Propane price drop contributes to rejection conditions

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, reviews propane fundamentals.

Catch up on last week’s Trader’s Corner here: Propane remains on the move, its inventory position robust

In our Sept. 6 edition of Trader’s Corner, we broached the topic of propane rejection. This past week, we had propane retailers in the Rockies reporting that some of the natural gas plants in their area were rejecting propane, limiting their supply of fungible propane.

It might be helpful to revisit the Sept. 6 Trader’s Corner. Here’s a quick review: Natural gas processing plants remove the heavier natural gas liquids (NGLs) from the methane. The methane is then sold to natural gas utility companies or other end consumers. The heavier liquids are then generally sent to fractionation facilities, though some of the propane can be separated and sold at the natural gas processing plant.

Rejection means that instead of separating the ethane and propane, some of it is left with the methane and sold to the natural gas utility company. Contracts will specify how much of the heavier NGLs can be left in the methane. Obviously, such an event would limit propane supplies and put upward pressure on prices.

Rejection occurs because the price of propane and natural gas are close enough that there is no benefit to enduring the cost of separating the propane from the methane. In other words, selling propane as if it were natural gas or methane becomes just as profitable as separating it and selling it as fungible propane to propane retailers and other consumers.

When we discussed this topic in September, we pointed out it had not happened for more than a decade, but the conditions were present for the possibility this year. But we will be quite frank in saying that our focus then was on the potential for natural gas prices to go much higher this winter. We believed a rise in natural gas prices would outpace the rise in crude and propane prices, leading to propane rejection at natural gas processing plants at some point this winter.

The focus was on natural gas because of the disruption in supply to the European Union from Russia, owing to the war in Ukraine. The U.S. has been seen as an alternative source of natural gas for Europe, so the demand is there. The problem is a lack of liquefied natural gas (LNG) export capacity in the U.S. The lack of export capacity was exacerbated by an accident that took the largest U.S. natural gas export facility offline on June 8.

The 2-billion-cu.-ft.-per-day Freeport LNG export facility in Quintana, Texas, was originally expected back online in early October. It being offline had kept U.S. natural gas prices down, but its opening had the potential to cause a sharp rise in U.S. natural gas prices, especially with U.S. demand increasing during the winter. The reopening of that facility was delayed several times, and U.S. natural gas prices are lower now than they were when we wrote the article in September. Further, Europe believes it is well positioned for natural gas supply for this winter, though it foresees problems later in 2023.

We are at the point of rejection occurring, but it has not been based on our premise that natural gas prices would rise faster than crude and propane’s price. Instead, it has been just the opposite. Economics reached the point of rejection because propane prices fell faster than natural gas prices.

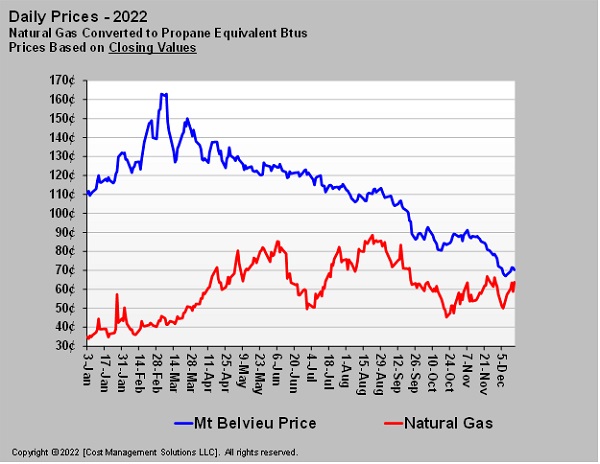

Chart 1 plots propane’s price against natural gas’s price that has been converted to a propane Btu equivalent value. It makes for an easy apples-to-apples value comparison. Back in September when we discussed this topic, we thought the lines for both propane and natural gas would be going higher. Further, we thought if the conditions for rejection were to be achieved, it would be because natural gas’s price would have risen faster.

