Reconsider: Is it a good time to buy propane?

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, Sept. 24 at 10 a.m. CDT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses why propane buyers should consider expanding their price protection window.

Catch up on last week’s Trader’s Corner here: Expanding your price protection window

Every propane retailer has asked someone or something at one point or another if it is a good time to buy propane.

Spouses probably get asked it a lot, even if their sole knowledge of the business is the stench of mercaptan. Grandbabies sound asleep in the rocker on the front porch have been asked. Friends that struggle to change the propane tank in their grill have no doubt been consulted. The man in the moon hears the question from time to time and so does the four-legged buddy laying at our side in the duck blind just before the sun emerges over the horizon. Squirrels that are trying to figure out how we got that deer stand so far up in their favorite tree have been asked. Even the bug that just splattered across our windshield is not immune from the question.

That question always seems to infringe on the thoughts of propane retailers even when they should be focusing on far more important things. Every retailer has dealt with being on the wrong side of a pre-buy. Every retailer has let a good buy pass them by and dealt with the consequences later. It is an important question that needs to be answered correctly, but it need not keep us awake at night, nor should the stress and worry about it take away from our family and fun.

If the question does seem to weigh on us too much, then it is likely because we haven’t established benchmarks that provide a discipline for guiding our decision making. We need benchmarks to change a question into a statement – from “Is it a good time to buy propane?” to “It is a good time to buy propane.”

Our success depends on a clear plan or goal, and our discipline guided by benchmarks ensures we follow the plan or reach the goal. There are a lot of what we will call generic benchmarks available to us. These benchmarks are common knowledge available to everyone. When we write Trader’s Corner for you each week or the Propane Price Insider report for our subscribers and readers each day, we provide these generic benchmarks, making readers aware of where things stand against those benchmarks.

Regular readers of Trader’s Corner know we have written about the buy window numerous times this summer. The buy window is based on a very simple but crucial benchmark. Propane retailers are generally buying protection from higher prices that could occur in the winter months from October through March. Over the past 10 years, Mont Belvieu propane has averaged 78.5 cents and Conway 76.8 cents during those months.

If price protection is bought at exactly those numbers, then there is about a 50 percent chance that the actual winter price will be above or below the price protection. So, when possible, a buyer wants to buy at or below those 10-year averages. Price protection below those numbers has reduced downside price risk, which is what the buyer assumes when taking a position.

As we discussed last week, buyers can greatly increase their chances of buying in the buy window if they expand their buying horizon. Traditionally, propane buyers have focused on the upcoming winter only. A retailer begins looking at winter price protection somewhere around April or May and wants to have the buying done by the end of September. That is a short buying horizon, and sometimes macro market conditions during such a short horizon prevent the buy window from opening. However, there is an active propane swaps market that goes three years out. The longer our buy horizon, the much greater the chance of getting the opportunity to buy propane at or below the 10-year price average.

Another generic benchmark is propane’s value relative to crude’s value. Crude’s price sets the bar for the overall refining complex of which propane is a part. Never mind that about 88 percent of propane supply comes from natural gas processing. Natural gas prices have little to do with the price of propane, except that when natural gas prices are low, natural gas production can slow, reducing propane supply. But once propane has been removed from the natural gas liquids stream and is a fungible commodity, it prices relative to crude.

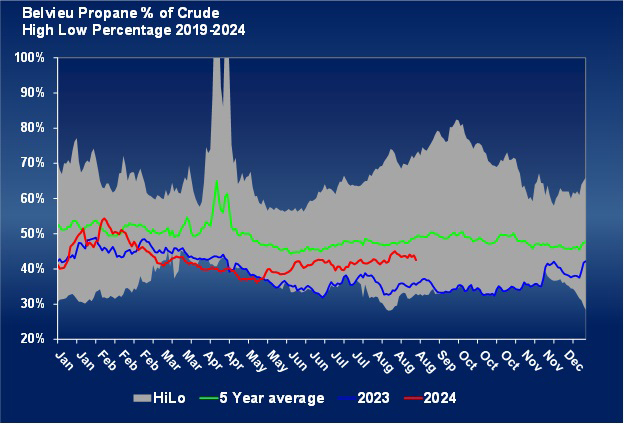

Over the past five years, propane has averaged 49.15 percent of the value of West Texas Intermediate (WTI) crude. A buyer’s risk increases when he buys propane valued above that mark and decreases when he buys below that mark. When both crude and propane prices are elevated, it is even more important to not buy above that mark.

Chart 1: Mont Belvieu propane percent of crude

The above table plots Mont Belvieu propane’s value relative to crude. A buyer wants to see propane valued below the five-year average green line. The 10-year propane price average above would take precedent over this benchmark. For example, if both crude and propane prices are low, propane might be a good buy even if it is valued above 49.15 percent of crude. If crude is extremely high, propane valued below 49.15 percent of WTI might still be too risky. We must understand and use this benchmark in the context of the overall pricing situation, which is dictated by crude’s price.

There are other generic benchmarks we follow. For example, simply looking for a price that is lower than last year’s price. There are also a lot of technical signals that come into play that are specific to propane. For example, is it above or below its 40-day moving price average? Buys below the 40-day moving price favor the buyer.

However, generic benchmarks will always have less importance than the retailer’s knowledge of his specific marketplace. Also, the benchmarks are not application specific. In other words, what a buyer is trying to accomplish makes a difference in whether a specific benchmark applies or not. For example, if a retailer is offering fixed-price gallons to their customers, the only benchmark that is important is whether the customers will agree to that price or not. Only the retailer knows if a certain price has worked in the past. Perhaps propane is valued above the 10-year price average, which we would say – speaking on a generic basis – is not a buy. However, a retailer may know that the price available is well within what he has offered and has been accepted by his customers in the past.

Another thing that can make you worry too much about propane’s price is trying to do too much price protection. If the number available is right at the 10-year price average, we would probably limit the buying to no more than 40 percent of our will-call sales volume. We want plenty of gallons that we can buy at market price during the winter if that is the best number the market has given us. We can be more aggressive on volume as the price falls below the 10-year average. And we sure don’t want to lock in too many gallons that don’t have a corresponding sell at prices above the 10-year average.

The other thing that increases stress is thinking you must buy at the lowest price of the year to be successful. That is absolutely and unequivocally not true. The lowest price of the year is never known until after the fact, so the person who is trying to buy it never does. The person buying a good opportunity based on good benchmarks may sometimes buy the lowest price of the year. Build a plan based on generic benchmarks and your knowledge of your specific marketplace and execute the plan year in and year out, and you will be a lot more successful with a lot less stress. Going from “is it?” to “it is” is very doable.

You are still going to ask rhetorical questions from time to time, but you know the answer. Plan and execute. Otherwise the bug’s answer is about as good as any.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.