Rising Cushing crude inventory could end crude, propane rally

Crude and propane prices are in the midst of a very strong run. Anytime a market has been in a strong uptrend, there is always concern that it could end and that a correction could take place.

For the most part, propane prices this spring have been pulled along by sharply rising crude. Crude buyers have generally ignored the current oversupply of crude and bought instead on what they believe the future holds for crude fundamentals.

The general belief is that increasing production from the Organization of the Petroleum Exporting Countries (OPEC) will be offset by declining production from non-OPEC countries. That will allow the typical year-over-year increase in crude demand to absorb the current oversupply of crude. Most expect this will occur sometime in the first half of 2017.

Recent data showed global crude demand in the first quarter was 1.4 million barrels per day (bpd) higher than what it was in the first quarter of 2015. That was a stronger growth rate than most estimates, which tended to be around 1.2 million bpd.

Earlier this year, many light tight oil (LTO) producers, commonly called shale producers, said they would start drilling again when crude reached the $40-to-$45-barrel range. However, recent conference calls from leaders of those companies suggest that is not the case. While some can break even at those prices to pay debt and make a profit, they need crude in the $50-to-$60 range. Therefore, many speculators believe they can count on crude going at least beyond $50 per barrel. Somewhere beyond that point, upside could potentially be limited by new production from LTO producers.

So is there anything that could sidetrack the crude rally other than new LTO production? Probably not for the longer term, but there is one thing that has the potential for causing a correction before the $50 to $60 prices band is reached.

Current oversupply is taxing storage facilities globally, and nowhere is that more evident than at the Cushing, Okla., crude trading hub.

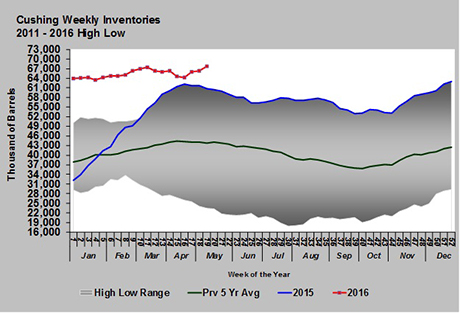

Last week, the Energy Information Administration reported that Cushing crude inventory had reached 67.812 million barrels after a 1.520-million-barrel build during the week ending May 6. The current inventory level puts Cushing just 2.188 million barrels below its presumed maximum working capacity. Given the rate of builds over the last three weeks, it is not out of the question to think Cushing could be nearing its limit. Market information company Genscape believes Cushing inventory increased over 500,000 barrels during the week ending May 10, which was more than most expected given the recent disruptions to supply.

It is certainly possible that the wildfires in Canada that decreased production by as much as 1.4 million bpd and the restart of U.S. refineries that were down for seasonal maintenance during April will keep Cushing inventory below capacity. However, as the chart shows, the recent builds are atypical for this time of year.

There isn’t a precedent to Cushing reaching its capacity and, therefore, there is no way of knowing the potential impact on prices. The general assumption is a bearish market for West Texas Intermediate (WTI) crude prices, which, in turn, could be a weight on propane prices.

There has been a very strong U.S. import market for crude. Last week, the United States imported 774,000 bpd more crude than it did during the same week last year. If Cushing reaches its capacity, it would seem that WTI crude would fall relative to Brent crude to back out those imports to some degree. But as we all know, OPEC is being very aggressive in taking market share from high-cost U.S. producers. If the imports keep coming and Cushing is full, U.S. producers may be forced to shut down more production.

Again, there is no way of knowing the impact on crude and propane pricing if Cushing reaches its capacity. Traders could simply shrug it off as they have done so for many other bearish events in this ongoing crude rally. However, if it happens, it’s possible that this event could readily put a pause in the crude rally.

Chart: Cost Management Solutions

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.