Propane remains on the move, its inventory position robust

The propane industry avoided what one leader called a “catastrophic” situation when Congress intervened this month with legislation to prevent a national rail union strike.

The strike would have had the potential to cripple the U.S. economy and obstruct propane deliveries in the middle of the winter heating season.

But by forcing the unions to accept a tentative agreement that had been reached in September – eight of 12 unions had ratified it – tens of thousands of employees remained on the job with their railroads.

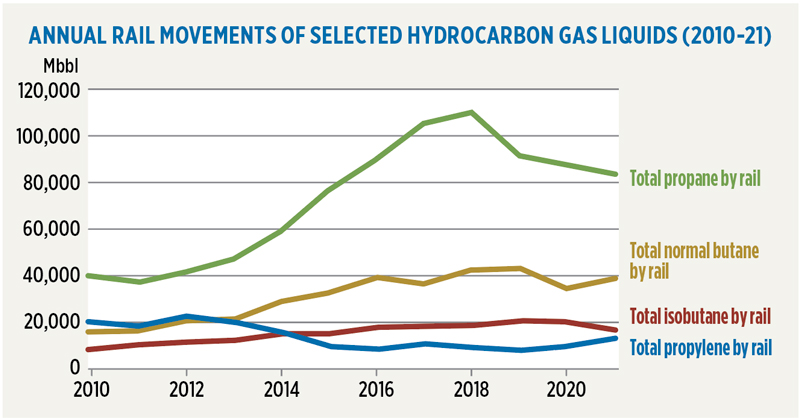

Chart 1: The rail system plays a vital role in the supply and distribution of propane and other hydrocarbon gas liquids. (Source: U.S. Energy Information Administration [EIA])

Congress acted swiftly on passing the legislation, and Biden signed it into law Dec. 2.

The propane industry did its part to highlight the gravity of the situation for those in power. The National Propane Gas Association (NPGA) shared a list of the many steps it took beginning in early September, summarized in our news about the agreement.

When it became apparent that further negotiations between the railroads and unions were not viable, President Joe Biden called on Congress to pass legislation to prevent a strike.

In late November, NPGA began meeting with congressional leadership to encourage immediate action as the industry would see impacts numerous days before a strike. By this time, NPGA had begun hearing of embargoes as well as letters of force majeure should slowdowns or shutdowns occur.

Propane retailers prepare throughout the year in anticipation of the next heating season. By firming up supply contracts and filling their customers’ tanks prior to winter, retailers ready their operations to meet high demand. Anticipating a large-scale interruption to a common mode of transportation, however, isn’t always part of the supply plan.

Rail shipments of LP gas account for roughly a quarter of all inter-PADD movements, according to the U.S. Energy Information Administration, and they’ve risen over the last decade.

At the LP Gas Growth Summit this year, we asked retailers about how they keep their customers in supply. What stood out to us was how retailers aren’t reliant on one supply source or method of transportation.

“Our big thing is diversification. We try not to put all of our eggs in one basket,” says Chelsea Aiken, general manager of High Grade Gas Service in Connecticut, whose company went from three vendors to seven. “There are several locations where we pull out of. We have a good portfolio to get gas from. If there’s a problem in one area, we can get it someplace else.”

Carl Kiedrowski, energy division manager at Country Visions Cooperative in Wisconsin, echoed Aiken’s outlook, as the cooperative mixes its propane procurement via pipeline and rail.

“We have a lot of different assets. We spread that around when it comes to supply to make sure we have enough,” he says. “If the rail goes down or the pipeline goes down, we can go to the other.”

Robust inventory

While the strike talk created some anxious moments for propane, the industry should feel good about its overall supply situation.

U.S. propane stocks are in an increasingly robust position, reports David Appleton of Argus Media during the World LPG Association’s LPG Week in November.

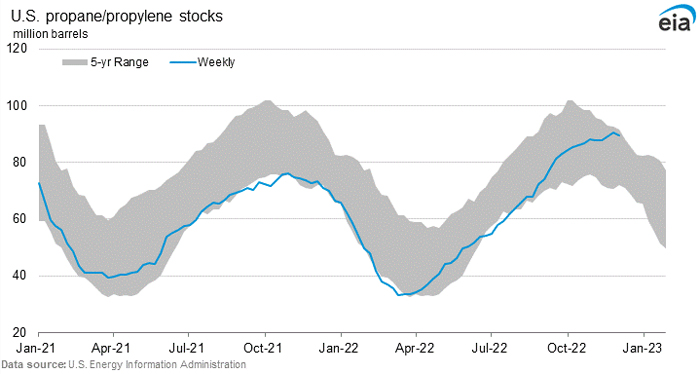

U.S. inventory moved from the bottom of the five-year range several months ago to near the top, eclipsing 90 million barrels in late November. Appleton says the higher inventory reflects strong production – now over 2.5 million barrels per day – and lower petrochemical demand in China.

“When it comes to the winter, we’re well supplied to this point,” he says. “We could see an uplift in prices January to March, but there’s a lot of product out there.”

At this point, Appleton says, the winter will be the key driver of global prices.

“It has to now be a heavy winter to see a strong uplift in prices.”

Start-of-winter prices

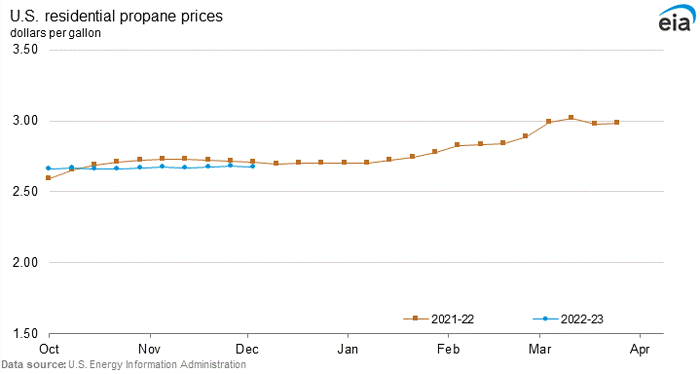

Propane prices during the first month of the current winter heating season were essentially unchanged compared with prices at the same time last winter, according to EIA.

The U.S. residential price of propane averaged $2.66 per gallon in October 2022, the same as the average price in October 2021, according to EIA’s Heating Oil and Propane Update.

As of Oct. 31, the U.S. residential price of propane averaged $2.67 per gallon, down 6 cents from the previous year.

Last winter, strong heating consumption and increased global demand for propane contributed to low U.S. propane inventories and high propane prices. This year, propane inventories are higher, but retail prices have changed little.

As of Nov. 4, U.S. propane inventories were 14 percent higher, at a total of 87.7 million barrels, compared with the same week in 2021, according to EIA’s Weekly Petroleum Status Report.