Crude inventory pattern impacts propane prices

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, July 30 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why improvements in propane fundamentals have only resulted in a modest decline in prices.

Catch up on last week’s Trader’s Corner here: Inventory movement raises questions about propane prices

Propane buyers interested in getting protection against higher prices this winter have been hoping the recent run-up in propane prices would reverse itself and give them an opportunity to obtain that protection at a more favorable price.

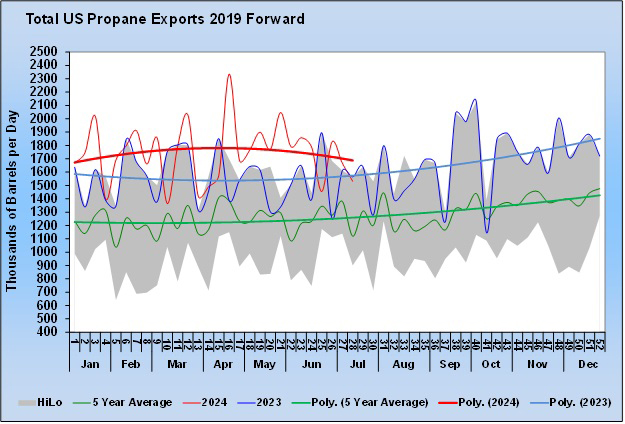

Hopes have been raised by a slowdown in exports that allowed propane inventories to build at an above-average pace over the last few weeks. As the chart below shows, propane exports, though high, have more recently been trending lower.

Chart 1: Total U.S. Propane Exports 2019 Forward

Further, it is possible that Y-grade that was being sent to Conway for processing is being diverted to Mont Belvieu (MB). We discussed last week that, for the week ending July 5, there had been practically no build in Midwest propane inventories and a big gain in Gulf Coast inventories. That went against the patterns for both.

We believed the Gulf Coast’s low inventory position was supporting propane prices in all regions. Our Trader’s Corner last week shared the belief that improving inventory on the Gulf Coast would take pressure off MB prices and help propane prices in all regions, even the Midwest, where it appears builds in inventory are slowing because of the possible diversion of Y-grade to MB.

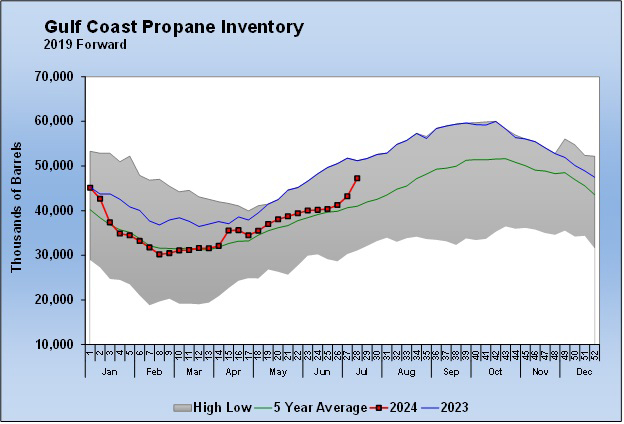

It was important to see the trend of small builds in inventory in the Midwest and a large build in Gulf Coast inventories happen for a second week in a row. For the week ending July 12, Gulf Coast inventories built well above average again.

Chart 2: Gulf Coast Propane Inventory 2019 Forward

The inventory deficit to last year has been halved in a couple of weeks. No doubt much of the build occurred because export cargoes were delayed on the Gulf Coast because of Hurricane Beryl. But we also note that, once again, Midwest inventories had practically no build. That supports the theory that Y-grade once destined to Conway for processing has indeed been rerouted to the Gulf Coast.

So far, the good news is that there has not been upward pressure on Conway prices due to the lighter inventory builds. Midwest inventories remain 2 percent above last year and 16 percent above the five-year average, despite the two very small inventory builds in a row.

Propane fundamentals have been moving in favor of the propane buyer. Exports have slowed, despite the economics to do so being good, leading to more propane inventory. The inventory builds are occurring in the right place, with the deficit to last year on the Gulf Coast greatly improved.

These improvements in propane fundamentals halted a strong rally in propane prices that occurred in June. Yet, they have only resulted in a modest decline in prices. Thus, the opportunity to buy winter price protection at a reasonable number has not reemerged.

