Global crude markets continue to adjust to OPEC’s new role in production

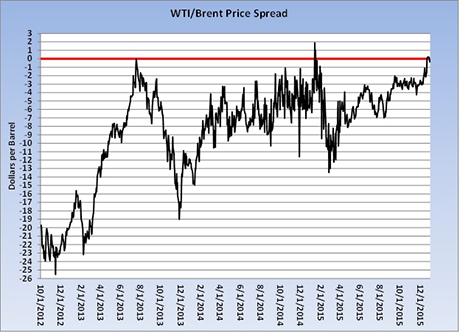

West Texas Intermediate (WTI) crude is the U.S. benchmark crude. Brent crude has become the benchmark crude for much of the world. In 2012, Brent crude was trading at $25.53 per barrel higher than WTI. Recently, however, the two benchmarks were at nearly equal prices. Last week, WTI spent some time higher than Brent.

The Brent premium developed as new production in the United States and Canada overwhelmed the U.S. storage and trading hub of Cushing, Okla. The first phase of removing the premium came when pipelines allowed landlocked crude in Cushing to be shipped south.

The closing of the spread was also supported by lowered U.S. production and higher global production that developed with the Organization of the Petroleum Exporting Countries’ (OPEC) decision to no longer be the world’s swing producer. The lowered U.S. production supported WTI, and the higher global production put downward pressure on Brent.

Until November 2014, OPEC’s policy was to support global crude prices by limiting its crude output. That target was for Brent to trade between $70 and $100 per barrel. That price range was considered a good balance between offering affordability for consumers and providing producers the incentive to continue developing additional sources of crude.

Innovations in drilling and production techniques have allowed producers to recover crude from shale formations. The cost of producing crude from shale was high relative to conventional production, but it was profitable at the OPEC target price range. Also, crude reserves in shale formations were abundant. The advent of producing crude from shale forced OPEC to reconsider its role as the world’s balancer of crude markets.

If OPEC cut production to try and support crude prices, its lowered production was simply offset by more production from shale formations, primarily in the United States. As a result, OPEC changed its policy from trying to balance crude markets to become the world’s baseline producer. The conventional crude production used in OPEC nations has considerable cost advantages over nonconventional production from shale and oil sands.

Essentially, OPEC’s decision was to let market forces determine which type of crude is produced. The change in policy is working. Production from shale formations in the United States is falling. However, it has not fallen enough to offset increased production from OPEC. OPEC estimates that global crude production is 2 million barrels per day (bpd) over demand.

The possible lifting of sanctions against Iran that have cut its crude exports by 1 million bpd looms. If those sanctions are lifted, the world could be oversupplied at 3 million bpd or have an increase in reserve supplies. Either prospect is bearish for crude.

The final phase of closing the spread occurred with the lifting of the 40-year-old U.S. crude export ban. This may not cause much immediate new export activity from the United States, but it does allow the market to operate more normally without the restrictions in place.

The current economics and the shutting of more U.S. production would encourage more crude imports. Last week, the United States imported 7.892 million bpd of crude, up 566,000 bpd from the previous week. Imports ran 831,000 bpd more than the same week last year.

As we begin 2016, it looks like global crude markets will spend much of this year continuing to adjust to OPEC’s new role. That is likely to mean a low-price environment for at least the first half of this year for both crude and propane.

Many believe crude prices will begin to recover by the end of the year as more high-cost crude is taken off the market. The low prices are also hurting alternative fuel development and conservation efforts. Low prices are helping to increase consumption, but so far the struggle of the global economy has limited the gains in consumption. Ultimately, it will be the fortunes of the world’s economies that will determine when the current ultra-low price crude environment will end.

For propane retailers, low crude prices, high propane inventory and the mild winter are certainly helping to keep supply costs low. However, retailers must keep a close eye on propane production. Decreased drilling activity for natural gas and lower values for natural gas liquids have slowed the growth of propane supply and could begin to erode it.

As we begin 2016, significantly higher export capacity and a slowdown in propane production could quickly clean up propane’s oversupply. If by next winter that has happened and crude markets have finally sorted themselves out, propane prices could move out of the current ultra-low price cycle. Though we would not expect a rapid increase in prices, an upswing in the pricing cycle would encourage more hedging of propane supply for the winter of 2016-17.

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.

Graphics: West Texas Intermediate