Survey charts propane industry’s response to challenges new and old

In its second year of nationwide distribution, Gray, Gray & Gray’s annual propane industry survey yielded a higher response rate, with results more representative of the industry on a national scale, explains Marty Kirshner, director of client services and chair of the energy practice group at the accounting and business advisory firm.

In its second year of nationwide distribution, Gray, Gray & Gray’s annual propane industry survey yielded a higher response rate, with results more representative of the industry on a national scale, explains Marty Kirshner, director of client services and chair of the energy practice group at the accounting and business advisory firm.

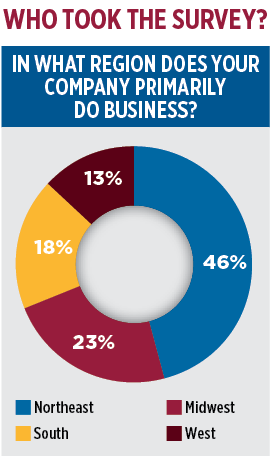

While results still favor the Northeast, participation in the Midwest and West jumped – by 13 percent and 10 percent, respectively – compared to last year.

In addition, the average size of the companies that responded – based on gallons sold during a heating season – decreased from 2.2 million residential gallons sold to 1.5 million gallons, which captures a more accurate picture of the number of small, family-owned businesses that comprise the industry, says Kirshner.

This year’s survey collects sales and operational data through the end of the 2019-20 heating season (April 2019 through March 2020). But having closed for responses in late July, it also reflects the industry’s current approach to the coronavirus pandemic and the online business environment it precipitated.

Pandemic priorities

As the coronavirus pandemic continues to threaten the nation’s economy and employee safety, survey results indicate the propane industry is adjusting operations, maintaining financial health and protecting its employees.

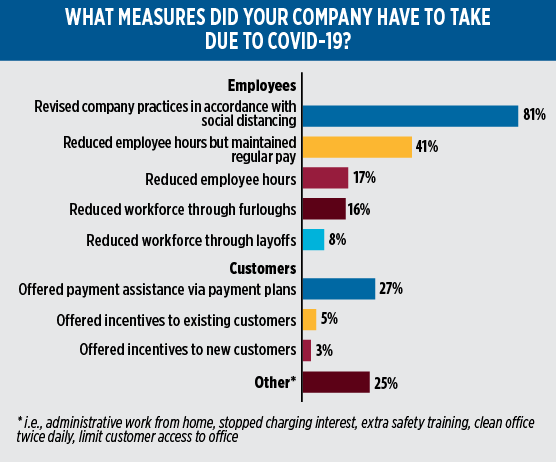

Paycheck Protection Program loans helped small operations keep employees on the payroll, says Kirshner. A sizeable portion of survey takers (41 percent) said their companies reduced employee hours but were able to maintain regular pay. Furthermore, a fairly low number of respondents reported their companies had to reduce labor through furloughs (16 percent) or layoffs (8 percent).

Marketers appear to be passing on some of the additional overhead that comes with social distancing and sanitation compliance through fees, a strategy Kirshner says Gray, Gray & Gray advocated to propane clients at the beginning of the pandemic. The average delivery fee, in particular, tripled from $5.97 last year to $18.68 this year.

Despite high unemployment during the pandemic, only 27 percent of respondents indicated their companies set up payment assistance plans for customers. Fewer still said their company offered any kind of incentive to existing customers (5 percent) or new customers (3 percent).

Doing deliveries for free for customers who are struggling to pay can kill the profitability of a propane operation, notes Kirshner. Payment assistance plans ensure a steady flow of cash and can be just as important as reducing overhead costs.

“As the pandemic continues, cash is going to become king,” says Kirshner. “Getting cash in the door will be as paramount if not more than making the actual deliveries or the service call. Many of the customers will be impacted financially, so you need to incentivize those who are either slow paying or who you know are going to have hard times paying.”

That could mean monthly payment plans or one-time write-offs on current balances – of perhaps 5 percent – to help customers square up, he adds.

Tech upgrades

The pandemic also has hastened the switch to online business. The change offers significant opportunity for growth, but survey results suggest marketers are still catching up on the latest technological improvements.

While 37 percent of survey takers who grew their customer list last year attribute success to better or more effective marketing, only 15 percent say better use of internet or e-commerce contributed. The highest number of respondents (47 percent) report they rely on a grab bag of traditional methods like reputation, better service and competitive pricing.

Kirshner thinks the number of companies focused on internet and e-commerce will increase over time, especially as more propane customers stay home and plug into their computers and mobile devices. He recommends marketers who haven’t made it a priority look at their websites and update their online capabilities so existing customers can make payments and get customer service, and new customers can set up their accounts online.

“Internet and e-commerce marketing right now is the gravy train that’s going to get you to the next level,” he says.

More online business also heightens the urgency of cybersecurity.

