Extreme events put inventory in unusual situations

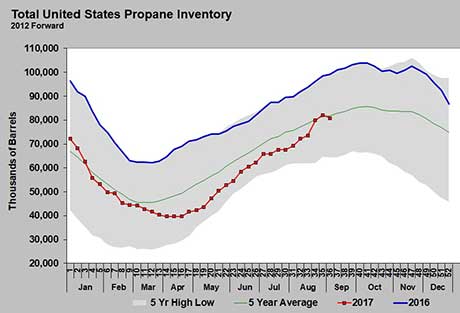

Propane prices increased after the U.S. Energy Information Administration (EIA) reported U.S. propane inventory fell 1.377 million barrels for the week ending Sept. 15 (see the chart below).

The draw was certainly early in the year, but it was a continuation of the unusual changes in inventory that have occurred since Hurricane Harvey. In the Sept. 11 issue of Trader’s Corner, we responded to the 6.346-million-barrel build in propane inventory. That build came the first week after Harvey.

Here is what we said: “The simple fact is that it is going to take several EIA reports before we know the true impact of Harvey. We would expect at least one more week with a hefty inventory build reported. After that, it will depend on how robust exports become. We expect that most of the ships that were delayed from Harvey will still pick up their loads, resulting in very heavy export volumes for a couple of weeks. We expect most of that activity to show up in data collected on Sept. 15.

“We think the propane market’s muted response to this massive inventory build was the correct response. We would guard against knee-jerk reactions to data reported over the next two to three weeks at a minimum.

“Overreaction to big inventory builds over the next two weeks could result in unloading supply positions that retailers wished they had back later. At this point, we suggest delaying decisions on unloading supply positions until closer to the end of the month, when the full impact of Harvey should be more clear. The controlled response to last week’s inventory report makes that recommendation much easier to make.”

Another above-average build of more than 2 million barrels was indeed reported for the week ending Sept. 8 (reported Sept. 13), as propane exports had not yet recovered. However, as anticipated, last week’s EIA report for data collected on Sept. 15 showed a massive increase in propane exports. Export rates were reported at just 180,000 barrels per day (bpd) for the week ending Sept. 8 but jumped to 1.065 million bpd for the week ending Sept. 15. That was an 885,000-bpd week-over-week increase.

That export rate is high for this time of year. Once the backlog of export loadings that were caused by Hurricane Harvey are filled, then we would expect future inventory changes to be more typical. However, we would not be surprised by one more week of high export rates before things settle down to a more normal loading schedule.

We also have room for a little more recovery in propane supply, which should help limit the negative impact to inventory.

When we warned against overreacting to the 6.3-million-barrel inventory build at the first of the month, Mont Belvieu propane was trading at 83 cents. As of last week, Mont Belvieu was trading at 94 cents. Conway moved from 79 cents to 90 cents. So, again, those that bailed on September supply positions as a reaction to the inventory build at the beginning of the month are regretting the move now.

When we are in unusual situations created by hurricanes and other extraordinary events, we need to be careful about overreacting to one, two or even three weeks of data. We must have the discipline to keep our eye on the bigger picture and realize the underlying data leading to those unusual inventory changes are often going to be temporarily skewed.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.