Propane inventory gets much-needed build

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses the latest propane inventory builds.

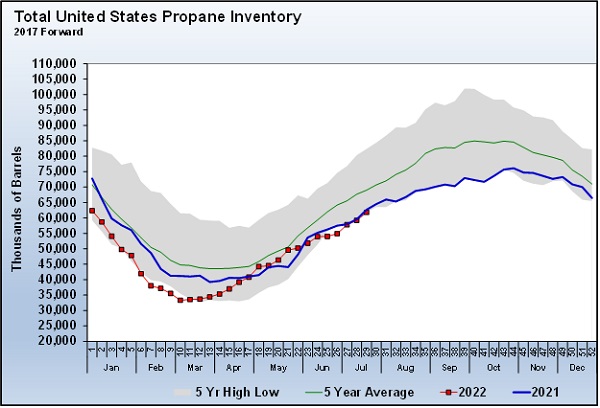

U.S. propane inventories got a much-needed above-average build for the week ending July 22, according to the Weekly Petroleum Status Report released by the Energy Information Administration on July 27. The 2.590-million-barrel build was higher than the 1.65 million barrels expected by industry analysts and double the 1.298-million-barrel five-year average build for Week 29 of the year.

With the gain, inventory managed to just barely avoid setting a five-year low for the 29th week of the year.

Inventory builds during March, April and May were very good, generally running above average. That allowed inventory that was setting five-year lows coming out of winter to climb back above 2021 levels and nearly to the five-year average. The build was a key reason propane prices dropped about 40 cents over that period.

But during June and July, inventory builds have been largely below average, and hard-fought security built into inventories during the early part of the seasonal build period has been largely given up. Total U.S. propane inventory is now 1.4 percent below last year and 10.5 percent below the five-year average, even with the good gain reported last week.

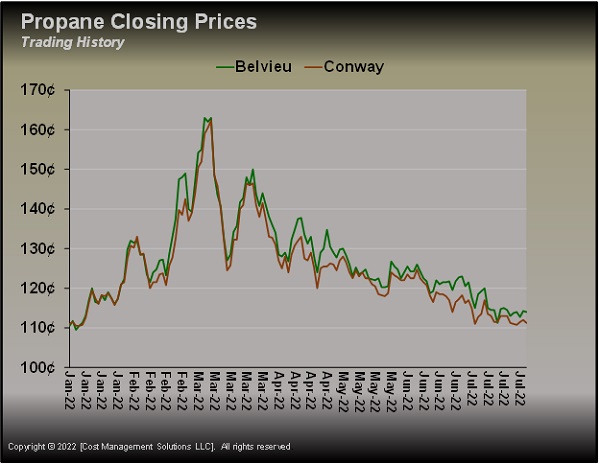

Fortunately for propane buyers, the poor performance of inventory builds has not yet shown up in the form of higher prices.

Propane prices have continued to fall and are near their lows for the year. Propane buyers have benefited from a timely drop in crude’s price.

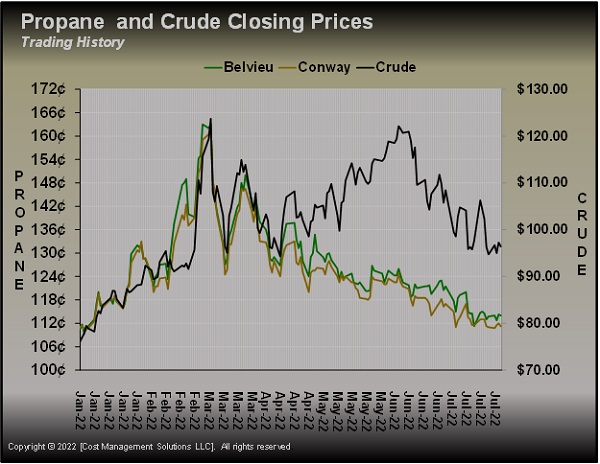

Chart 3 overlays crude’s price movement with propane’s. During January through March, the two commodities prices were tracking each other closely. By the end of March, though, the fundamental picture for propane was looking much better than crude’s. There was a lot of uncertainty about crude supplies, while propane inventory was building at an above-average pace. That allowed propane prices to separate from crude’s price during April and May. Propane was trading at around 42 percent of the value of WTI by the end of that period.

At the beginning of June, the inventory builds started disappointing for propane, but fortunately it was at exactly that time the crude prices started trending lower. Crude has been in a downtrend since June 9. Had crude remained in its uptrend while the propane inventory builds became below average, propane prices could be in a much higher tier than they are currently. The weaker inventory builds have caused propane to lag the fall in crude, and it now trades at 49 percent of WTI crude. Nonetheless, the downtrend in propane’s price has continued on the back of sharply falling crude.

As propane buyers, we must realize that things have gone very well for us to this point in 2022. Propane inventory was in really nasty shape coming out of winter but recovered quickly, allowing prices to fall. When crude prices were rallying propane fundamentals were improving, allowing propane prices to resist the gains in crude. As propane fundamentals weakened crude prices fell, allowing propane prices to continue to drift lower.

High temperatures are not good for propane retailers in terms of sales. Domestic demand is running 29,000 barrels per day (bpd) less this year than last. But from a supply-side perspective, that lower demand has helped subdue propane prices. U.S. propane exports are running 101,000 bpd higher this year than last, so the lower domestic demand has helped offset the higher export demand to some degree.

As propane buyers, we don’t need to get lulled into a false sense of security here. Our domestic demand period is just ahead. The world needs alternatives to Russian energy, and U.S. propane may be a part of the mix. To hope for a sudden drop in export demand as our demand period starts might be a bit optimistic. There are expectations that Europe will have to burn more crude for electrical power generation since Russia is limiting natural gas exports to that region. Doing so would add support for crude prices.

The U.S. is exporting crude at a high rate, but the draws on our Strategic Petroleum Reserve are scheduled to end during September. Once the midterm elections are over, neither political party may be motivated to draw the reserve down more. The U.S. exported 4.548 million bpd of crude last week. That was 2.085 million bpd more than the same week last year. Once the release from reserves stops, crude supply is going to tighten, and that could elevate its price right in the key-demand period for propane. And of course, it is very hard to predict how much crude supply there will be from Russia. It doesn’t seem like Western nations can or really want to stop the flow of Russian crude, but it is still an uncertain situation that could keep upward pressure on crude prices.

The bottom line is that there are still plenty of scenarios where propane prices could be much higher this winter. Propane prices have been in a downtrend since March, and that can lull us into thinking the trend will continue. Be cautious about that thinking. At least some winter price protection is warranted. While prices could go lower, hedges made at current prices probably won’t become a major liability. There just aren’t a lot of scenarios out there under current conditions that would point to a total collapse of energy prices. The end of the Russia/Ukraine war maybe, but it’s hard to see that ending before winter. Overall, it seems there is more risk to not doing anything in terms of price protection for this winter than there is to any hedges we may take at this time.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.