Manufactured housing remains high priority for propane industry

Randy Doyle’s affinity for the manufactured housing market formed 20 years ago during a conversation with a propane industry champion.

Randy Doyle, right, and PERC’s Bryan Cordill discuss manufactured housing at the 2022 Propane Expo. (Photo by LP Gas staff)

Doyle learned from Milford Therrell, an LP Gas Hall of Famer whose work helped lead to the creation of the Propane Education & Research Council (PERC), about how the industry had lost a market it once dominated.

Since then, Doyle, a 40-year propane industry veteran and now a consultant with Holtzman Propane in Mount Jackson, Virginia, has kept a close eye on the manufactured housing industry. And he doesn’t like what he’s seen as it relates to propane.

In visiting manufactured home retailers in his area, Doyle has noticed a lack of propane tanks on-site. A clean-burning energy source that could bring affordability, reliability and comfort to homeowners of manufactured housing units was nowhere to be found.

“We’re losing the game. If you play sports or in business, you shouldn’t like to lose,” he says during an educational session on manufactured housing at this year’s Southeastern Convention & International Propane Expo, held by the National Propane Gas Association in Nashville, Tennessee.

Though challenges exist for propane in the manufactured housing market, new industry initiatives and partnerships are keeping hopes alive that propane will one day reclaim its place in a market that’s experiencing an upsurge in production over the past several years, even through the COVID-19 pandemic.

Lost market share

How challenging are the market metrics for propane in manufactured housing?

Propane owned about half of the market in the 1990s before its share dropped to 21 percent in 2000, 13 percent in 2015 and 9 percent in 2020, according to PERC. In 2020, more than 717,000 manufactured homes used propane for heating.

“Many manufactured homes go beyond the gas mains, and look at the advantage propane can have,” Doyle says. “Why is it we have lost the market? And is this a viable market for the propane marketer? If the answer is ‘yes,’ what do we do as propane marketers to get that back?”

Ninety percent of propane’s market share in manufactured housing comes from northern areas of the U.S., where a quarter of all manufactured homes are located, according to PERC. In Pennsylvania and New York, respectively, more than 95 percent and 90 percent of factory-built homes use gas. But in the rest of the country, propane’s market share has fallen to 10 percent.

“Electric heat became easier,” explains Bryan Cordill, director of residential and commercial business development at PERC, about the overall decline in market share.

Many manufactured home retailers prefer to sell a house with one utility (electricity) because it quickens the sales process and eliminates one more person (the propane marketer) needed to set up a property, Cordill says. In some cases, electricity is considered a requirement.

Cordill also cites consumers’ unfamiliarity with propane, safety concerns and bad experiences as other barriers to propane’s adoption in the manufactured housing sector.

“It’s not uncommon to go to these manufactured home retailers and ask about propane, and they would say, ‘I can’t remember the last time somebody put in propane,’” says Doyle, whose company joined the Virginia Manufactured and Modular Housing Association to make inroads in the market.

The stories Doyle heard were disappointing and discouraging – until he met Allison Scholl, the owner of Pat’s Manor Homes in Mount Crawford, Virginia, in 2019.

Partners provide answers

In a 2021 PERC “Technology Series” webinar about the manufactured housing market, Scholl refers to the “dignity of homeownership and dignity of choice.”

The Virginia native believes homebuyers should have choices available to them. In the manufactured housing world, she says, electricity is often the default.

Scholl’s belief in energy choice stems from personal experience. When she moved back to Virginia from Arizona about 15 years ago, she had propane installed in her home. She recalls an ice storm that knocked out power for days, but she could still heat her home with a gas fireplace.

“I realized how vulnerable my children and I were living in an all-electric home,” she says during the webinar with Cordill and Doyle. “I will never not have a propane option in my home for heating and [cooking].”

Scholl says she’s not different from other buyers and thinks about her customers, many of whom live in rural areas where power can be unreliable, especially in the winter months. Often these buyers aren’t presented with all of the choices that homebuyers receive when building a home on-site.

“Part of the motivation I have is presenting the dignity of choice, educating our customers that they do have a choice with their power source and heating – not just electrical or oil, that they have the choice of going with propane,” she says. “It’s cleaner, oftentimes easier and a very economical way to heat your home.”

For homebuyers to realize the benefits of a propane option, including the lower total cost of ownership it affords in manufactured housing, the propane industry must play a key part in the process, its leaders say.

A partnership between Holtzman Propane and Pat’s Manor Homes helped to identify requirements and steps the industries can take to make propane a success again in manufactured housing.

“Pat’s Manor Homes became our trial,” Doyle says.

Housing types defined

- Manufactured homes: Formerly known as a mobile home, these homes are constructed according to a code administered by the U.S. Department of Housing and Urban Development (HUD Code). Manufactured homes are built in the controlled environment of a manufacturing plant and are transported in one or more sections on a permanent chassis.

- Modular homes: Constructed to the same state, local or regional building codes as site-built homes. The walls and components are built in a factory and shipped mostly complete or in panels to the home site. Final assembly and finish are completed on-site.

- CrossMod homes: A new class of manufactured homes built to the federal HUD Code. These types of homes are installed on a permanent foundation, qualify for conventional financing and are appraised using comparable site-built homes.

