How propane rejection could impact supply, pricing

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews how a potential propane rejection could impact supply and pricing this winter.

With the background provided in last week’s Trader’s Corner, we are ready to move to a more specific look at U.S. natural gas and how developments in that market could impact the U.S. propane market. As we mentioned, 87 percent of U.S. propane supply comes from natural gas processing, and 13 percent comes from crude refining. Once the ethane, propane and heavier natural gas liquids (NGLs) are separated from the methane, they are priced relative to crude.

However, there is a situation where the price of natural gas could significantly impact the price of propane. It is a situation that has not been in play for many years, but potential for the event to happen this winter is in place. We are talking about propane rejection at the natural gas processing plant.

Natural gas produced from a natural gas well, or as associated natural gas production from a crude well, moves to a natural gas processing plant, which simply separates the methane from the NGLs. The methane is then transported to natural gas utility companies, and the NGLs are shipped to fractionators where the ethane, propane, butanes and natural gasoline are all separated into fungible products that then move to their respective consumers. Ethane mostly goes to petrochemical companies. Propane goes to petrochemical companies and to propane wholesalers/retailers/consumers. Butanes can go to petrochemical companies and refiners, and natural gasoline goes to refiners to blend with refined gasoline.

However, if natural gas prices get high enough, some of the ethane and propane might get rejected at the natural gas processing plant. Rejection means that instead of separating all of the ethane and propane, some of it is left with the methane and sold to the natural gas utility company. Contracts will specify how much of the heavier NGLs can be left in the methane. Obviously, such an event would limit propane supplies and put upward pressure on prices.

Currently, U.S. natural gas (methane) is trading at $9.3140 per MMBtu, which is the equivalent of 85 cents propane. With propane valued at 108 cents, economics dictates it be separated and sold separately from the methane. The cost of separation is about 6 cents, so natural gas would need to rise about another 20 percent, to $11.18 per MMBtu, before rejection is a real possibility at today’s propane price.

U.S. natural gas prices have more than doubled since this time last year. Global events are driving natural gas prices higher as supplies from Russia are threatened. Right after Russia invaded Ukraine and the world started looking at how to respond, there was pressure to stop buying Russian energy. In our March 14 Trader’s Corner, we explained how difficult that was going to be, especially relative to natural gas. European natural gas prices reflect this fact. As of Sept. 1, the European Union Dutch TTF natural gas price is at $72.14 per MMBtu, or 7.75 times higher than the U.S. natural gas price. EU natural gas prices started climbing when Russia started building up its troops to invade Ukraine. For example, in November 2021, the Dutch TTF price was $11.38 per MMBtu, or about 16 percent of what it is today.

Russia is already limiting natural gas supply to the EU, so it is more difficult for them to build inventory before winter. There is also the real possibility they could completely cut off the EU during winter to try to end the West’s support of Ukraine. They want the West to be forced to put pressure on Ukraine to succumb to Russian demands for ending the war. This is almost certainly why Ukraine is starting an offensive to try to reclaim its territory from Russia before winter. Events could unfold where the West will cut off military aid to Ukraine, forcing it to concede whatever territory Russia holds at the time.

If Russia starts cutting off natural gas supplies to Europe, the sky is the limit to where natural gas prices could go on a global basis. A reason that U.S. natural gas prices are not more in line with global pricing is our limited export capacity of around 12 billion cu. ft. per day (bcfd) compared to our supply of around 107 bcfd. The U.S. could produce more, but there is no place to go with it until more export facilities are built. That means the U.S. remains well supplied, while many other countries search for reliable natural gas supplies.

The U.S. situation will change some in November, which could cause increased upward pressure on U.S. natural gas prices. On June 14, a large explosion took the largest U.S. liquefied natural gas (LNG) exporting facility offline. The explosion that idled the plant was caused by the overpressure and rupture of part of an LNG transfer line that released a vapor cloud and ignited, according to its owner, Freeport. The resulting fire did other damage to the plant. Operations were expected to partially resume in October, but the start date has been pushed to November. In November, the U.S. could export another 2 bcfd from this facility, putting them nearer capacity. It is anticipated the plant will be up to its full capacity of 2.25 bcfd early next year.

