Maximizing the benefits of financial swaps

After being in a downtrend since January 2014, propane prices could be at the beginning of a long-term uptrend. It is a prospect that has many propane retailers interested in hedging the cost of their future propane needs to protect against rising prices.

Many retailers are interested in protecting themselves and their customers as far out as three years. Currently, that appears to be a good idea. Financial swaps are the go-to tool for propane retailers to provide base price protection, especially if they are considering fixing prices beyond the upcoming winter.

Traditionally, retailers have used pre-buys from their physical suppliers to fix prices for the upcoming winter. Indeed, pre-buys still play an important role in supply risk management, but more and more retailers are using swaps to fix the price on the majority of the gallons they want to hedge.

The primary reason swaps are being used is that, in most cases, there is no upfront deposit necessary as long as retailers have established a line of credit with their trading partners. Perhaps even more important is the flexibility that swaps provide, especially when fixing prices that are far out. Over time, market conditions can change and retailers need to have the ability to adjust their supply plans.

Financial swaps can be exited before their “maturity.” For example, a retail propane company could own a swap to fix its prices for February 2019. However, anytime between now and February 2019, the retailer can close down the position and take whatever gain or loss has incurred to that point. A change in market conditions could mean the retailer no longer sees the price fixed as an asset and wants to exit the position rather than incur more losses. Or perhaps the market has shifted in the retailer’s favor and it believes taking the profit early on the position is the best choice. All retailers have experienced being well up on a pre-buy at some point, only to see the gains lost by the time the gallons are available to be pulled.

Many are new to the process of using financial hedges, so let’s go through the process of getting set up. To trade or use financial hedging tools, such as swaps and options, retailers must establish relationships with one or more trading partners. Cost Management Solutions helps its readers and clients establish relationships with counterparties.

As part of the process, the retailer will submit credit applications and financial statements to potential counterparties. It is possible to trade if the counterparty does not offer a line of credit, but for this discussion we will assume a credit line of $50,000 is established with a single counterparty. With credit established, the retailer does not have to make an upfront payment to establish a swap or series of swaps.

Let’s say the retailer wants price protection for the next 36 months and will buy financial swaps to provide the protection. In that case, it will own 36 swaps beginning in March 2016 and ending in February 2019. For our example, let’s assume it wants 10,000 gallons per month of price protection.

In this case, the retailer has 360,000 gallons of swap positions. Each of the 36 swaps will have a strike price that will be compared to the monthly average for the corresponding month it covers. The price could be the same over all 36 swaps (a strip price or average price), or each swap could have its own strike with future months likely having a higher price than the closer months.

If the strike price is above the monthly average, the retailer receives the difference (thus protection from higher prices), but if the monthly average is below the strike, the retailer must pay the difference (protecting a counterparty from lower prices).

The idea is the retailer will have charged its customers based on the strike price of the swap, not spot prices. So if spot prices for the physical gas are higher than planned, the swap reimburses the loss. On the other hand, if prices are lower than the strike, the extra margin the retailer makes on its propane sales will cover the swap loss. This process repeats itself 36 times over the 36 swap contracts.

Because the swap settlement caused payments to suppliers and receipts from customers to happen at about the same time, there is no strain on the retailer’s cash flow. However, problems could occur for the retailer if prices fall too far and exhaust its credit limits with its counterparty.

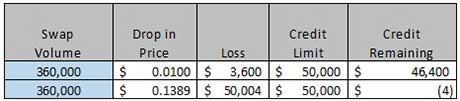

In our example, the retailer has a $50,000 line of credit and 360,000 gallons of swaps in play over 36 swaps. The counterparty is concerned about accounts receivable risk and considers the risk over all 36 swaps when evaluating its exposure.

Every 1-cent drop in the price of propane across the futures’ price of the swaps results in $3,600 of the retailer’s credit line being used. A 13.89-cent drop in propane will exhaust the credit limit of the retailer.

At that point, the retailer will have two choices: close some or all of the swaps or be margin called.

Closing all of the swaps in the case of a 13.89-cent drop will result in a hedging loss of around $50,000, which will be paid out as each month settles over the remaining months of swaps. The retailer can keep the positions open by immediately paying a margin deposit, usually the equivalent of 10 cents per gallon. In this case, the retailer would wire $36,000 to the counterparty to keep all 36 swap positions open. This money is held in reserve by the counterparty to protect it from further accounts receivable risk.

If prices turned higher and the retailer’s position returned to a loss that was within its credit limit by a reasonable amount, it could request its margin call to be returned. Otherwise, this money will be held by the counterparty until the swaps naturally settle with each progressing month.

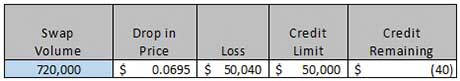

The amount of swap gallons can have an impact on the potential for a margin call. Let’s say the retailer decided to hedge 20,000 gallons per month instead of 10,000 gallons per month. In that case, just a 6.95-cent drop will result in the credit limit being exhausted and force a choice among the options discussed above.

A retailer may want to use financial hedges to protect a large portion of its projected future sales, but it may be limited as it manages the cash-flow risks discussed. A retailer may have to make tough choices in how much to hedge. It may have to decide to protect just one year out and add future protection as swaps during that year expire. Or if it wants the protection over a long timespan, it may need to hedge fewer gallons per month.

One thing is for sure: A retailer does not want to get so many gallons in play that just a small downward movement in prices will require closing positions or having to respond to a margin call. Financial swaps have become an invaluable tool in helping propane retailers bring predictability to their supply costs, which they can leverage into higher margins and more satisfied customers. Understanding how the cash flow works with swaps and other financial tools is an important part of making sure these tools provide the maximum positive impact on the retailers’ bottom line.

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.