US propane exports hit record as domestic demand plunges

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates the latest Weekly Petroleum Status Report.

Catch up on last week’s Trader’s Corner here: Review of EIA’s Short-Term Energy Outlook

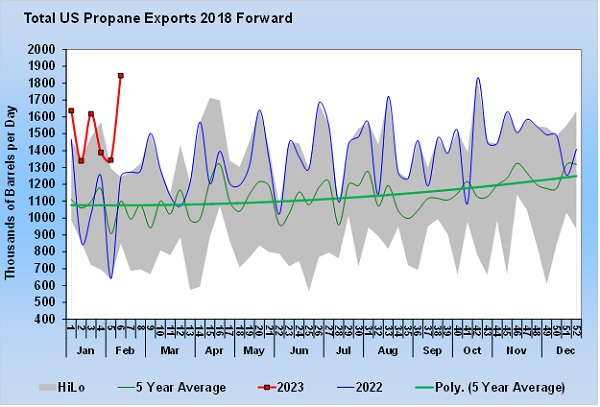

In the latest Weekly Petroleum Status Report, the Energy Information Administration reported the U.S. exported 1.845 million barrels per day (bpd) of propane.

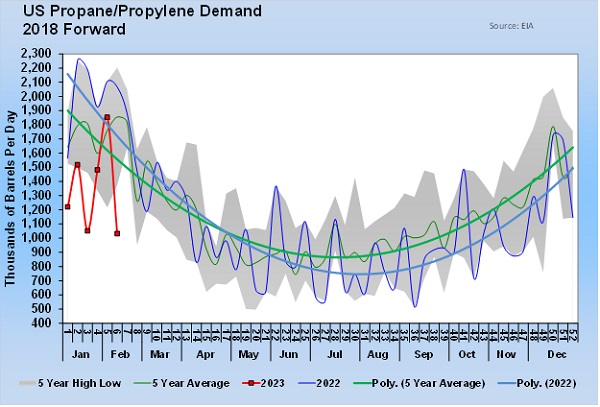

That rate of exports was a record high. Exports were up 501,000 bpd from the previous week as U.S. domestic demand plunged 821,000 bpd. Domestic demand was at just 1.032 million bpd, compared to 2.067 million bpd during the same week last year. That is a 1.035-million-bpd difference.

Year to date, U.S. propane exports are running 448,000 bpd higher than at the same period last year. Meanwhile, domestic demand for propane is down 658,000 bpd through the first six weeks of the year.

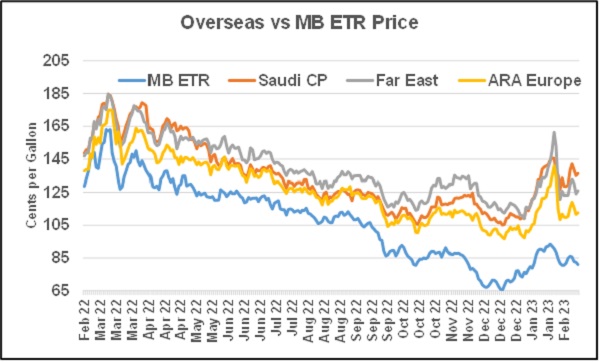

Overseas, propane values have been outstripping the U.S. market, keeping demand for U.S. propane high.

Chart 3 plots propane values at various points around the globe. Mont Belvieu ETR and Saudi CP are supply points, while the Far East and Europe are key export markets. As the chart shows, Saudi CP is priced high compared to Mont Belvieu ETR. It does have a transportation advantage, but Mont Belvieu ETR is favorably priced against it.

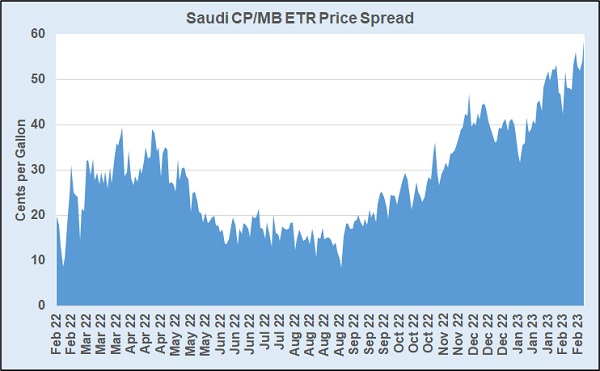

Chart 4 plots the price premium, or spread, that Saudi CP holds over Mont Belvieu ETR. The wider spread is favorable to U.S. exports. Note how the spread jumped after OPEC cut its crude production in November.

The key demand area and a primary destination for U.S. propane exports is the Far East.

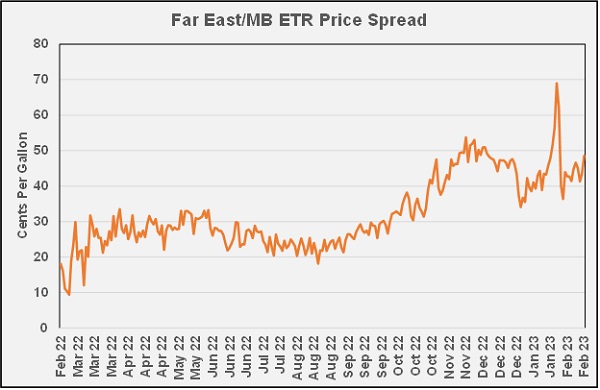

Chart 5 shows how the price premium that the Far East holds to the U.S. market has been growing. Weak U.S. domestic demand is keeping prices low here, while China opens up its economy and is demanding more.

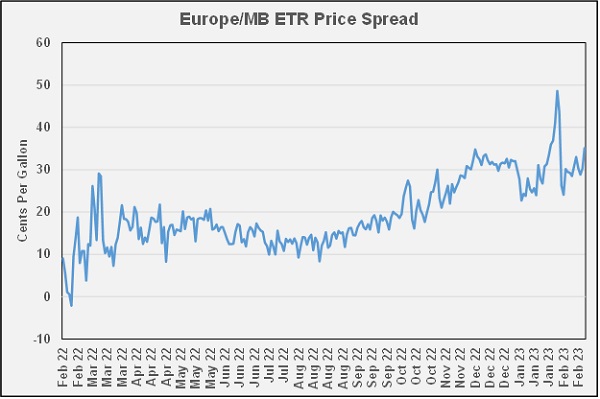

The price spread with Europe is not as high as Asia, but it still favors exports, especially from the U.S. East Coast.

It is amazing to have seen the transition of the U.S. propane industry over the years. When we began, the U.S. was a net importer of propane. This past week, in the middle of winter, domestic demand was more than 800,000 bpd less than export demand. There is no reason to think that trend will not continue.

Of course, the high spreads between the U.S. and overseas markets represent price risk. If U.S. demand picks up, U.S. prices will have to move quite a bit to start backing out the exports. The better scenario for U.S. retailers and consumers would be for Saudi CP prices to start coming down.

But, that could be a while as OPEC limits its crude production to support crude prices.

Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman says the current OPEC+ deal on output will remain in place until the end of the year. He remains skeptical of a recovery in Chinese demand. He also blamed the International Energy Agency for the releases of crude from strategic reserves because of its prediction that Russian crude production would drop 3 million bpd last year. Russian crude continued to flow even as the U.S. and other consumer nations released large quantities of crude from reserves.

As U.S. consumers of propane, we have to be more and more aware of the global outlook for energy markets as U.S. exports will remain the key driver of demand and pricing.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.