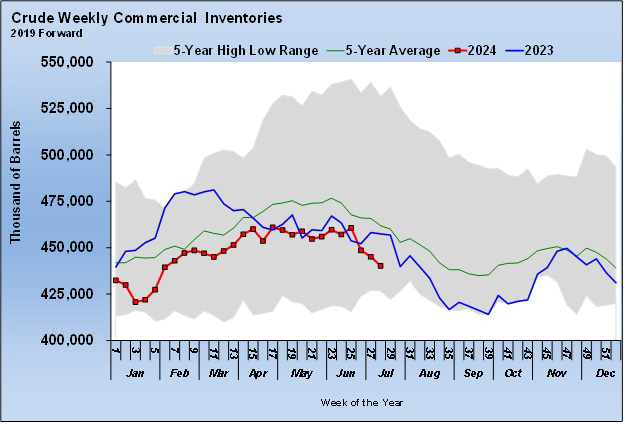

The reason: For propane prices to correct significantly lower, there also needed to be a downward correction in crude’s price to correspond with the improved propane fundamentals, but that has not occurred. There was a brief downward correction in crude prices in early July that helped, but crude has now recovered after a series of strong draws on its inventory.

Chart 3: Crude Weekly Commercial Inventories 2019 Forward

As the chart shows, it is normal for crude inventories to fall this time of year. However, the more than 20 million barrels in inventory decline over the last three weeks has U.S. crude inventories on a concerning trendline. This string of big inventory draws needs to end for there to be much hope of a significant correction in crude’s price.

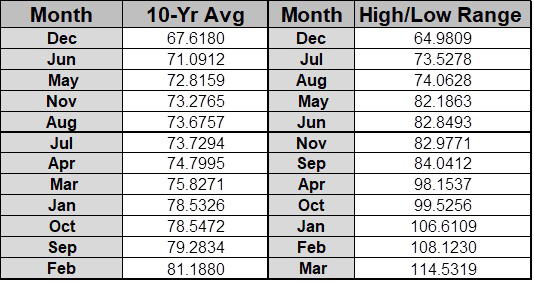

The normal ebb and flow of crude’s inventories has a significant impact on propane’s pricing throughout the year. The table below will help us see that impact a little better.

Table 1

In the first two columns in the table above, we averaged the monthly averages for 10 years and then ranked the months from the lowest price to the highest price. In the second two columns, we took the difference between the high and low monthly average over the 10-year span, then sorted from the month with the smallest high/low range to the month with the highest high/low range. The second grouping is an effort to reflect price volatility for the specific months.

Let’s focus on September. Note September is the second highest monthly average. If you want to know why, look at the crude inventory chart above. Crude inventories usually reach their low for the year during September, which supports its price and thus supports propane’s price. The tighter high/low price range for September compared to the winter months suggests that September is going to be more consistently high than the winter months.

Yes, February has averaged higher than September, but the extreme high/low range means that prices are highly dependent on overall winter heating demand. If winter is strong, February propane prices can be very high, but if winter is weak, they can be very low.

The point is, if you really wanted to bet on which month would have the highest propane prices, September would likely be the month to place your money. The reason is that what makes propane prices high in September is a consistent pattern related to the ebb and flow of crude inventories, whereas February pricing is much more reflective of irregular weather influences.

Let’s look at December now. December seems like such an anomaly. It averages the lowest propane prices of the year. And its range is low, which suggests it’s a predictable pattern. Again, referencing the crude inventory chart gives an idea why. Crude inventories recover after September through the end of November. As December starts, the pressure has come off crude’s price. At the same time, propane inventories are not yet under a lot of pressure this early in winter. Especially in recent years with mild winters, propane inventories are in great shape during December.

Even though crude inventory can turn lower in December, crude markets generally mellow out after the rise in inventory and the end of the summer driving season. They can often stay that way until the summer drawdown in inventory begins again. Meanwhile, propane prices can rise during the first quarter of the year, but that almost totally depends on weather as reflected by the wide high/low range for January, February and March.

Finally, this analysis shows why the May and June buying window is so important for propane buyers seeking protection from higher prices for the upcoming winter. Those months are before the largest declines in crude inventories occur. If propane fundamentals are cooperating during those months, we can often see the best propane pricing.

But, once the drawdown in crude inventories starts occurring after June, propane prices are fighting an uphill battle. Crude prices are going to start firming up from midsummer, and that is generally going to support higher propane prices.

So, even though we have seen improvement in propane fundamentals recently, higher crude prices are countering much of the potential downward pressure on propane prices. It’s a predictable cycle.

Unusual circumstances are generally needed to cause crude to help with propane prices in late summer and early fall. Propane buyers need something abnormal to happen in crude markets to cause crude’s price to go down. At this point, it might be negative news on the economy/crude demand or the resolution of a war that is currently providing a support for crude. OPEC+ reopening shut production would help, but it is saying its production cuts are likely to continue through the end of the year.

All charts courtesy of Cost Management Solutions