Expected La Niña could heighten hurricane season

From October through March, the propane industry is consumed by weather reports, heating degree-days and its overall supply and distribution processes.

As temperatures warm in the spring and summer, propane retailers shift their focus as they ready their operations for the next winter.

Meanwhile, other weather concerns exist that can impact the energy industry, especially further upstream.

Looking at this year, meteorological consulting firm WeatherBELL Analytics expects an active hurricane season. It wouldn’t be surprising to see an impactful storm in June and multiple hurricane hits starting in July or August. Other forecasting services are taking their predictions a step further. AccuWeather, for example, is forecasting 20 to 25 named storms across the Atlantic basin in 2024, including eight to 12 hurricanes, four to seven major hurricanes and four to six direct U.S. impacts. These numbers are all above the 30-year historical average.

These types of firms anticipate the development of La Niña in the coming months, possibly as early as June.

Why does that matter exactly?

La Niña is sometimes referred to as “a cold event,” according to the National Oceanic and Atmospheric Administration (NOAA). Cold waters in the Pacific Ocean push the jet stream northward, affecting the weather in and around the United States.

During a La Niña year, NOAA says, chances increase for drought in the southern U.S. and heavy rains and flooding in the Pacific Northwest and Canada. Winter temperatures are warmer than normal in the South and cooler than normal in the North. There’s also the possibility of a more severe hurricane season.

“La Niña could lead to more extreme weather activity,” says Joe McGinn, vice chairman of producers for the Propane Education & Research Council, during a producer presentation to the council in April.

McGinn says his midstream service company, Energy Transfer, monitors these types of developments to gauge potential impacts on the energy industry.

“That creates havoc in terms of the Gulf Coast – both exports coming out of the Gulf Coast and not to mention production and impacts depending on where those storms are,” he says. “That could potentially decrease, temporarily, exports if you can’t get ships in and out of places like Nederland and the Houston Ship Channel, not to mention it could shut down production within the East Coast.”

Speaking of weather, the refinery-heavy Houston area faced destructive winds of nearly 80 mph during severe storms last week, with minimal damage to refineries during initial assessments, Argus reported.

Lower winter prices

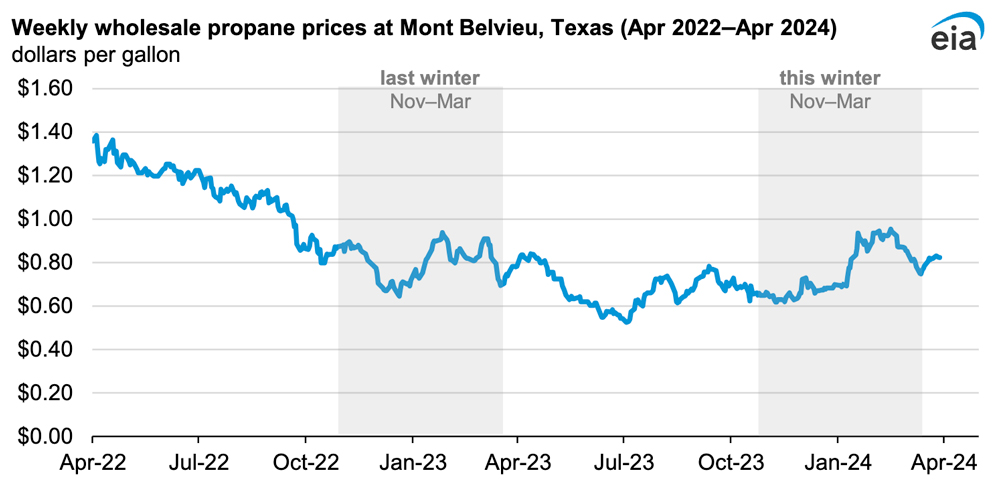

Wholesale and retail propane prices were slightly lower on average this winter than last winter, the U.S. Energy Information Administration (EIA) reported.

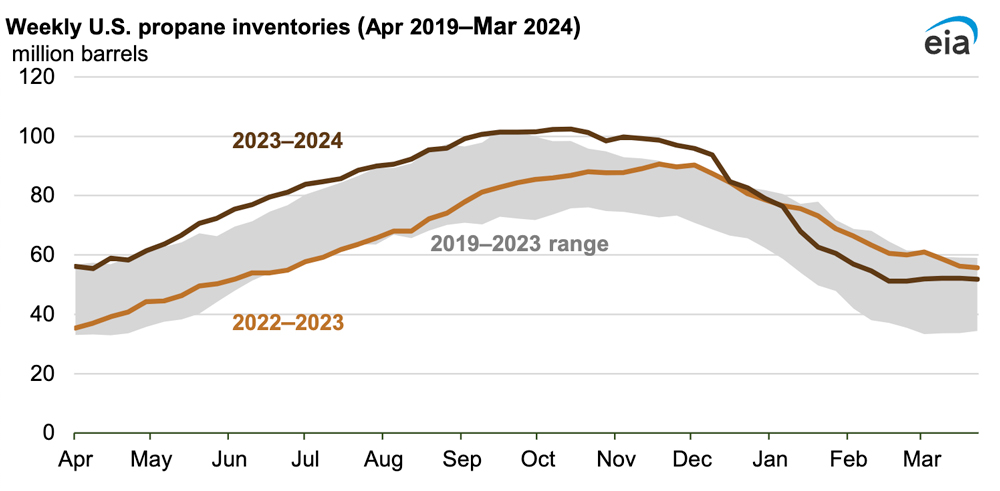

EIA says the decrease owes largely to mild weather and strong propane inventories heading into the winter heating season.

Wholesale propane prices at Mont Belvieu, Texas, averaged 77 cents per gallon during the 2023-24 winter heating season. This price was slightly lower than the 80-cent-per-gallon average recorded last winter heating season and the $1.25-per-gallon average for the 2021-22 winter heating season.

Retail propane prices for the three U.S. regions for which EIA publishes data – the East Coast (PADD1), Midwest (PADD 2) and Gulf Coast (PADD 3) – decreased this winter compared to last winter. Prices in all three regions stayed relatively flat until mid-January, when Mont Belvieu prices began to increase.

On the East Coast, propane prices averaged 1 percent lower than last winter, although they increased slightly above last winter beginning in January. In the Midwest, prices stayed well below the previous winter’s prices and ended the season 10 percent below last winter. On the Gulf Coast, prices began the heating season 7 percent below last winter and ended 1 percent lower.

The lower retail prices helped keep average household expenditures on winter propane about 3 percent lower, estimated around $1,300.

Chart 2: Weekly U.S. propane inventories. Data source: U.S. Energy Information Administration, Weekly Petroleum Status Report

Some other notables from EIA:

- Propane inventories remained above the previous five-year range (2018-19 to 2022-23) for most of the storage injection season. For the first week of the winter heating season ending Nov. 3, 2023, the EIA reported U.S. propane inventories at 98.4 million barrels, 12.2 million barrels more than the five-year average.

- Last year’s corn crops were planted early, leading to an earlier-than-normal harvest and less grain-drying propane demand in November 2023. As a result, Midwest propane inventories began the winter heating season near the top of the five-year range.

- Propane inventories in the Gulf Coast region began at the top of the five-year range at the start of the winter heating season. Inventories drew down to a low of 30.2 million barrels in the last week of February 2024, which was average for the previous five years.

- Propane exports set a record high in 2023 and have continued to stay elevated through the end of the winter heating season, contributing to high inventory withdrawals. Despite record-high exports, low winter heating demand contributed to Gulf Coast propane inventories remaining near the five-year average.