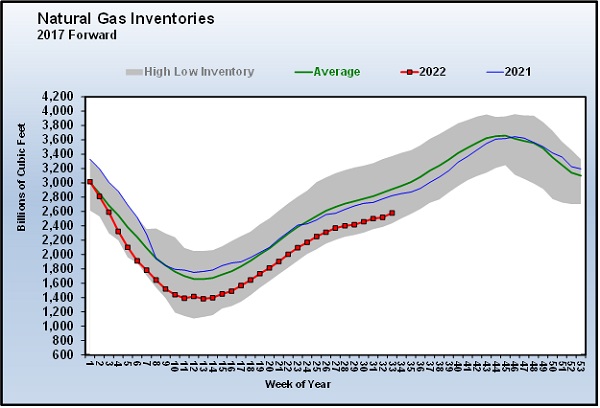

With EU natural gas prices already high and supplies from Russia far from certain, demand for LNG from Freeport should be robust when it resumes operation. When the plant went down, we suggested U.S. natural gas inventory, which was running below last year and the five-year average, would recover. But that has not been the case.

U.S. natural gas inventory, which has been below last year all of this year, simply has not improved since the Freeport facility went down. Perhaps producers are waiting in the wings with supply that can be brought online in conjunction with the opening of the Freeport facility in November. If not, there could be a drop in inventory that could boost prices right in the middle of winter. Regardless, just the resumption of Freeport would allow more U.S. natural gas to enter the global market and could cause U.S. natural gas prices to move higher.

We are not suggesting U.S. natural gas prices could rise to anywhere near the pricing in Europe. There simply isn’t enough export capacity to make that happen. But U.S. natural gas prices don’t have to increase 700 percent, just 20 percent, before propane rejection could potentially occur.

To be clear, when rejection occurs, some propane will be left with the methane and sold as “natural gas” to the customers of

natural gas utilities. Whatever percentage of propane is rejected will therefore not go to fractionators, so there will be less supply of specification propane needed by propane retailers/consumers.

We are not in any way predicting this will happen. We are pointing out the potential for it to happen is greater than we have seen at any point in the last decade. It is simply another factor that a propane retailer should consider when deciding on price protection for this coming winter.

The impacts of propane rejection on propane pricing have generally been dramatic though short-lived in the past, occurring during high heating-demand periods that caused a shortage of natural gas supplies. The demand situation in the above scenario could be much longer term in nature. The shortage would not be caused by an extreme cold front that lasted maybe a week, but potentially as long as Russia believes it is benefiting politically from limiting natural gas exports. That could be all winter and beyond. If rejection were to occur, the price reaction in propane markets will likely be very swift. It will be hard keeping up with the impacts on pricing much less getting ahead of the situation once it is occurring. The only way to mitigate the impact will be preparation before the occurrence.

We said in last week’s Trader’s Corner that should the worst happen with natural gas, it could challenge us all economically and maybe even morally. That may sound dramatic, but it could really test the West’s resolve to stand behind Ukraine in its war against Russia. We are not sure if Ukraine is ready to undertake the military offensive it has just initiated. If it were not for the natural gas dilemma that Europe will face this winter, we question if the offensive would be conducted at this time. If that is true, brave Ukrainians will die unnecessarily in the coming weeks because Europe gave up its energy security to Russia. The U.S. would be very wise to consider with all due seriousness and haste the vulnerabilities in its supply chains; otherwise it may find itself facing similar impossible decisions now thrust upon Ukraine of which not all are of its making.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.

The amount of propane that might be rejected by processing plants is very small. Gas Pipelines have upper limits on the heat content for the gas they’ll accept that will restrict the amount of propane that can be left in the line. Even at today’s gas prices propane will still be recovered.