Getting ahead of rising propane prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses strategies for price protection in the face of rising propane prices.

Catch up on last week’s Trader’s Corner here: What the future holds for crude prices

Did you know that studies show that propane retailers tend to pass on price increases to their customers more slowly than their suppliers pass on price increases to them? Isn’t that nice?

Suppliers put out a posting each day, which is easily changed, or they sell to their retailers based on an index to a trading hub such as Conway and Mont Belvieu, where prices quickly change. But the retailer, especially in the winter, is very busy, and adjusting prices to their customers often lags behind the price increases they are receiving.

Of course, the result of this tendency is an erosion of the retailer’s margin. With costs up, this is a tendency we should avoid if possible. In today’s Trader’s Corner, we are going to discuss a simple but effective strategy for combating this tendency. In the process, we are going to point out something that even veteran users of propane swaps may not know. If you have been considering using swaps but can’t get yourself to pull the trigger, this strategy may be just the one you need to get your feet wet. The duration of the position is just a month. Less time generally lowers risk, and the process will be completed quickly, which is great for getting a feel for how the process works for those using a swap for the first time.

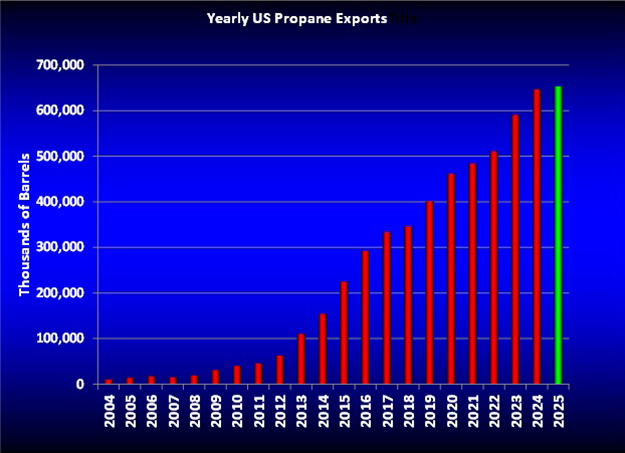

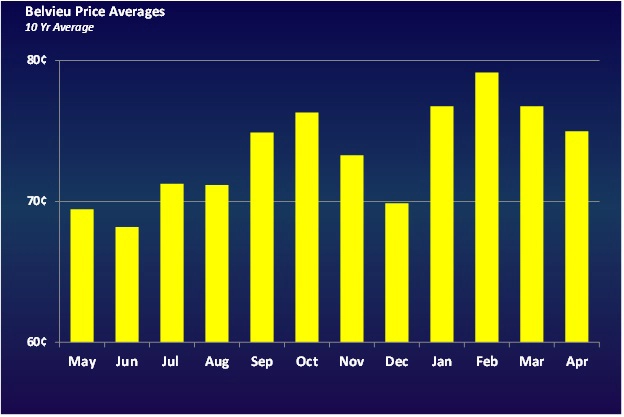

Chart 1 plots the 10-year average price by month for Mont Belvieu. The first thing we need to do is identify the periods when retailers are most likely to be hurt by the tendency to lag price increases. Four months stand out: September, October, January and February.

We have discussed the tendency for prices to slide in November and December before, but it is worth noting again here, since it could impact the strategy we are going to suggest.

Crude is a major influencer of propane’s prices. Crude inventories are usually at their lowest toward the end of the summer, which can keep crude prices supported. This year, that has not really been the case. Crude inventories are indeed low, like they usually are this time of year, but pricing this year hasn’t been typical. The reason is that OPEC+ has been increasing production for six months, which has held crude prices in check.

Even so, propane prices moved up to start September. From that standpoint, there could be seasonal influences for propane itself, such as buying ahead of winter, or perhaps just a little hype and anticipation of the upcoming demand.

In our Trader’s Corner from a couple of weeks ago, we pointed out that refineries start taking down units in the fall to do maintenance after driving them hard through the summer months to meet gasoline demand. The resulting decrease in crude throughput at the refineries takes the pressure off the price of crude.

Over the last 10 years, propane has generally been oversupplied, and winters have been on the milder side, so propane supply has not been under pressure in early winter. The combination of falling crude prices and adequate propane supplies has caused November and December propane to have a 10-year average price lower than the months on either side.