Note that natural gas’s price does not have to exceed propane’s because there is a cost to extracting propane, so rejection reduces processing costs. Propane was about 6 to 8 cents higher than the equivalent Btu of natural gas when the reports of rejection came to us.

The thinking was the spread between the two lines would be where it is today, but both would be considerably farther up the price scale. We did indeed think that fundamental supports for natural gas would be stronger than the fundamental supports for propane.

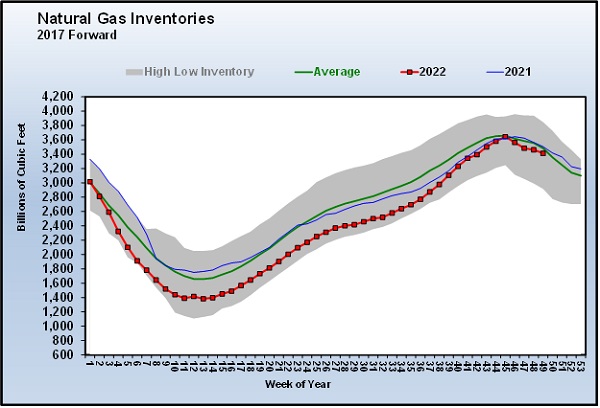

Chart 2 is U.S. natural gas inventory. Back in September, we imagined winter hitting and the Freeport LNG terminal back online in October limiting the gains in natural gas inventory. We imagined inventory levels remaining well below last year and the five-year average. Instead, inventory has recovered to much nearer those levels.

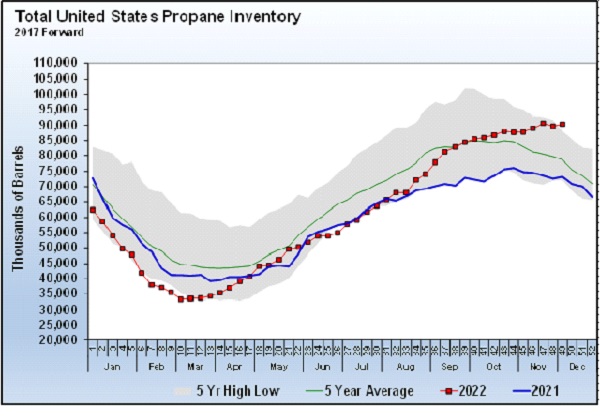

At the same time, we did not envision propane fundamentals being so incredibly strong.

Admittedly, in September, we did not envision propane’s inventory chart looking this bearish for prices. We were concerned about the lack of propane demand during the summer, thinking that could represent pent-up demand that would hit when winter started. We thought the gains in inventory in late August were an outlier. We even feared they were going to lull the propane industry into a false sense of security only to be unpleasantly surprised when demand finally hit.

But remarkably, domestic propane demand never ignited. It has continued to lag through the winter heating season just as it did during the summer, causing inventories to set a new five-year high for the 49th week of the year. We are a bit bumfuzzled given that heating degree-days are higher than last year. We have no idea where domestic demand has gone, but it’s not there, and its absence has caused high inventory and bearish pricing conditions for propane.

So, while we recognized there was a potential path to propane rejection, the path that was taken to get to the destination was obscured from our view. The spread between propane and natural gas is right on the border of encouraging rejection, so it may not be widespread enough to do a lot of damage to fungible propane supply and inventory. But we are to the point where it will be harder for propane prices to go much lower if natural gas prices stay where they are or go higher. The potential for them to go higher is present if the Freeport terminal resumes operation, as the company says it will by the end of the year. However, the Federal Energy Regulatory Commission has a long list of requirements Freeport must meet to restart, and they have missed three previously announced restart dates.

As an industry, we are generally tuned into crude for propane price direction, but now is a time to utilize your picture-in-a-picture option and watch natural gas closely too.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.