January cold impacts US propane supply

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the January cold’s impact on U.S. propane supply and argues that confidence in propane supply remains high.

Catch up on last week’s Trader’s Corner here: Propane speculation for retailers

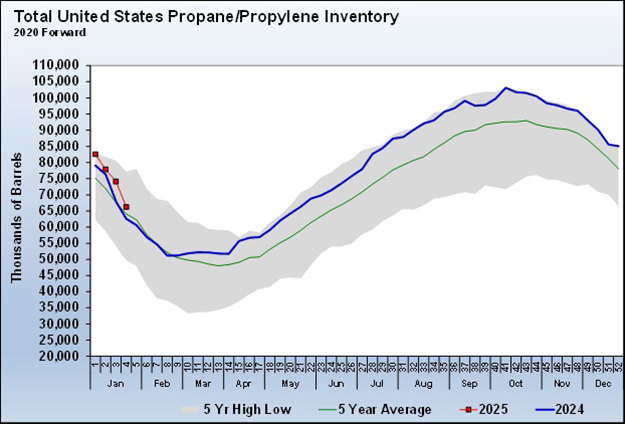

On Wednesday, Jan. 29, the Energy Information Administration (EIA) released its latest data on the state of U.S. energy for the week ending Jan. 24. In the report, the EIA said U.S. propane inventories fell 7.886 million barrels. There has been a strong call on inventories during the month of January as the bitter cold caused demand to far exceed available production and imports.

During the last week of December 2024, the EIA reported U.S. propane inventories at 85.043 million barrels. For the week ending Jan. 24, inventories stood at 66.249 million barrels. That is a total of 18.794 million drawn on inventory over a four-week period. There will certainly be more draw on inventory in the coming weeks and it is likely more above-average draws will be reported in the nearby weeks as the final impacts of the January cold are tallied.

U.S. propane inventories peaked during the week ending Oct. 11, 2024, for the current winter. Since that peak, there has been a decline in inventory of 36.886 million barrels. Despite the large drawdown, U.S. propane inventories remain in good shape.

The nice cushion in inventories enjoyed at the beginning of the winter has largely been eliminated, but there is nothing dire concerning propane inventories or supply. Inventories are 3.354 million barrels or 5.8 percent above this point last year and 2.02 percent above the five-year average. It remains highly likely that inventory will fall below last year and the five-year average when the final accounting of this year’s winter storm is completed.

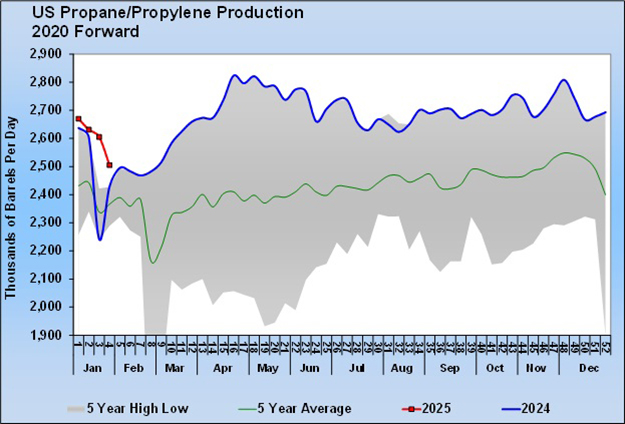

All components in the supply demand balance calculations contributed to the substantial inventory drawdown last week. On the supply side, imports were down 26,000 barrels per day (bpd) and production fell 100,000 bpd. On the demand side, domestic needs were up 401,000 bpd and exports increased 68,000 bpd. Combined, it was a negative impact of 595,000 bpd on U.S. propane supply, resulting in the 1.126 million bpd call on inventory, up from 531,000 bpd the previous week.

When winter storms plunge temperatures below normal, increased demand for heating is expected. What is often forgotten is those frigid temperatures have negative impacts on just about ever aspect of energy supply. Freezing temperatures reduce production of oil and gas. Refineries and fractionators have issues, resulting in less marketable products.

These issues were reflected in ready-for-sale propane inventories, which took the brunt of the inventory drop at 7.338 million barrels. Ready-for-sale inventories had been running above 60 percent of total U.S. propane inventory, but this past week fell to 58.7 percent of the total inventory.

Of the current 66.249 million barrels of propane inventory, only 38.875 million barrels are now in fungible or marketable form. The rest remain in Y-grade and must be fractionated before it becomes usable. There is good news, though. A look at U.S. propane production gives us confidence that inventories will recover, returning to a good position over the summer.

The blue line above is last year’s propane production and the red line is this year’s. The 2023 winter storm had an even greater impact on propane production than this year’s storm has had so far. If we trace last year’s production following the storm, we see that U.S. fractionators went into overdrive to replace inventories. Production started hitting new records by March 2024 and peaked at 2.823 million barrels per day in mid-April.

Propane inventories hit their 2024 low at 51.177 million barrels on March 1. By the end of June 2024, they had already recovered to 75.836 million barrels on their way to the record high set on Oct. 11 of 103.135 million barrels.

Over the course of the year, there was a bottleneck created by limited propane export capacity that had more of the high propane output going into inventory. U.S. propane export capacity is limited to about 1.8 million bpd even now. Propane export capacity will start increasing toward the end of this year, but there is potential for inventories to take a similar path this summer as they did last summer.

Of course, there is no guarantee that fractionators will go into overdrive this year like they did last year, but we think the probability is high. If they do, propane inventories could see similar builds to last year, starting next winter in good shape.

But even if inventories start next winter in a similar position to this winter, it does not mean we can necessarily expect the same pricing environment. Even though the impact of the new export capacity will not be fully felt until the winter of 2026-27, propane prices in the winter of 2025-26 could be supported simply by the completion or near completion of new export capacity.

The good news is that there is still hope for weak crude prices at the end of the year, which will help hold propane prices down perhaps by countering the impacts of the new propane export capacity. We see outlooks for WTI crude to be below $70 per barrel in the fourth quarter.

For now, we expect favorable propane buying conditions to develop over the summer. But beyond this summer, a more supportive environment for propane prices is likely to emerge.

All charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.