Outlook for crude and its impact on propane prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores crude’s impact on propane prices.

Catch up on last week’s Trader’s Corner here: January cold impacts US propane supply

Crude’s price is the predominant factor that sets the pricing environment for propane. As crude’s price goes up or down, so does propane’s price. Propane’s own fundamentals such as supply and demand will influence the value relationship with crude to a degree, but it is crude that determines the overall pricing environment.

We have used many analogies over the years to help visualize this relationship. One is imagining crude as a fighter jet and propane as a rocket fixed under the wing of that jet. The rocket is going to go where the jet goes most of the time. The jet may be at a low altitude, a high altitude or somewhere in between, and the rocket is with it.

Occasionally, propane fundamentals are going to come into play, impacting its supply or demand and causing the rocket to launch. The rocket may go higher or lower than the altitude of the jet in those cases. However, the rocket ultimately spends most of its time riding along with the jet.

So, if one is going to have any outlook or forecast for propane prices, they must begin with an evaluation of crude, which usually goes well beyond a fundamental analysis. Once that is done, an evaluation of propane fundamentals will determine the likelihood that the rocket will launch and whether its trajectory is likely to be up or down relative to the jet.

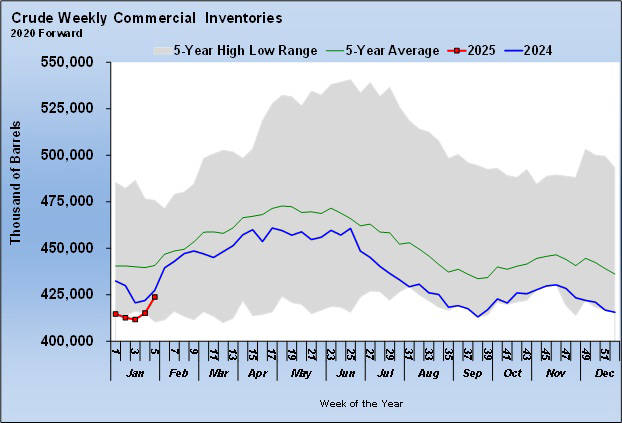

This past week, the Energy Information Administration reported a healthy 8.664-million-barrel build in U.S. crude inventories that was much needed.

Before the gain, crude inventories were setting or near five-year lows for this time of year. The increase pushed inventories near last year’s level, but they are still well below normal.

Despite the low inventory position in the U.S., crude prices have been falling recently.

A real challenge for predicting crude’s price is that it is influenced by many factors such as global politics, economics and market manipulation. Crude is valued more on those factors than where its fundamentals stand at a given moment.

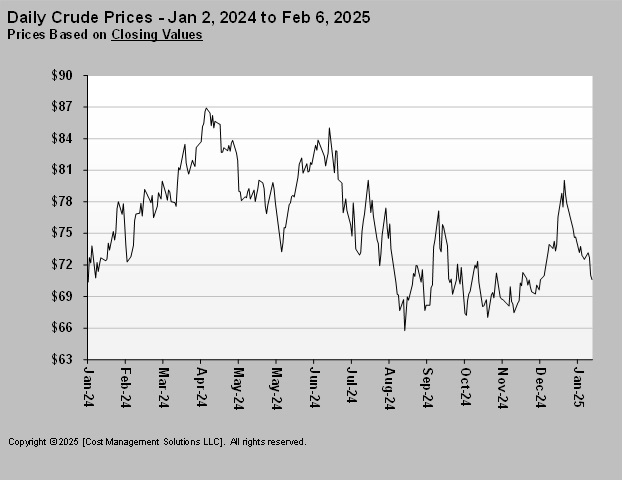

For example, the overall downtrend in crude’s price started around April of last year based on macroeconomic conditions that were expected to keep demand growth limited, especially in China. China is important because it has been the primary source of crude demand growth in recent years. Crude prices rebounded for a while at the end of 2024 because China announced it was going to take measures to stimulate its economy. Issues in the Middle East also threatened supply. Cold weather in the Northern Hemisphere increased demand for heating. These factors added momentum to crude’s rally.

