not known and the installation barriers are not overcome, market share losses to electricity will continue.

7. New propane technologies and applications. New propane technologies and applications can power propane market growth, but only if the industry becomes more adept at marketing these new technologies:

a. The autogas market will continue to be propane’s highest gallon-growth potential. The displacement of just 1 percent of the gasoline market would grow the propane industry by 1.5 billion gallons, or 12 percent. However, autogas growth faces strong headwinds: 1) advancements in electric vehicle technology; 2) advancements by the natural gas industry to market its significant U.S. production; 3) propane is competitively disadvantaged without a “renewable” brand; and 4) too many propane marketers do not use autogas in their fleet.

b. Hydronic space heating presents a growth opportunity by displacing the inefficient emergency electric heat strip that backs up air and ground sourced heat pumps. Hybrid propane furnace/heat pump systems also provide a strong entry supporting climate change objectives.

c. Growth in reliance on renewable power generation (solar and wind) will create a premium power generation market for backup power generation, including propane.

Gallon forecast for 2030

Propane marketers can grow gallons by using propane autogas for their own fleets. Photo courtesy of Propane Education & Research Council

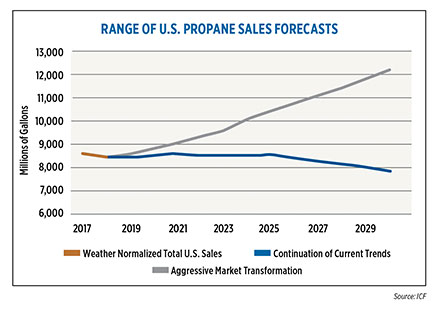

We as an industry have a choice to make. A continuation of historical practices will lead to a continuation of historical trends. These historical trends will result in propane sales of about 7 billion gallons by 2030, a 1.2-billion-gallon loss. However, significant growth in gallon sales is possible if:

- Propane marketers become focused on growing their business with new customers and applications, rather than fighting with their competitors over a shrinking market share.

- The industry develops commercially viable applications in power generation and renewable hybrids in the residential and commercial markets.

- Propane’s place in the new low carbon energy world is established by obtaining the “renewable” label, and creating a message that propane is part of the carbon solution. This will require a tight collaborative effort between PERC, NPGA and state associations, and partnerships with third parties who will tell our story.

- The industry successfully executes an autogas growth strategy that raises the industry’s use of propane in its fleets, creates a nationwide service network and offers reliable technologies in most vehicle classes.

However, these steps are not easy. We must plan for a future that we cannot see clearly, but between the shadows of uncertainty, there is enough visibility to see the broad outline. Referencing Peter Drucker again: “The best way to predict your future is to create it.”

The next generation of industry leaders will judge us on whether or not we demonstrated the foresight, courage and teamwork to create a desired future.

If we fail, they will be left to pick up the pieces of a significantly smaller industry with little competitive position. If we succeed, they will inherit an industry that has positioned propane’s place in the future clean energy market.

Mike Sloan is managing director of Natural Gas and Liquids Advisory Services at ICF. Randy Doyle is a 30-year industry veteran who has worked with both multi-state and independent propane marketers. He currently serves on the PERC council and the NPGA board of directors.

I am very encouraged by this article. I’m hoping it’s not the only one with this message but it’s the only one I have read recently challenging us to ask what we want for our future and telling us what is true. Great is better than terrible and terrible is better than mediocre and we have been stuck at mediocre.