How US crude production is offsetting OPEC’s cuts

By now, almost everyone knows that the Organization of the Petroleum Exporting Countries (OPEC) and other major crude-producing nations have reduced their production in an effort to eliminate a surplus of crude oil that has kept crude prices subdued for months.

Near the end of the first quarter of 2016, reports began to surface that OPEC was considering a production cut. It was the first of this kind of talk since OPEC announced a change in its market strategy in November 2014.

Prior to 2014, OPEC tried to balance crude supply and demand with production controls aimed at maintaining prices at what it said was a fair balance for both importing and exporting nations. OPEC claimed the resulting higher price would ensure the capital investment in the energy sector necessary to supply the world with crude.

The higher crude prices made producing crude from higher-cost shale formations viable. Soon after, shale oil from the United States was flooding the market and driving crude prices lower. By November 2014, OPEC had seen enough and unveiled its plan to shift its strategy from supporting prices to maximizing market share. It would use its substantially lower lifting cost to sell more crude, thus generating the revenue it desired even with crude valued lower.

The idea was that the low price of crude would drive the high-cost producers out of business and leave OPEC with increased market share and eventually a rising price environment. In part, the plan worked, as supply from high-cost producers began to dwindle. However, with no controls, OPEC was easily outproducing the declines elsewhere, resulting in a build of crude inventory in industrialized nations to 3 billion barrels, which was about 286 million barrels above the five-year average.

The expected rise in crude prices never occurred, leaving OPEC nations and other major producers that use revenue from crude exports to run their governments, searching for ways to support crude prices. The result was the recently enacted production cut agreement by 24 nations.

Under the agreement that was approved in November and enacted in January, OPEC nations were to cut nearly 1.2 million barrels per day (bpd) from their October production levels and other producers were to chip in with 600,000 bpd in cuts. OPEC nations have done a good job in meeting their pledge production cuts, while other producers have not cut production as much as they had pledged. However, even with the cuts, global crude supplies increased in February.

While the plan has not reduced crude inventory, crude prices nevertheless increased 46 percent in 2016. That has been great news for producing nations, but the higher prices can only be sustained if inventories do eventually come down as originally expected.

The problem for OPEC has been those U.S. shale oil producers that had suffered so severely after OPEC’s November 2014 policy shift came roaring back to life. This took place almost immediately after reports surfaced that OPEC might be backtracking on its program to gain market share and shifting back to controlling production.

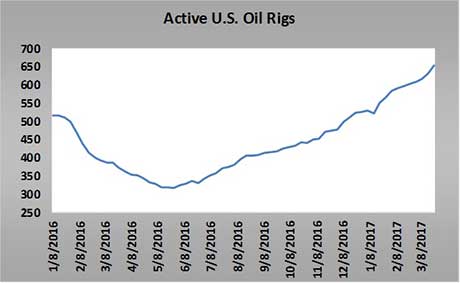

From the time that rumors of a possible production cut agreement surfaced until it was implemented in January, rigs actively drilling for crude had increased from 316 to 525. Drilling activity has continued with 652 rigs actively drilling for crude in the United States.

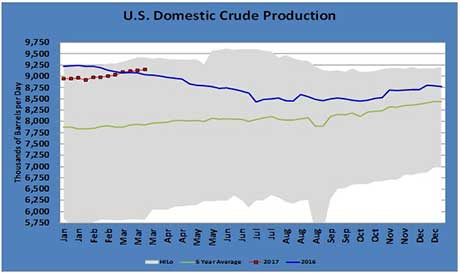

The drilling activity led to a much quicker ramp-up in U.S. crude production than expected.

After decreasing through the first half of last year, U.S. crude production began rising in the second half of 2016. Since the beginning of the fourth quarter of 2016, U.S. production increased by 680,000 bpd. That increase has offset more than half of the cuts that OPEC nations have achieved.

Now OPEC and other producer nations are in a quandary. They can stay the course with the production cuts knowing increased production from the U.S. is going to cancel out much of what they are doing and make the process of reducing the global crude overhang a very long one.

Or they can go back to the strategy of essentially unlimited production in hopes of once again reducing supplies from the United States, knowing that strategy led to the inventory surplus in the first place and sharply lower crude prices, which they can’t tolerate for very long.

Regardless of how they proceed, the high case for global crude oil prices will probably be $60. The low case for crude could be much worse if OPEC decides it must try and put U.S. producers back in their proverbial bottle. In any case, there is not a lot of risk that sharply higher crude prices in 2017 will cause a rise in U.S. propane prices.

The upward pressure on propane prices will more likely come from tightening U.S. propane fundamentals. Given those pressures have a chance of being high this year, it is quite fortunate for propane retailers and their customers that the upside price potential for crude is limited.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.