Can the propane industry handle this winter storm?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines how the latest winter storm and falling temperatures could impact propane prices.

Catch up on last week’s Trader’s Corner here: Opportunities in propane prices

U.S. propane prices are on the rise with markets trying to get bulled up a bit as 2025 gets started.

Propane prices had dropped to 76 cents at Mont Belvieu Energy Transfer (MB ETR) on Dec. 26, 2024. Conway closed at 72.75 cents on that day. Currently MB ETR is trading at 86.5 cents and Conway at 84.25 cents. That is a 10.5-cent, 14-percent increase at ETR and an 11.5-cent, 16-percent increase at Conway. Those are hefty gains in just five trading sessions.

Crude prices have been on a seven-day run, which has contributed to the rise in propane prices. From Dec. 26, 2024, WTI crude is up $3.51 per barrel or 5 percent. So, obviously, there is more behind the rise in propane than just crude.

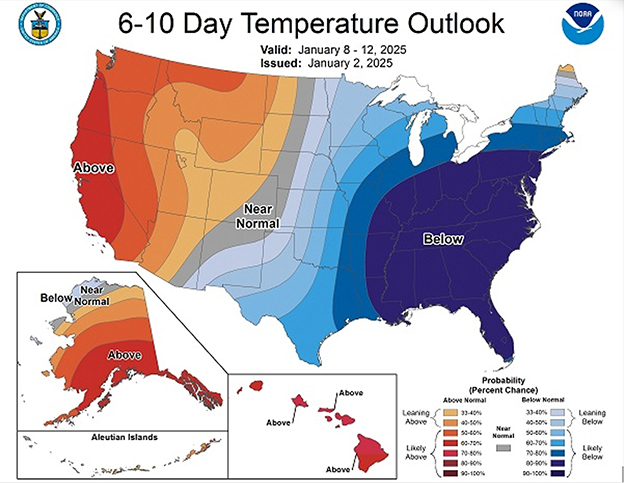

Propane markets have gotten all bullied ahead of a strong winter storm that could drive temperatures below normal. Below is the latest temperature probability map from the National Oceanic and Atmospheric Administration.

This map shows that during the period between Jan. 8 and Jan. 12, temperatures in the eastern half of the country are expected to be below normal, with a good portion having a very high probability of being below normal.

Other forecasts show the cold being much broader across most of the country, covering about 40 states. In the Upper Midwest, temperatures could reach 30 to 40 degrees below zero. Even the Deep South could see temperatures in the 0-to-10-degree range. No doubt such a winter storm is going to create a call on propane inventories, drawing them lower. The severe cold so far south will also likely cause production issues with all hydrocarbons, including propane. Production areas will freeze up, and fractionators are likely to have weather-related issues.

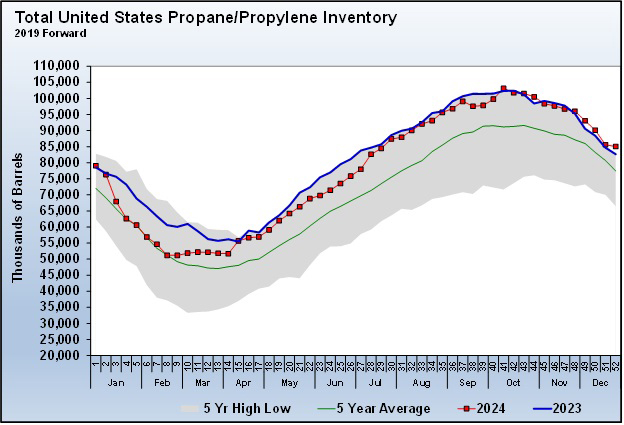

The good news is that propane inventories are in amazingly great shape for this time of year.

U.S. propane inventories are currently at 85.043 million barrels. That is 2.396 million barrels higher than this time last year. For the week ending Dec. 27, 2024, inventories were 2.9 percent higher than last year and 8.79 percent higher than the five-year average, setting a five-year high for that week of the year.