With this bigger pricing picture in mind, let’s overcome this tendency to allow our retailer margin to erode when prices are rising. In seven of the last 10 years, propane prices have been higher in September than they were in August. Therefore, we propose that the retailer consider buying a swap for September propane in late August.

If a retailer bought a September swap with a volume close to most of their expected demand, the swap could offset margin erosion if the retailer failed to pass on price increases as rapidly as their wholesalers. If propane prices rise over the course of the month, the payout on the swap would offset some of the margin erosion.

The biggest issue with the swap in this scenario is that it settles on the month average. So, if prices steadily go up throughout the month, the swap may not cover all the price increase. In other words, the swap would not offset all the price increase on propane bought toward the end of the month. In this case, the retailer might still need to make a price adjustment at some point to protect margin.

Another tool that retailers could use is a physical position. A physical is just like a swap at the beginning in terms of its strike price. However, instead of settling on the month’s average, the retailer decides when to close the position. Assuming prices went up steadily throughout the month and the retailer chose to close the position on the last day of the month, the payout on the physical would be higher than the payout on the swap.

To more closely match the market, the retailer could also settle a portion of the physical at different increments over the month. Let’s say the retailer bought a 40,000-gallon September physical position at the end of August. He could close 10,000 gallons per week over the course of September.

There are a couple of things that retailers should consider when using physicals over swaps. It is obviously attention-intensive for the retailer. Picking the right date to close the position or closing the position in increments requires the retailer to be more involved over the course of the month. It will be a busy time of year, and it may not be something the retailer wants to commit to doing.

The other consideration is what is known as the bid/offer spread on propane. When buying a swap or physical, the initial strike price will be based on offers in the market. Offers are the price that sellers are willing to take at the time the position is opened. Offers are higher than bids, which is what buyers are willing to pay.

Yet when the retailer closes the physical, he will receive a price near where propane is being bid. Looking at the trading screen as we write, the difference between the bids and offers is between 0.5 cents and 1.5 cents. Bid/offer spreads could get even wider in some situations. If the retailer uses physicals, they should consider this bid/offer spread and build it into the price they charge their customers. Since a swap naturally settles on the monthly average, the bid/offer spread is not really a factor.

Here’s the thing that veteran swap users may not know. It is already September as we cover this subject. So, can a position for September still be taken? We are writing this on Sept. 5, but as you read it, it will be Sept. 8. But you can still take a swap position for September. Let’s say you do it on Sept. 8. Then your swap will settle on the balance of the month (Balmo) price average from Sept. 9 through Sept. 30.

Based on the price history above, regardless of using swaps or physicals to implement the strategy, the retailer might consider repeating this strategy for October, skip November and December and then resume it in January and February.

As always, current market conditions should be considered when implementing any strategy.

Looking at the price history, a retailer might also consider selling a swap or a physical at the end of a month that precedes a month that is usually lower – for example, selling a swap or physical at the end of October for the month of November. However, we want you to consider some things very carefully if you are tempted to do so.

In the strategy we discussed, the retailer is protecting himself from margin erosion and, to a lesser degree, protecting customers from higher prices. Those are activities that are compatible with a commercial retail propane business. Selling swaps or physicals for a commercial propane retailer isn’t really managing a risk so much as it is speculation.

If a retailer has a pre-buy or has bought a swap position and is therefore long on propane for the upcoming month, then selling a swap or physical would be considered a price risk management strategy.

However, if the retailer does not have such a position, selling a swap or physical does not perform any kind of risk management. Anyone who is commercially in the business should proceed carefully before speculating.

Without a hedge position, a propane retailer is naturally short the supply they will sell in the future and is thus at risk of higher prices. If the retailer then takes a speculative position by shorting (selling a swap or physical), they are doubling down on the negative consequences of higher prices. Higher prices will not only make maintaining sales margins harder – they will also result in a trading loss that will need to be covered.

Looking at Chart 1, it might be tempting to short (sell a swap or physical) for December propane, which means the retailer would get a financial windfall in a falling price environment. But that is speculating – pure and simple. Should prices go up instead, the trading losses could negate a lot of hard work delivering propane to end-use customers.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.