More recently, crude prices are down because of a ceasefire in Gaza between Israel and Hamas and because of a new U.S. administration that is pro-energy with policies that could lead to more production. Meanwhile, the economic policy of that same administration is considered a threat to the health of the global economy, which threatens demand. On top of that, OPEC+ manipulates production. Often that manipulation seems to have far more to do with politics than managing supply relative to real demand to maintain a balance. All the changes and gyrations in the market happened with little fundamental change in crude’s supply and demand.

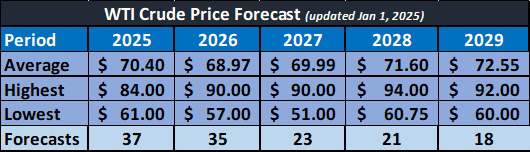

Amongst all those factors, market analysts have predicted the price of crude for this year through 2029.

The bottom row is the number of forecasts that are provided for each of the years. These are forecasts made by large institutions that spend millions of dollars to try and predict such things.

The analysts’ forecasts are averaged. For 2025, WTI has an average price forecast of $70.40 per barrel. The highest estimate was $84 and the lowest $61 per barrel.

WTI crude averaged $75.77 per barrel in 2024. At this time last year, this same survey found analysts believed WTI crude would average $78.84 in 2024 with a high estimate of $89 and a low of $71. So, if you use the average of a lot of highly paid analysts that spend millions of dollars in analyzing the crude market, you can get within about 4 percent. As forecasts go, that is not too bad, so the $70.40 predicted for this year seems like a reasonable, educated baseline for WTI crude’s price. Theoretically, we know the altitude of the fighter jet.

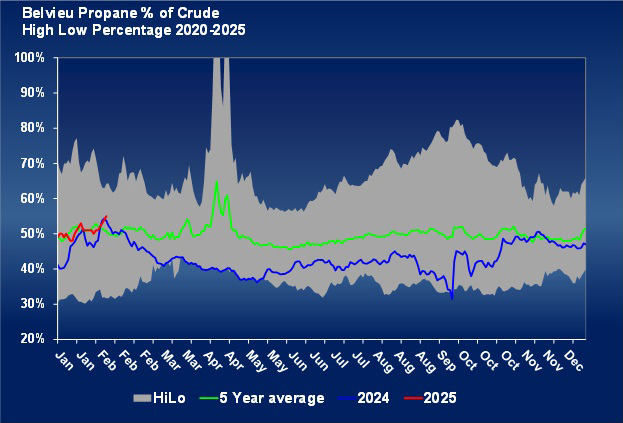

In 2024, Mont Belvieu propane (chart above) averaged 43 percent of WTI crude with a range between 31 and 54 percent. Propane is currently at 54 percent of WTI, so it is extremely overvalued relative to what it averaged all last year, but it is near where it was valued relative to crude at this time last year.

The United States should remain well supplied with propane in 2025, which we discussed in our last Trader’s Corner. We have concerns beyond 2025, but for now, we think this year will lead to propane being valued somewhere in the area it was valued relative to crude in 2024.

If that is true, propane will average around 72 cents in 2025. Given that it has averaged 90 cents so far this year, we will need to see much lower prices this summer to hit that average number. Buyers want to see the same type of falloff in prices and relative valuation that was experienced from this point forward last year.

For reference, propane averaged 77.67 cents in 2024 with a 51-cent low and a 94.75-cent high. There has already been a higher high set for 2025. But remember, crude is expected to average lower this year than last year, so we can have a reasonable expectation that once winter influences are over, there will be a good retreat in propane’s price.

Because there are so many political and economic factors that can impact crude, it is hard to predict, but we have to start somewhere. The analysis in this Trader’s Corner at least gives us a baseline from which to work. Our job now is to read the script that the market writes each week, evaluating if the story is going as expected.

All charts and tables courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.