Not all inventory builds are created equal

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, assesses propane inventory builds by region.

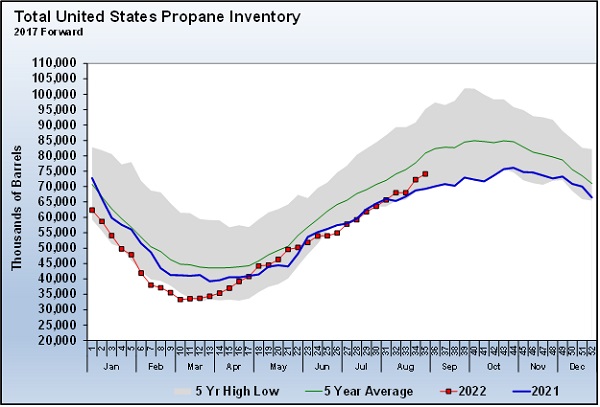

There have been some solid inventory builds for U.S. propane over the past couple of weeks, pushing the total to 74.118 million barrels, 4.836 million barrels, or 7 percent, higher than last year.

Though inventory remains below the five-year average by 8.4 percent, it’s above the previous year, which always seems to have a positive psychological effect on the market. Besides, the five-year average is skewed by large inventory positions in 2019 and 2020. Inventory peaked at 96.520 million barrels and 101.842 million barrels, respectively, in those years. The market knows that we have survived many winters with inventory around where it is now, which calms the market and keeps prices from pushing too high. Propane was at 121 cents at this point last year and trading at 75 percent of West Texas Intermediate (WTI) crude’s value. The current 104-cent price, and 51 percent relationship with WTI, is reflecting more confidence heading into this year’s demand period.

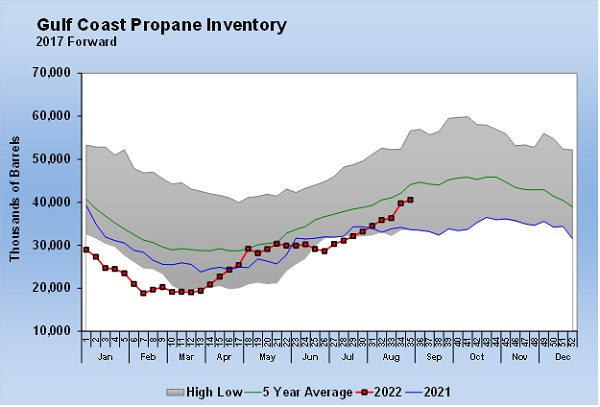

Gulf Coast

While the overall inventory picture has become much more encouraging in recent weeks, regional inventories are not equitably distributed. Gulf Coast inventory is disproportionately better than other regions.

Gulf Coast inventory is 6.95 million barrels above this time last year and represents all the inventory improvement over last year. Gulf Coast inventory has improved significantly since the Medford, Oklahoma, fractionator went down mid-summer. In fact, inventory there was setting a five-year low when Medford went offline.

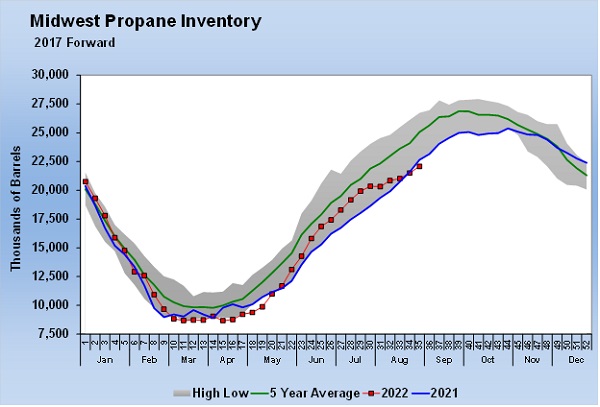

Midwest

What has been good for the Gulf Coast has been bad for the Midwest.

After the Medford fractionator went offline, the Y-grade it processed shipped to the Gulf Coast for fractionating. Obviously, the loss of around 53,000 barrels per day of spec propane production has been detrimental to the inventory position in the Midwest.