Says Bryan Cordill, director of residential and commercial business development at the Propane Education & Research Council (PERC), “It’s becoming difficult to look at a house and tell if it’s a modular or site-built home.”

Sources: U.S. Department of Housing and Urban Development and PERC

Live-burn program

Holtzman Propane and Pat’s Manor Homes agreed that, for homebuyers to truly understand the benefits of propane, they needed to see and feel propane at work. They developed a live-burn program that showcases propane-fueled appliances in a model home. Holtzman installed a Rinnai gas furnace, a set of gas logs and a tankless water heater, and they’ve also discussed adding outdoor propane options like fire pits and grills.

“The customer goes in and experiences gas heat in the winter rather than walking into a cold house,” Doyle says.

On the webinar, Scholl adds, “It becomes reality when they see it, feel it, touch it. … The live-burn program is very important.”

Along the way, PERC became involved, offering to fund installation of live-burn appliances at retail sales centers in exchange for information and feedback on what it would take to grow the market. The council cites market share growth in manufactured and modular housing as one of its strategic priorities.

At its April meeting in Nashville, PERC approved $120,000 for a manufactured housing sales center partnership in which propane marketers are asked to engage with their local sales center to promote propane model homes through the installation of a propane furnace, fireplace or tankless water heater. The council will cost share with propane marketers up to $6,000 for each sales center location to install live-burn floor models operating on propane.

According to PERC, the project would build on a successful test with Pat’s Manor Homes and expand to more sales centers across the country.

Manufactured housing in the US

- 22 million Americans who live in manufactured homes

- 8.4 million manufactured homes

- $106,590 average cost of a manufactured home (without land)

- 105,772 manufactured homes produced in 2021 (9 percent of new single-family home starts); this is up from 94,390 in 2020 and 94,615 in 2019

- 90 percent of residents are satisfied with their homes

- 71 percent of residents cite affordability as a key driver in choosing manufactured housing

Source: Manufactured Housing Institute

Marketer commitment

Manufactured housing is in the propane industry’s niche, Doyle says.

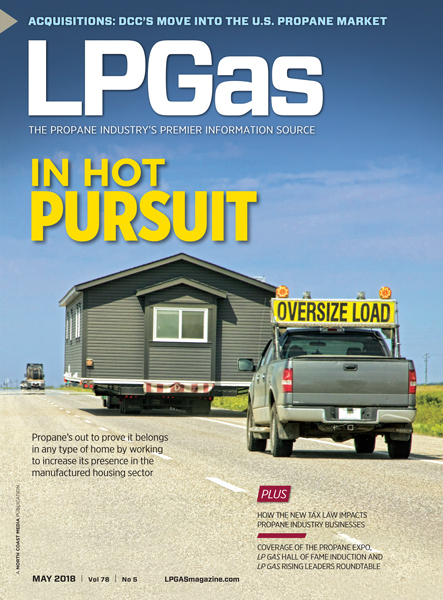

LP Gas coverage from May 2018 also focused on opportunities in manufactured housing. (Cover photo: Dougall_Photography/iStock / Getty Images Plus/Getty Images)

The market’s popularity and growth will only continue to provide residential gallon sales opportunities for propane marketers who are committed to making manufactured housing a priority, the industry leaders add, but the process takes a lot of patience and perseverance.

For marketers, according to Cordill and Doyle, that means building a relationship with the owner or manager of a home retailer and supporting them; educating the home retailer and its sales team about propane; setting up a live-burn program; and serving as that full-service propane solution for customers. From sale to install, all parties must be on board and comfortable with propane, and that process begins with the marketer.

“I would suggest, if you are serious about this, pick up the phone and call one of your [home] retailers” and ask if you can come out and talk propane, Doyle says.

Among the talking points for marketers is how a propane option can give the manufactured home retailer a competitive advantage in the marketplace and another outlet to increase revenue.

Success, he says, will come one marketer at a time.

“If we cannot compete in the manufactured housing market, where can we compete?” he says. “We know and should be confident that we’re far better than an all-electric option.”

HUD Code updates

The Department of Housing and Urban Development (HUD) is taking steps to update the Manufactured Home Construction and Safety Standards, referred to as the “HUD Code.”

The proposed updates were published in the Federal Register and are the largest set of changes to the HUD Code in over two decades. HUD says the updates support the federal government’s priority of expanding the supply of manufactured housing as a component of its efforts to address the nation’s housing supply challenges.

Notable for the propane industry: Updating and adding new standards will allow for the use of more modern and energy-efficient appliances, including gas-fired tankless water heaters, eliminating the need for HUD alternative construction approvals for use of such appliances. The proposed updates are available for public comment for 60 days.

Fighting stereotypes

Allison Scholl, owner of Pat’s Manor Homes in Mount Crawford, Virginia, says the company fights a lot of stereotypes when it comes to the safety of manufactured homes.

“Manufactured homes, in the past, had a reputation for burning more quickly if they caught fire, and you put propane in that mix and it breeds concern in our customers,” she says. “Thankfully, the manufactured housing industry has made huge strides.”

Scholl emphasizes the safety aspects of manufactured homes and says a home goes through 121 inspections before it leaves the manufacturing facility.

“There’s a lot of education we need to do as a [home] retailer, both about the safety of propane and the safety of manufactured housing,” she says.