Producers extend deal to limit production. So what’s next?

Major producers, including most Organization of the Petroleum Exporting Countries (OPEC) and Russia, agreed on Thursday to extend the production quotas implemented in January through the end of 2018. OPEC agreed to cut 1.2 million barrels per day (bpd) and other non-OPEC producers, including Russia, agreed to cut 600,000 bpd from October 2016 production levels during 2017. That agreement was later extended through March 2018. This latest agreement extends an additional nine months.

For the most part, these producers have done a good job of adhering to their commitments that limit production. The result has been a reduction in crude inventory levels that has led to a major recovery in oil prices – from $27 per barrel for West Texas Intermediate (WTI) crude to about $59 per barrel.

OPEC began informing crude markets in early 2016 that it was considering reinstituting the quota system it had abandoned in November 2014. Generally speaking, crude prices have been on an upswing since that time.

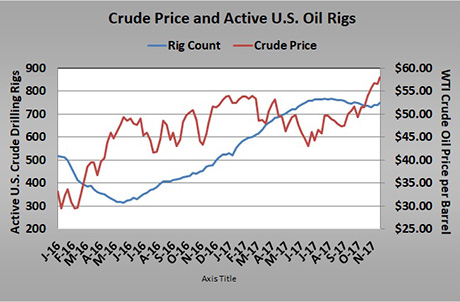

With the increase in crude prices came a resurgence in U.S. crude drilling activity. There were 1,601 rigs drilling for crude in the United States just before OPEC announced it was ending its quota system in November 2014. Active rigs fell to just 316 by May 2016, just before OPEC announced it was considering reimplementing the quota system. Last week, there were 747 rigs drilling for crude in the U.S.

There has been friction between U.S. producers, OPEC and Russia throughout this time as increases in U.S. production threatened to offset efforts by OPEC and Russia to reduce the glut of oil and support prices.

The leaders of OPEC have been sending signals to U.S. producers that they should limit their drilling and instead reap the benefits of higher prices resulting from the quota system implemented by other producers.

The chart above suggests that U.S. producers might be listening.

The assumption was that any price above $50 per barrel would cause an increase in U.S. drilling activity. When crude prices began a general downtrend from March until June, U.S. drilling activity began to slow, especially when the price for WTI crude fell below $50 per barrel.

However, since that downturn in drilling activity, U.S. producers have been slow to reignite their drilling programs, despite a surge in WTI price crude to nearly $60 per barrel. Despite a $16 gain in crude’s price since June 23, there has been only a slight uptick in drilling activity over the last couple of weeks. WTI crude has been near or above the magic $50 mark since mid-September, yet U.S. producers have hardly increased drilling activity over the following two-and-a-half months.

Coinciding with the producers meeting on Thursday, the largest producer in the major U.S. shale play in the Permian Basin said he hoped U.S. producers would keep drilling activity steady and pass on increased profits to shareholders. Essentially, he was telling OPEC and Russia he had received the message and hopes other U.S. producers have as well.

In case those other U.S. producers aren’t listening, Russia insisted on a quota system review during a meeting in June. The implication is that if U.S. producers step up drilling activity, Russia and perhaps OPEC will abandon their quotas and push the price of oil down again – basically putting U.S. producers back in their bottle.

Russia and OPEC sent a clear message to U.S. producers with the caveat they will revisit the quota system in June. They are letting U.S. producers know they can benefit from other producers’ efforts to support prices if U.S. producers don’t increase production. Russia has essentially said if a higher price causes an increase in U.S. production, it will flood the market with more production and drive prices lower again.

It is absolutely essential that propane retailers monitor this battle as it unfolds by closely watching U.S. drilling rig activity and production. If U.S. producers maintain or only slowly grow drilling activity between now and June, crude could stabilize around the $60-per-barrel mark for WTI crude. If they do not, there is a strong possibility that Russia and OPEC will abandon their quota system for a while and start driving prices lower again.

For now, we would expect propane to trade around 70 percent of WTI crude next summer. At $60 crude, propane at 70 percent would be priced at $1 per gallon. However, if crude drops to $45 per barrel, as other producers punish the U.S., propane would be priced at 75 cents per gallon at the same 70 percent relationship to crude.

As retailers prepare for next winter, some will be considering positions prior to the June producers meeting. If that is the case, they should be very aware of how U.S. drilling and production is trending ahead of that meeting.

Crude prices surged on the production-cut extension announced Nov. 30. From this point until June, we expect the price of crude to be related directly to U.S. drilling and production numbers, unless there are geopolitical developments that threaten supply elsewhere.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.