At 22.079 million barrels, inventory is 576,000 barrels, or 2.5 percent, below last year, setting a five-year low. The amount of inventory held in the Midwest has been trending lower for years. But this year looked to be different, with inventory on a trend to be well above last year during the early part of the inventory builds period. The tightness in Midwest supply last year seemed to encourage holding a little more inventory.

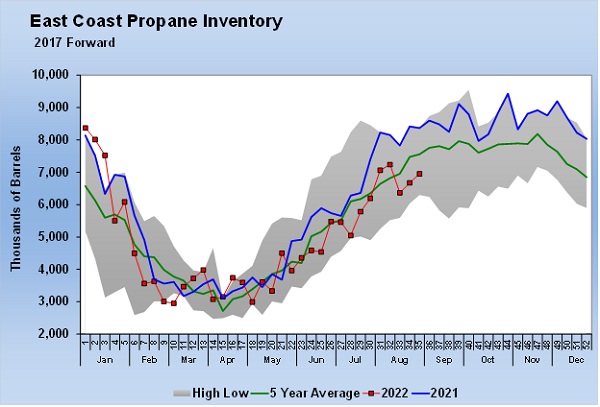

East Coast

There isn’t a lot of inventory held on the East Coast, but it is also much lower than at this time last year.

Inventory on the East Coast can be volatile due to the relatively small capacity compared to the export rate, but at this point, it looks like there is less movement out of the Midwest to the East Coast. Inventory is 1.42 million barrels, or 17 percent, below last year.

Propane inventory in the western half of the country has been less impacted, holding just 118,000 barrels, or 2.6 percent, less than last year.

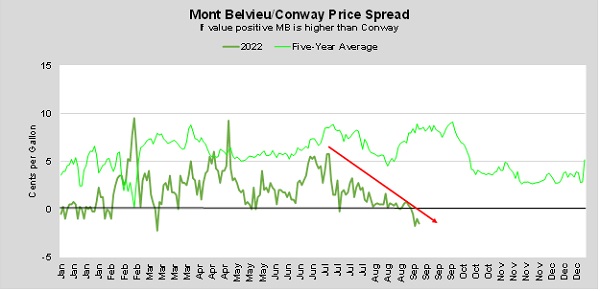

The price spread between Mont Belvieu ETR and Conway propane reflects the situation.

Mont Belvieu propane was holding a 5.75-cent premium to Conway propane before Medford went down. That was to encourage more movement of spec propane from the Midwest to the Gulf Coast. Remember, at that point, strong exports had Gulf Coast inventory setting five-year lows; Midwest inventory was in much better shape than it was the previous year.

Pricing

The script has flipped now with Midwest inventory setting the five-year low and Gulf Coast inventory nearly 21 percent better than last year. Now, Conway propane is valued 1.5 cents higher than Mont Belvieu ETR.

We must keep in mind that seasonal demand has a disproportionate impact on the Midwest since crop drying and winter heating are its primary demand. Gulf Coast demand is more balanced with exports and petrochemicals strongly in the mix. We are just now getting to the key Midwest demand period, with pricing and inventory positions already trending in discouraging fashions.

If you are a Midwest or East Coast propane dealer, you can’t let the headline inventory number dissuade you from getting exceptionally prepared for this winter. Things simply aren’t trending well for us in those areas, and there is no indication we have seen that Medford is going to be up and running at a point where it can have much if any impact on this winter’s supply picture.

It may be time to take your trucking company to dinner and make sure you are at the top of its customer list; you may need it to make some long hauls for you this year. Start checking out where you can get supply via rail – whether from Canada or the Gulf Coast. Get your storage full, and keep it there. Do everything under your control to get customer tanks full, and encourage them to keep a larger reserve than usual when ordering a refill. Consider pre-buying a little more supply this year and/or using financial swaps to protect more of your supply from higher prices.

We will hope the Midwest and East Coast stay well supplied and all of these measures will turn out to have been unnecessary. However, we ignore the current inventory and pricing trends at our peril.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.