Propane faces support from crude market bullishness

Recently, propane prices have not gone beyond 78 to 80 percent of West Texas Intermediate (WTI) crude’s price. When propane prices fall, the downward movement has been ending when propane’s value reaches 72 to 74 percent of WTI crude’s value. But now crude prices are increasing, which means even if propane prices stay in the 72 to 80 percent of crude range, propane will be higher. So, what is going on with crude?

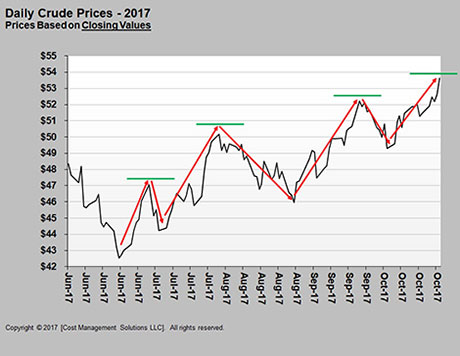

The chart above shows crude closing prices since June. Crude reached its year highs in January and February after the Organization of the Petroleum Exporting Countries (OPEC) and other producers announced they were implementing a production controls agreement. From March until June, crude prices fell, as it didn’t appear the global surplus of crude would come down, despite the production agreement.

In June, there were signs that global crude supply was tightening. Initially, producer nations had surplus supplies and were still exporting at high rates, despite reducing production. By June, producer nation surplus was gone and export volumes began to slow, drawing down inventory in consumer nations.

At the beginning of the year, those consumer nations held inventory at 300 million barrels above the five-year average. The surplus has now been cut in half. In addition, most analysts are predicting higher growth in crude demand for next year than they had in earlier forecasts.

To add to the bullishness, OPEC and other producers are signaling they will extend the production controls agreement through 2018. Further, there are growing geopolitical issues that threaten crude supplies from Iraq, Iran, Libya, Nigeria and Venezuela.

As the chart shows, crude prices stepped up as supply and demand fundamentals became more supportive. In these steps, traders will push prices up, followed by a profit-taking pullback. The move down is called consolidation. Note that the pullback does not fall to the point of where the previous upward movement started.

The next supportive news pushes prices again, followed by the predictable consolidation before making the next push. Crude is currently rising to establish the next step. It could be difficult for crude to get significantly higher from here until the market is convinced this new price will not result in an increase in drilling in the United States.

Some believe that any price above $50 would cause an increase in drilling. However, higher drilling and well completion costs mean it would take a higher value in WTI crude to trigger more drilling. This would give traders the courage to take this current test higher.

We suspect that $60 Brent and $54 to $55 WTI will be the top of this step. We would expect some consolidation, but more likely a trading range between $50 to $55 for WTI through the end of the year. If U.S. drilling kicks into high gear, prices will drive below that range.

For this reason, we hope that most of the upward price support for propane from crude is complete and crude prices will generally settle into the $50 to $55 range. Then, as winter weather influences occur, we will have to see if propane is willing to go beyond 78 to 80 percent of crude.

Based on a $50 to $55 crude range and propane trading at 72 to 80 percent of crude, we would expect a short-term trading range for propane between 82 cents and 105 cents. However, given current conditions, we would think prices will favor the upper end of the range with a fall to 82 cents a low probability. If crude stays tame, then it’s just a matter of seeing what winter does to global demand for U.S. propane.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.