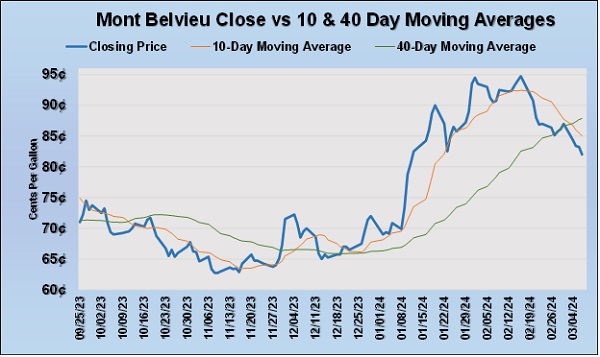

Contangoed vs. backwardated crude price curves and propane prices

May 13, 2025 By Mark Rachal

Mark Rachal looks at the impact of crude forward price curves on propane prices.

Read More

Mark Rachal looks at the impact of crude forward price curves on propane prices.

Read More

Mark Rachal, director of research and publications, explains key concepts in propane futures.

Read More

Cost Management Solutions discusses three tools that propane retailers can use to manage supply side risk.

Read More

In this Trader’s Corner, we will try and capture some things we know as propane buyers, some things we may not know now but could, thus reducing the number of unknowns to one.

Read More

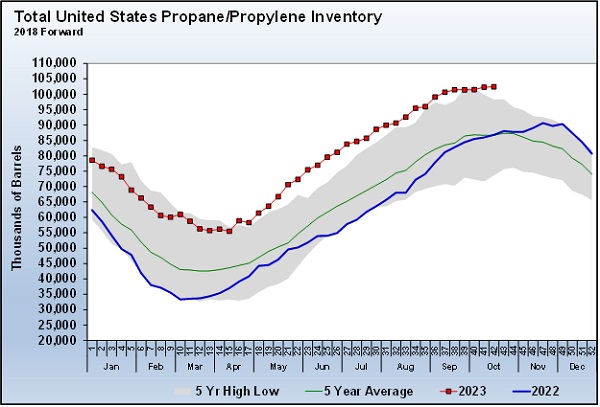

Propane prices have been declining since the middle of February. The market feels bearish – and with good reason.

Read More

Cost Management Solutions’ Mark Rachal, director of research and publications, discusses propane’s relative value to crude and inventory options this winter.

Read More

Nicolas Pintabona joined Angus Energy as an account executive, focused on hedging opportunities for the company’s client list and expanding in the Northeast.

Read More

Price risk management firm Synergy Commodity hired Arthur Ravo as a senior adviser. He has more than 32 years of experience in propane supply and hedging.

Read More

For future reference, use this list of key points about financial swaps and how they can be used with pre-buys and spot buying to manage price risks.

Read More

Speculation requires vigilance in monitoring the position. If it isn’t performing as expected, then the prudent step might be to close the position.

Read More