Propane speculation for retailers

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains how propane retailers can take long and short positions on propane.

Catch up on last week’s Trader’s Corner here: The dreaded propane price spike

In trading circles, the terms “long” and “short” are used a lot. Speculators on commodities make their livings by taking long or short positions.

A speculator takes a long position by buying a commodity or taking a financial position on a commodity in the present on the expectation the commodity will be higher in the future. The trader that is long on a commodity only makes money if the price of the commodity goes up after the long position is taken, providing the opportunity to sell it at a higher price in the future.

A speculator may also commit to selling a commodity that they do not yet own at a certain price in the future. Since the speculator does not own the commodity that they are committing to sell in the future, they are said to be short the commodity.

The trader taking a short position is betting the price of the commodity is going to go down between the present and the future when they must make good on their sell commitment. The only way a speculator that is taking a short position can make money is if the commodity’s price falls between the date they committed to make the future sale and the date that the transaction must be completed by delivering the commodity or settling the financial transaction.

Again, a speculator only makes money in a long or short position if the commodity’s price moves in the direction they were betting on when they entered the position.

A propane retailer is a commercial player in the propane industry with the ability to make money by selling propane. They are not propane traders. In fact, you could say a propane retailer does not make money on the commodity. They make money providing a service. It just so happens they are providing a service as part of the delivery chain of the commodity propane. The fact that it is propane is irrelevant; it could just as easily be toasters.

But even a commercial player in a commodities supply chain can take a long or short position on the commodity that they provide to customers. Propane retailers are naturally or normally short the propane they will sell in the future. There is the expectation they will provide propane to an end user at some point in the future, and if they do not already own what the end user will demand, they are short. They often remain short until very near the time they will make the physical delivery of the commodity. It may literally be a matter of hours between the time the commodity is in the possession of the retailer and the time the retailer delivers it to the customer. Until then, the retailer is short on the commodity.

When a commercial player is short on the product they sell, the inherent risk is that prices will increase. If the price of a commodity increases, it has the potential of hurting the demand for the commodity. When the demand for a commodity drops, it hurts every entity in the supply chain of that commodity. In the case of propane, that applies to producers, fractionators, pipeline operators, transportation companies, equipment providers and retailers.

Therefore, mitigating the risk of higher propane prices for the consumer should be an interest for every entity in the propane supply chain.

A propane retailer may want to mitigate the risk of higher propane prices by being less short on the propane they will sell in the future. Buying prebuys from wholesales suppliers, filling storage and buying swap positions are three ways propane retailers can take long propane positions, thus lowering the risk of higher prices. In other words, ways of lowering the risk of being short on the commodity. When they take these actions, they become a speculator.

Whatever portion of the overall future demand the retailer has become long on exposes him to the risk of prices going lower. That risk was at the core of last week’s Trader’s Corner. We presented our case for why taking that risk is more of a necessity than an option in our view.

Nonetheless, the downside price risk is there for a retailer that tries to manage the price risks of being short on their commodity by becoming long on their commodity. That is why we believe that financial swaps are a vital component of any price protection strategy.

When a propane retailer desires to mitigate upside price risk, they buy a swap position. When they buy a swap position, they establish a known price or strike. As we have pointed out many times, there are benchmarks to use to increase the likelihood that the strike price of the swap being bought will be in a favorable price range for the swap buyer.

In the future, the buyer of a swap will be paid if the actual market price is higher than the strike price. The buyer will pay the difference between the future price and the strike if the future price is lower.

Remember, when the retailer bought the swap, they took a long position. But what if market conditions change and the retailer no longer wants to be in that long position? Is there anything they can do? When using swaps, it is actually easy to end the exposure of falling prices that the long position presents.

To stop the exposure, the retailer can simply sell a swap for an equal time and volume as the original swap buy. Let’s say a retailer took price protection for October 2025 buying a swap with a strike price of 78 cents on a volume of 10,000 gallons today. He is now long on October 2025 propane on 10,000 gallons. He did this to mitigate the risk that propane prices will be higher in October 2025. The conclusion being that owning 10,000 gallons of propane with a known price of 78 cents is better than being short 10,000 gallons at an unknown price.

But let’s say a month later, the retailer believes that market conditions have changed, and he is no longer concerned about higher prices in October 2025. He no longer wants the long position. He can then take a corresponding short position by selling an October 2025 swap with a volume of 10,000 gallons.

Let’s say the strike on the swap sell is 76 cents. The net difference between the buy and the sell is 2 cents, and in this case, the retailer is on the losing side, meaning when both positions settle in October, he will owe 2 cents no matter what prices do going forward. But if he believed that prices will be even lower than 76 cents once October comes, it was an outcome he willingly accepted. The key is that the retailer no longer wanted to be long on October propane and had a way to counter the long position by selling a short position. He had flexibility.

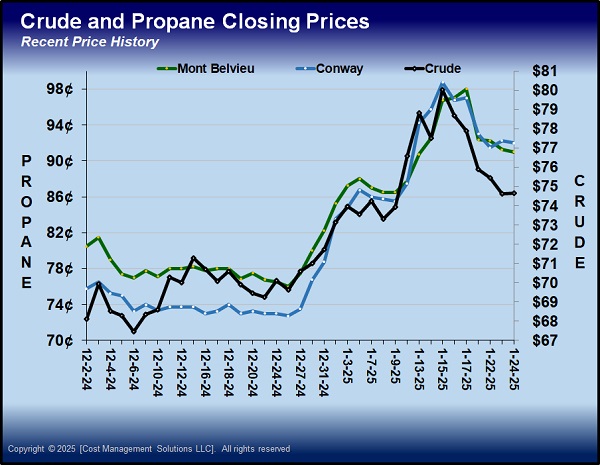

With the recent spike in propane prices, we have seen propane retailers that were long on propane take corresponding short positions to lock in a gain on the position. For example, many retailers that had long February 2025 propane positions believed that propane prices could fall in February when this cold front ends. While prices were elevated, they sold February swaps that locked in gains on their February long position.

Now, propane prices may be high in February, and the retailers may then wish they only had the long positions. But once they entered the short position, it ended any future benefit of a February 2025 long position. The long position could gain in February, but that will now be offset by the short position loss. Conversely, any decline in prices in February will hurt the long position but help the short position. The effect in February, when both the long and short positions settle at the end of the month, is the positions will offset, securing the gain that was present when the offsetting short position was taken in January.

No doubt, if February turns out to be cold and prices are high, retailers that closed long positions could regret it. But their assessment was “a bird in the hand is better than two in the bush.” The key is that they had the tools at their disposal to mitigate upside price risk when they thought it was needed and reverse the decision once they thought it was no longer needed. In the cases we have seen in January, retailers were capturing the gain on the position when they thought the maximum benefit of it had already been realized.

These retailers may have become long on February propane months ago when they were concerned about higher prices and/or because the market was pricing February 2025 propane at a favorable value. But once they perceived that the benefit of being long on February 2025 propane had likely already been realized, they did not have to wait until then to capture it. Instead, they realized it in January 2025, thereby eliminating the threats to the long position they perceived might occur in February 2025.

Featured homepage image: tttuna/E+/Getty Images

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.