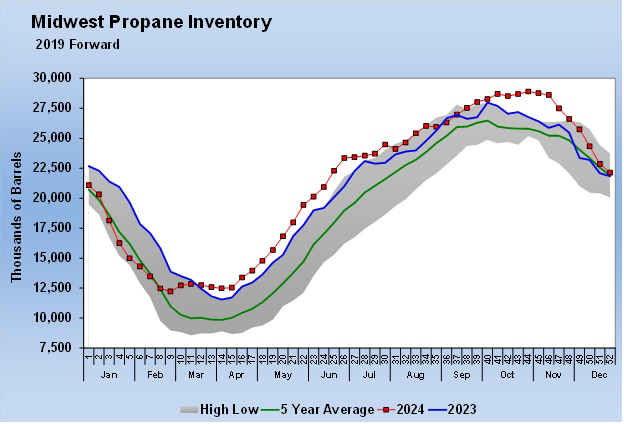

Regionally, inventories are in great shape as well. Midwest inventories, which are likely to take the brunt of this storm, are slightly higher than last year and the five-year average.

Gulf Coast inventories are in even better shape. There is plenty of inventory to get through this storm. There is no doubt that such a severe storm is going to cause logistical problems and shortages locally. Sellers need to have as much product on hand as possible. The sharp rise in propane prices recently would suggest buyers are getting prepared.

Some forecasters believe this January will be the coldest in the last 14 years. Europe will also be experiencing cold weather along with the United States, which should keep export demand robust as well.

But even such a dramatic bout of cold is unlikely to change the long-term bearish prospects for propane prices. We think such cold would have to be sustained well past January to reset the propane price environment from longer-term bearish to longer-term bullish.

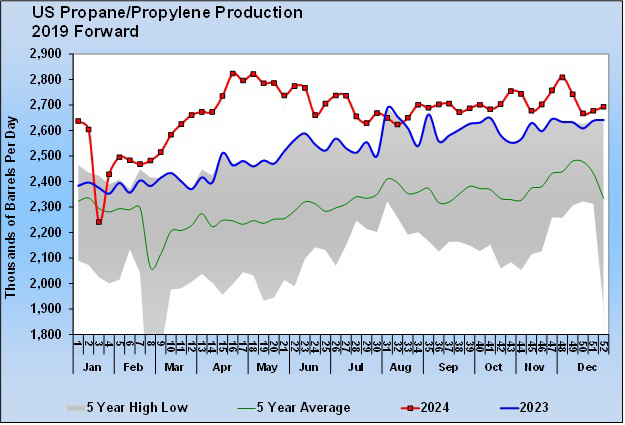

Not only are inventories at the hubs positioned to deal with a rise in domestic demand, but propane production is robust.

Propane production set new five-year highs and has been doing so almost all of 2024. Propane production was 2.693 million barrels per day (bpd) for the week ending Dec. 27, 2024. That is 130,000 bpd below the peak production rate set earlier in the year. So, the industry has the production capacity to replenish any drawdown in inventories.

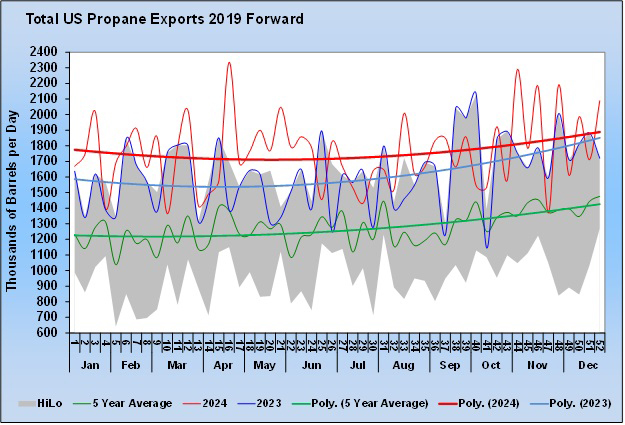

Meanwhile, propane export capacity is limited. Exports have averaged 1.757 million barrels in 2024, and sustainable capacity is widely believed to be 1.8 million barrels.

The straighter red line in the chart above is the U.S. propane exports trend. Though exports have been higher in 2024 than last year, the trends are coming together. That trend reflects the limited export capacity. So, no matter how much export demand increases, there is only so much propane that can move overseas. New projects that will come online at the end of 2025 and in 2026 should boost export capacity by about a third.

We believe it will be the new export capacity that will have the potential for changing the pricing dynamic of propane in the longer term. Until then, the impacts of the storm on propane supply should be shorter term in nature. Unless the cold persists for much of the remainder of this winter, we think the odds of a significant moderation in propane prices exist for the latter part of this winter and the summer months.

Finally, propane sellers will be getting some much-needed demand. The good news is that we think they will be able to have their cake and eat it too. Though we think retailers will have to deal with high prices in the short term, especially in areas where logistical issues occur, we do not believe a systemically higher price environment will occur as a result.

All maps and charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.