Petrochemicals’ use of propane cooling to begin 2023

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, analyzes why petrochemicals’ use of propane is cooling.

Catch up on last week’s Trader’s Corner here: US propane exports hit record as domestic demand plunges

We have used several Trader’s Corners recently to look at the lack of domestic propane demand from various angles. When we first started looking, we pointed out that industry data didn’t appear to be showing a significant decline in petrochemical demand for propane as a feedstock. Thus, we surmised that most of the domestic demand decline was coming from the retail segment. As part of that assumption, we speculated that propane in secondary and tertiary (retailer and consumer) levels might be getting pulled down due to economic stresses caused by inflation. That theory still has some validity, but we are also seeing more of a drop in petrochemical demand compared to when we first started looking. With this Trader’s Corner, we are going to update the trend in petrochemical use of propane so you can see the change in the trend over the last few months.

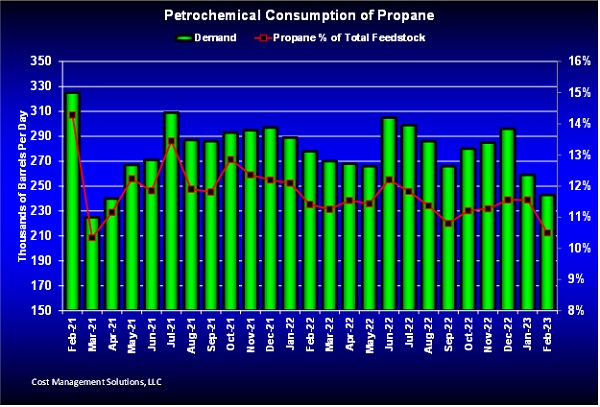

Chart 1 shows petrochemicals’ use of propane as a feedstock to make the various products they supply. The red line also shows what percentage propane is of the total feedstock stream. As you can see, when we first started exploring the lack of domestic demand a couple of months ago, the use of propane by petrochemicals was trending higher.

In September 2022, they were consuming 266,000 barrels per day (bpd) of propane, but that total had increased to 296,000 bpd by December. You can also see by the red line that propane was increasing as a percentage of the feedstock stream. That would indicate petrochemicals were seeing its value more favorably when compared to other natural gas liquids. The December usage was comparable to the 297,000 bpd in December 2021, and why we said that the drop in domestic demand did not appear attributable by a significant degree to petrochemicals.

But the trend changed in January with a drop to 259,000 bpd. Estimates for usage this month are down to 243,000 bpd. Also note that propane’s percentage of the total feedstock stream is well off too. Again, that would mean that other options are being seen as more economically favorable.

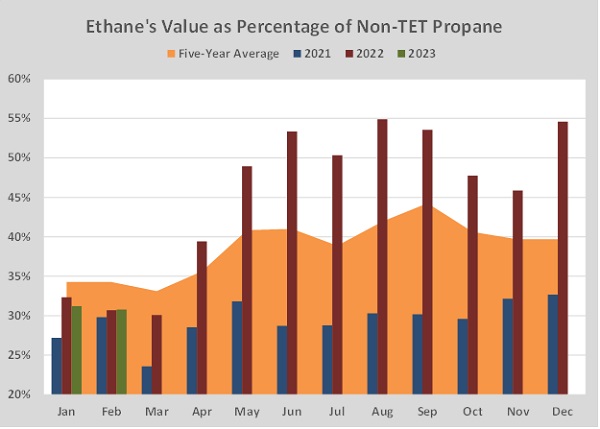

By far the biggest component of the petrochemical feedstock stream is ethane, with propane a distant second. Ethane is a much cheaper feedstock than propane. Chart 2 shows ethane’s value as a percentage of propane’s value. If you look at the red bars for 2022, you can see a big jump in ethane’s relative value. Over time, that would certainly favor petrochemicals using more propane. But, since the turn of the year, ethane prices have plummeted. As the green bars for this year show, ethane is once again valued relative to propane – about where it was in 2022. That would push petrochemicals back to ethane at the expense of propane consumption, which is showing up in the latest numbers.

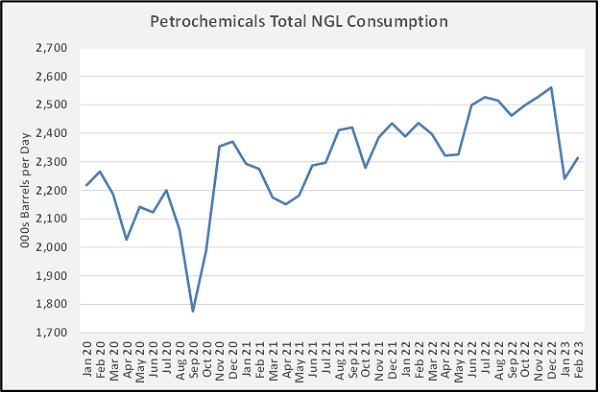

Chart 3 shows total natural gas liquid consumption by petrochemicals. After being on a general uptrend last year, consumption really dropped off in January. Weather was a possibility, but we are going to have to see if a rebound in consumption occurs over the next couple of months. The rebound in February has been weak at best.

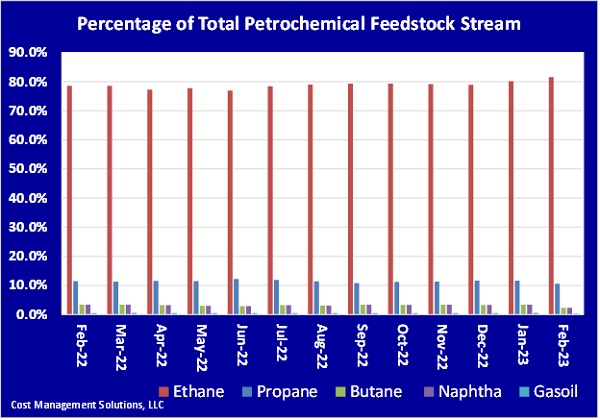

Chart 4 shows what percentage of the total petrochemical feedstock stream each NGL component represents. Ethane eclipses everything else. This month, ethane has 81.6 percent of the feedstock stream; that is up from 80.1 percent last month. Propane has been 10.5 percent, down from 11.56 percent last month.

The drop in ethane’s value should keep propane demand on the lower side. But a general rebound in throughput would still increase propane consumption, even if at a lower percentage of the total consumption.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.