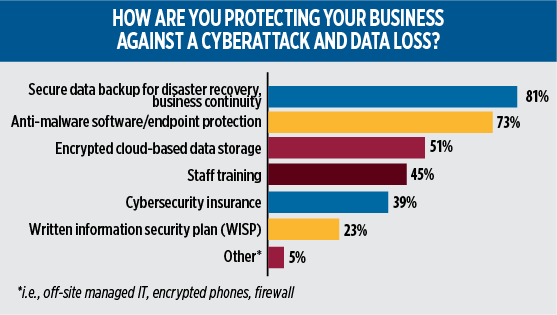

Most respondents (81 percent) indicate they securely back up data for disaster recovery and business continuity, but Kirshner emphasizes that number should be higher: “One-hundred percent of companies should have that in place, and I worry for the 20 percent that don’t.”

Survey results indicate several other areas of improvement retailers should consider:

Only 45 percent report they train staff to detect spam and malware, a priority in remote work environments.

Fewer (39 percent) invest in cybersecurity insurance, which mitigates losses from data breaches, business interruption and network damage, among other problems.

Use of written information security plans (WISPs) drew even fewer responses (23 percent). A WISP is a document that spells out the administrative, technical and physical safeguards the business has in place to protect against cyber threats. While this administrative task may not draw the attention of busy marketers immediately, the high level of risk associated with a cyberattack – not to mention requirements to report the issue to customers and state agencies – warrant robust security plans, says Kirshner.

Promising future

Survey results reflect more familiar concerns about the future of the industry as well.

Of those respondents who lost customers last year, the majority say they lost them to competitors – with similar prices (7 percent) or lower prices (49 percent). But just behind internal competition lurks the threat of competing energy sources. Gas conversions accounted for 21 percent of responses, while a variety of other competitive energy concerns – oil competitors, conversions to electricity, and electric heat pumps and forklifts – captured much of the remainder.

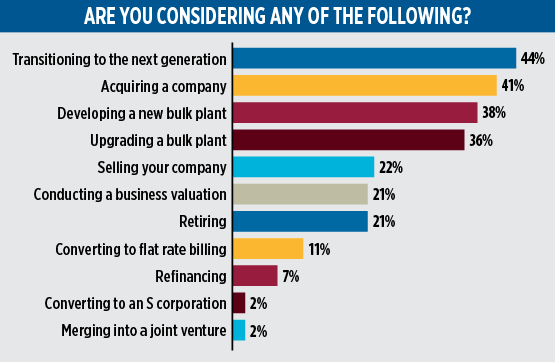

Meanwhile, industry consolidation continues as retiring leaders of family businesses determine whether to sell or hand down ownership to the next generation. The percentage of survey takers who say they are considering selling their company stayed about even compared to last year – at 22 percent.

The number of respondents who indicated they were considering acquiring a company dropped compared to last year – from 53 percent to 41 percent.

Kirshner believes delays in acquisition processes brought on by the pandemic, as well as some skittishness about taking on new customer lists, likely account for the difference. Fundamentally, though, economic conditions continue to support acquisitions, he says.

“The mergers and acquisitions market is still as robust as it was pre-pandemic, and the multiples and prices for companies are equal to or in most cases greater than what they were before, and it’s a pretty big premium for these companies,” he says.

Companies interested in undertaking an acquisition before the pandemic are still capable of doing so, he adds: “From an economic standpoint, it doesn’t seem like there’s any company that’s saying it can’t afford to buy a company. We’re not seeing that at all.”

Notably, the number of survey takers who say they are considering transitioning their business to the next generation spiked from 26 percent to 44 percent year over year.

Kirshner sees in this result “promise” that the industry’s tradition of family ownership will continue with the younger generation.

Employment and wages

Survey respondents employed an average of 63 people, with full-time service technicians accounting for 15 percent of the workforce and delivery drivers accounting for 19 percent.

Survey respondents employed an average of 63 people, with full-time service technicians accounting for 15 percent of the workforce and delivery drivers accounting for 19 percent.

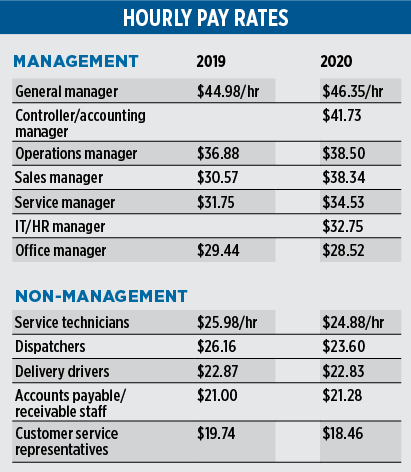

While 83 percent of survey takers specified raising wages to retain employees, the average hourly pay stayed fairly even compared to last year.

Most wage growth – albeit modest – went to managerial positions. According to respondents, sales managers saw a robust 25 percent increase in pay compared to last year, which Kirshner attributes to a concerted effort in the industry to seek organic growth through internal sales, and to a strong economy pre-pandemic that may have enabled sales people to bring in new accounts.

Kirshner also notes the wages reflected in the survey are likely underreported, and that real-world wages are probably 10 to 15 percent higher.

Data used in charts and tables sourced by Gray, Gray & Gray.

See full results of Gray, Gray & Gray’s annual propane industry survey – including information about margins, contracts, fees, asset management (tanks and fleet) and other benchmarking data – at gggllp.com/propane-survey-results-2020.