Gasoline demand is influencing crude prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why gasoline demand will influence the price of crude.

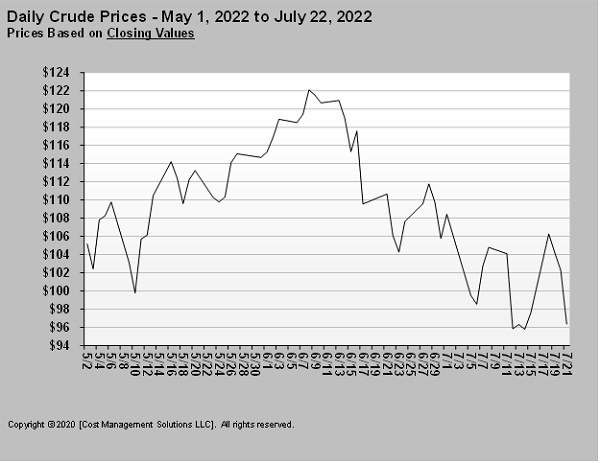

Propane buyers have benefited from a downtrend in crude that began on June 9.

Prior to June 9, crude prices had been climbing as supply concerns primarily related to Russia’s invasion of Ukraine dominated crude’s price direction. But, in early June, the focus of traders began to shift from supply to demand. The war was causing major economic issues around the world, not to mention high energy prices. Not only were energy supplies threatened but so were food exports from both Russia and Ukraine. Food costs were going up along with energy costs. This came on the heels of massive government spending to try to combat COVID-19 and its impacts on economic activity.

The combination caused inflation to start spiraling out of control, hitting 40-year highs. Central banks began to respond to inflation by raising interest rates and otherwise tightening monetary policy to slow down economic growth and hopefully inflation. The actions of central banks and the potential for energy demand destruction started taking the lead in crude price direction.

Indeed, supply concerns are still present, and we can see that since the June 9 downtrend developed, there have been rally attempts driven by supply issues. But overall, demand worries have remained the dominate driver.

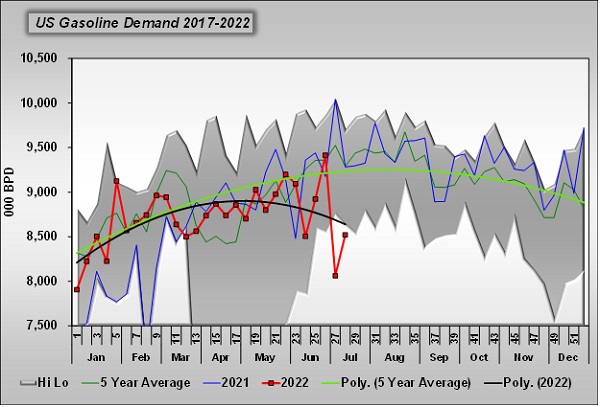

High energy prices started hurting demand for energy products. This time of year, during the summer driving season in the Northern Hemisphere, gasoline gets much of the attention of traders. In the natural gas liquids part of the energy spectrum, gasoline-making components like butane and natural gasoline show more price sensitivity than, say, propane.

Recent data on gasoline has shown signs of demand destruction. As they say, there is no better cure for high prices than high prices. Naturally, consumers try to decrease consumption where possible when prices increase.

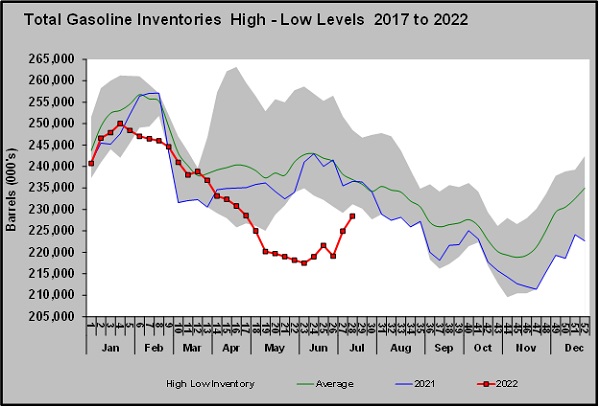

Chart 2 on U.S. gasoline inventory shows how declining supplies were part of the upward pressure on energy markets until June. But in early June, gasoline inventory started building again, which corresponds to the downturn in crude’s price. Refineries were processing more crude, running at high rates above 94 percent. At the same time, high prices were taking their toll on the consumer, which started showing up in lower gasoline demand.

Demand numbers can be a bit choppy, so we added a couple of trend lines to Chart 3 so you can better see the impacts of higher prices. The green line is the five-year average gasoline demand. You can see how it generally rises this time of year before peaking in August. The black line shows how this year has been different. From almost the beginning of Russia’s invasion of Ukraine and the resulting spike in gasoline prices, demand destruction began. The impacts on demand have accelerated recently.

The data on gasoline in Charts 2 and 3 have heavily influenced what crude prices have done as reflected in Chart 1. Crude is at a critical stage. With the downturn, it is close to falling into a bear market. A bear market for crude is generally considered to occur when its current price drops below its 200-day moving price average.

Crude has been above its 200-day average since December 2021 and in a bull market. On July 14, West Texas Intermediate crude fell below its 200-day moving price average for the first time since December. It rallied back above it with a strong bounce, but it was once again testing support at the 200-day average by the end of last week. Testing support simply means we were seeing if there were enough buyers to maintain the bull market. If buyers are still bullish on crude, they are going to see a drop to the 200-day moving average as a very good buying opportunity. If there aren’t enough players with the conviction that crude should remain bullish, prices will drop below the 200-day moving price average and start closing below that mark.

On July 14, crude’s price dropped below the mark but rallied intraday to close above it. If closing prices start coming in below the 200-day average, then it could spark more chart-related or technical selling, and a bearish phase for crude could begin.

We don’t think there are quite enough traders who believe a global recession that will hamper crude demand longer term is an absolute certainty. There are also still plenty of concerns about crude supply reliability, which will make a fall into a bear market for crude particularly hard. However, the economic data is not trending well in most cases. Neither is inflation nor central banks’ responses to it.

We are actually at a very critical time here for propane. Propane fundamentals have recently been more supportive of higher propane prices. The downtrend in crude since June 9, along with the time of year, have been immensely important in countering these fundamentals shifts in propane, keeping pressure off propane prices. But if crude stays out of bear territory and crude bulls start gaining confidence again, a rally in crude could develop. If that occurs and propane fundamentals keep trending in a way that is more supportive of propane’s price into the seasonal demand period, the pricing environment for propane could start looking a lot different.

High prices in gasoline slowed demand, ensuring enough supply this summer. In a similar fashion, higher prices for propane could also develop as its seasonal demand period nears. In any case, whether crude stays in a bull market or drifts into a bear market will heavily influence propane’s overall pricing environment when the higher seasonal demand period begins.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.