Part III: Russia/Ukraine conflict to intensify ‘energy war’

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, continues to discuss the challenges of meeting customer expectations this winter.

Over the last couple of Trader’s Corners (Read Part I and Part II), we have been looking at how the U.S. is doing in helping the global energy supply situation so that its allies in Europe might become less dependent on Russia for energy. As we pointed out, our immediate ability to help on the natural gas front was limited by our available LNG export capacity. There are efforts to increase that capacity, but it would be unfair to judge on how we are doing with natural gas exports during the short time since the energy war between Russia and Europe began.

We say Europe and not just Ukraine because Russia has been conducting a successful energy war with the West. The tension in that war notched up last week when expected severe damage was done to the Nord Stream pipeline system that once carried natural gas from Russia to Europe. It is consensus that the damage to the lines was an act of sabotage, but who conducted the attack is unknown. Of course, the West blames Russia, and Russia blames the West.

In any case, our focus in this series has been on how the U.S. has done in terms of crude and petroleum products in helping Europe since that is the area where we had meaningful capacities. Again, we could have been more impactful if we had the capacity to provide more natural gas since that is the greatest need of our allies in Europe. They were more dependent on Russia for natural gas than crude and refined fuels. Unfortunately, an accident at the largest liquefied natural gas facility in the U.S. during the summer has further limited our ability to help replace Russian natural gas supplies to Europe. Thus, our focus has been on where we had the capacity to help, which was by reducing our consumption or increasing our supply of crude and petroleum products.

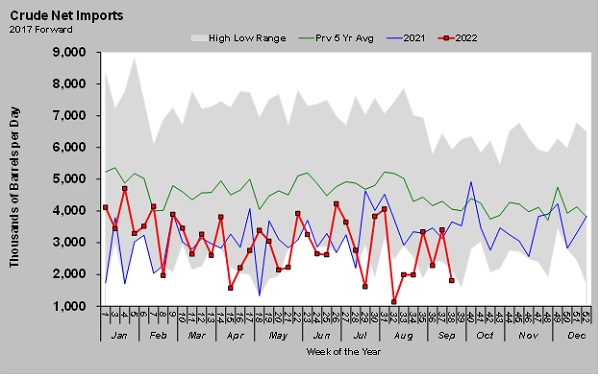

We have decided the easiest way to measure this is by looking at net imports of crude and petroleum products. However, we are going to break out just the crude piece first and then add in all of the petroleum products.

Russia launched its invasion of Ukraine on Feb. 24. Since then, the U.S. has remained a net importer of crude even though it has been releasing significant volumes of crude from its Strategic Petroleum Reserve (SPR). From the week ending Feb. 25 to the week ending Sept. 23, the U.S. has released 157.437 million barrels of crude from the SPR into commercial markets. During the 30 weeks of the war, the U.S. net imports (imports minus exports) have averaged 2.853 million barrels per day (bpd). During the 30 weeks leading up to the war, net imports were 3.546 million bpd. That is a decline of 693,000 bpd, which one could argue helps our allies in Europe by that much.

However, at the same time, releases from the SPR have averaged 750,000 bpd. What this tells us is that we have not truly increased our crude supply or decreased our crude demand in real terms. Any help we have provided has been as a direct consequence of releasing crude from the SPR. In fact, since the release from the SPR has exceeded our net import reduction, one could argue we are positioned to put more pressure on global crude supplies once the SPR releases end. In terms of the long energy war that is ahead, the U.S. has yet to put itself in the position of providing sustainable help by reducing its crude demand.

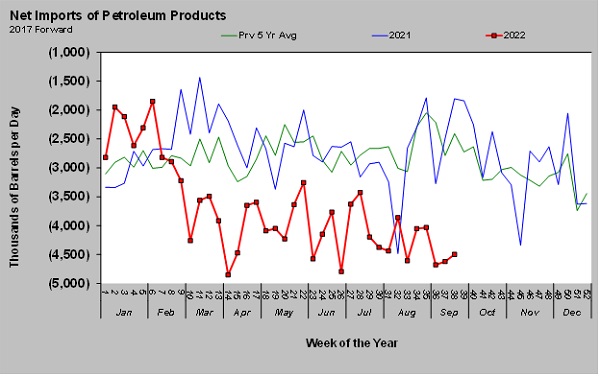

We can also have an impact by either using less petroleum products or producing more to export. Petroleum products are essentially everything that is made from a barrel of crude, with gasoline and distillates the biggest components. Reducing our products’ net imports could even be more impactful than reducing our crude demand. To do so would likely mean we are providing more ready-to-use refined fuels to our allies.

Since the war began, the U.S. has had net petroleum product imports of minus 4.066 million bpd – in other words we’ve been a net exporter. During the 30 weeks prior to the war, we were a net exporter of 2.723 million bpd. Therefore, we have increased our net petroleum product exports by 1.343 million bpd since the war began.

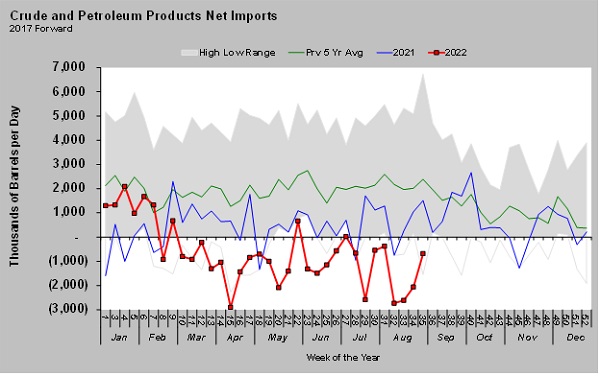

Combining crude and petroleum products, the U.S. is at 1.213 million bpd of net exports since the war began, whereas we were importing 793,000 bpd during the 30 weeks before the war began. That is a swing of about 2 million bpd. Unfortunately, we have also seen a decrease of 361,000 bpd of crude and petroleum products commercial inventories. This is on top of the 750,000 bpd of crude released from the SPR. So about 1.1 million bpd of the improved net import/export swing of 2 million bpd can be attributed to drawing on inventory – not the more sustainable increase in production or decrease in demand.

At this point, the U.S. may be having a positive net impact of around 900,000 bpd on the global crude and petroleum products supply that is sustainable after the draws on commercial and strategic reserves end. Assuming all of it is directly or indirectly helping our allies in Europe, it is not a bad contribution to the energy war. It is disappointing that our government has not been more proactive in encouraging more energy production, but we could say the same about the European Union governments that have the most to gain from actions to increase hydrocarbon production.

By the West not doing more to improve energy security, we believe it risks increased escalation in not only the military conflict in Ukraine but also the energy war that encompasses the globe. Winter is coming to the Northern Hemisphere. It is going to be the most challenging time in the energy war. In our view, the U.S. and its allies in Europe have not shown nearly the urgency they should have to become better prepared over this summer – while releasing vast amounts from strategic reserves and pulling down commercial inventory – to attain a more secure and sustainable energy position. The SPR releases seem to have been more political expediency than part of a comprehensive plan to be more energy secure. If we are correct, this winter will extract a greater toll in human suffering and economic damage than might have occurred had more decisions been made based on realism rather than idealism.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.