Financial swaps provide predictable results

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains best practices for using financial swaps.

In this Trader’s Corner, we will continue our study of financial swaps with our fifth segment in the series. If you missed parts one, two, three and four, you may want to review them since each segment builds on what we covered previously.

As we prepare to delve into this next segment, remember that using financial swaps to counter the changes in propane prices in the physical market is a separate activity. Retailers do not need to change their physical suppliers when employing financial swaps.

We do recommend buying from your physical supplier on an index contract if possible if you are going to use financial swaps. Financial swaps trade and settle at the trading hubs of Mont Belvieu and Conway. Buying from a supplier at the Mont Belvieu or Conway price, plus a specific differential, helps connect the pricing of the retailer’s physical propane and the financial swap, enabling them to work better together.

In our last segment, we set up an example in which a propane retailer agreed to a fixed-price sale to a commercial, industrial or municipal account. In our scenario, the price of propane went up from the time the fixed price was quoted and the propane was delivered. Therefore, the retailer made less margin than desired from the physical side of the transaction. However, the financial swap paid the difference. Combined, the two activities yielded the exact margin the retailer estimated when providing the fixed-price quote to the customer.

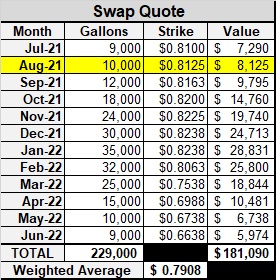

Of course, we also know propane prices can go down. In our example, the retailer entered into the agreement with the customer in May 2021. The financial swaps that allowed the deal to be done were entered during May as well. Physical delivery of the propane began in July with 9,000 gallons. Let’s move on to August now but assume this time that propane prices fall.

As you can see from the schedule of months and volumes, our retailer is obligated to deliver 10,000 gallons in August.

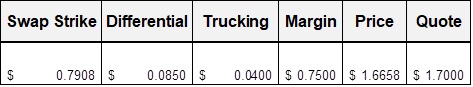

The retailer’s desired margin was $0.75. He only needed to charge $1.6658 to make that margin, but he bumped the price up to $1.70 to provide a buffer for a contingency we discussed thoroughly in the last segment.

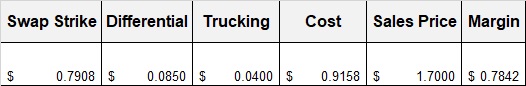

To make this a little cleaner to discuss without looking at the contingency, let’s assume our target margin was $0.7842 from the outset.

Let’s review the following pricing components before moving on.

Swap strike: For this deal, the retailer entered into 12 different swaps each with a specific volume per month based on the customer’s expected demand. Each swap had its own strike price. However, the quote to the customer was made using a weighted average price for the entire series of swaps of $0.7908. At the end of the month, the strike price is compared to the monthly average to determine what direction the money flows when the swap settles. If the monthly average is more than the strike, the retailer gets a check for the difference. If the monthly average is less than the strike, the retailer pays the difference.

Differential: This is the amount that is added to the daily average at the trading hub on the day physical gas is lifted by the supplier to determine how much the retailer will pay for the propane at the pipeline delivery location. When pricing is done this way, rather than at a posting, it is called an index contract because the price is indexed to the trading hub.

Trucking: The known negotiated cost for a trucking company to deliver propane from the pipeline terminal to the retailer’s bulk tank.

Cost: The sum of the previous “costs.”

Sales price: The predetermined fixed price that the customer will be charged for propane delivered regardless of the actual cost of the propane to the retailer.

Margin: The budgeted margin expected once the physical supplier is paid, the consumer pays and the swap settles.

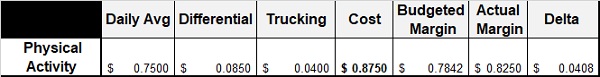

So in this week’s example, we look at a case where propane’s price falls.

In this case, the physical propane in our tanks only cost $0.8750 instead of the $0.9158 that the price to the customer was based upon, so the margin on the physical delivery of the propane was $0.0408 more than budgeted.

Again, let’s assume the Mont Belvieu monthly average turned out to be $0.75 cents, the same as the daily average we paid for the physical propane. That is $0.408 below the strike price on the swap of $0.7908.

In this case, the retailer will use the extra margin made on the physical transaction to pay the difference on the swap: $0.408 x 10,000 gallons = $408. Combined, the activity on the two transactions returns the margin to $0.7842 just like it did when physical prices were higher. So it doesn’t matter which way physical propane prices go; the goal of combining the physical and financial transactions is for the retailer’s margin to be exactly, or very near, what he budgeted when he quoted the customer.

Here is the problem, though. Retailers tend to get amnesia when the transaction goes in this direction. Back in July when the retailer received the check from the swap, it was the best thing since sliced bread. However, when he writes this $408 check, he tends to forget that the swap allowed him to make a fixed-price quote with essentially no risk or worry. At the time, the budgeted $0.7842 margin was just what he wanted; he did choose it, after all. Now, all he can see is that he could have made $408 more in August on this deal were it not for that swap.

As the year goes on, the remaining 10 swaps will settle just like the previous two months. The retailer may be receiving checks from the swap because physical propane prices went higher. He may be writing checks because physical propane prices went lower. In May, when all this began, there was no way to know for sure which way physical propane prices would go. Without the swaps, the retailer would have had no way of providing a fixed price to the customer without taking on significant risk.

Swaps are risk management tools when used like our example. They are true hedges that provide predictable results. In next week’s Trader’s Corner, we will look at how things change when swaps are used to speculate. Speculation comes when we own the swap, but we do not have an offsetting fixed-price sell against it.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.