The developing DME market: What it means for LPG

As the renewable fuel builds momentum in the U.S., propane industry leaders and companies are considering roles they can play.

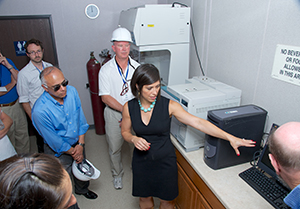

Oberon Fuels’ plant in Brawley, Calif., produces DME directly from methanol. Photo courtesy of Oberon Fuels

Developments with a renewable fuel similar to propane have LP gas industry leaders weighing the benefits of a partnership and considering new opportunities for their businesses.

Dimethyl ether (DME) has been discussed in propane industry circles for years, and it was the topic of a renewable fuels article in LP Gas.

But DME made progress last year on two particular fronts: In February, ASTM International, a globally recognized organization that develops technical standards, released a specification for DME as a fuel. Then in August, Oberon Fuels, a California company that manufactures DME, received U.S. Environmental Protection Agency approval for the fuel’s inclusion under the Renewable Fuel Standard.

What does it mean?

DME appears to have momentum as a renewable fuel that can help displace diesel in motor fuel applications. And because DME exhibits propane-like properties, officials representing both fuels believe each side can benefit.

“There is no silver bullet” when it comes to alternative fuels, says Brittany Applestein Syz, vice president of business development and general counsel for Oberon Fuels. “Being able to bring another clean-burning fuel to market only provides more choice for the customer. There is room for all of these fuels.”

The ASTM subcommittee on LP gases formed a task force to develop the specification for DME, and propane industry leaders were part of the process. ASTM D7901, the specification’s official designation, provides guidance for fuel producers, engine and component suppliers, and infrastructure developers on DME purity, testing, safety, and handling.

Over time, the task force plans for the ASTM specification to also cover the blending of DME with propane.

Blending the two fuels is one area that intrigues the industries, as blending up to 20 percent DME with propane usually requires no modifications to equipment or distribution networks, industry officials say. It’s already being done internationally. Ultimately propane industry leaders view DME blending as a way for propane to gain renewable fuel status and possible future tax incentives.

Defining DME

More than 5 million tons of DME are produced annually worldwide from various feedstocks, mostly through methanol dehydration, the International DME Association reports. Feedstocks include renewable materials (biomass, waste, wood and agricultural products) and fossil fuels (natural gas and coal). China is a major producer of DME from coal.

DME is popular in domestic cooking and heating when blended with LP gas, particularly in developing countries seeking benefits in price, economics, demand for clean fuels and energy security. DME is also becoming a promising alternative vehicle fuel.

These two 30,000-gallon DME storage tanks have a similar look and feel to that of propane tanks. Photo courtesy of Oberon Fuels

Oberon Fuels calls DME a simple fuel. It’s clean and colorless, and easy to liquefy under moderate pressure (75 psi) and transport, much like propane. Those qualities are driving Oberon’s push to use DME as an engine fuel to displace diesel, particularly in heavy-duty applications.

“DME performs like diesel; it has the power and torque of diesel, but it handles like propane,” Applestein Syz says.

Based in San Diego, Oberon Fuels was formed in 2010. It has one plant in Brawley, Calif., capable of producing 4,500 gallons of DME per day. Production commences when an OEM needs DME for testing, she adds. Oberon has been working with Volvo in North America on DME-powered test vehicles.

Oberon Fuels also touts the benefits of stable pricing with DME because it’s not tied to crude oil pricing. Declining to provide a specific price, the company says DME is competitive with diesel pricing.

Because DME and propane are similar, Oberon Fuels sees an opportunity to partner with the propane industry, using its infrastructure and distribution network to reach customers and, in turn, provide additional business for propane companies.

“Propane and DME are used for different applications,” Applestein Syz says. “DME is used in heavy-duty hauling – Class 8, 13-liter trucks pulling heavy loads. It can get you up the hills. This is where DME excels.”

Oberon Fuels has one plant in Brawley, Calif., capable of producing 4,500 gallons of DME per day. Photo courtesy of Oberon Fuels

Only minor modifications to the diesel engine are needed for it to run on DME, making construction, mining and agricultural applications target markets, as well, Applestein Syz says.

Some companies already supplying equipment to the propane industry are seeing an opportunity with DME. Parafour Innovations, which manufactures propane autogas refueling dispensers, has been working with Oberon Fuels, the International DME Association and Volvo to demonstrate its DME dispenser. Red Seal Measurement and Gas Equipment Co. also are showing an interest in DME.

“We’re seeing real buy-in from the propane industry,” Applestein Syz says.

Oberon Fuels says it will continue to reach out to propane industry players as it works to execute its business model – the deployment of small-scale, modular DME production plants to coincide with growth in regional markets.

Developing standards

One of the latest discussion topics between DME and propane industry leaders centers on storage standards, says Bruce Swiecicki, senior technical adviser, regulatory and technical services, at the National Propane Gas Association.

While ASME containers and Department of Transportation cylinders could be used to store and ship DME, no code exists that references bulk storage of the product.

“In terms of storing DME, we determined it is not within the scope of NFPA 58; it is within the scope of NFPA 55, which is compressed gases,” Swiecicki says. “But within that NFPA 55 standard, there is not much to say about bulk storage of compressed gases.”

The potential odorization of DME is also being discussed, he adds.

Swiecicki envisions propane and DME stored in separate containers and mixed at a point along the distribution chain, possibly in the bobtail at the bulk plant – whatever is most advantageous to the propane marketer and for the end-use application.

“How it would look in the handling of this material is similar to what we see going on with propane,” Swiecicki says.

Blending aside, propane marketers could also distribute straight DME, potentially making it another service to offer customers and fulfilling Oberon Fuels’ vision of DME companies partnering with the LP gas industry.

“We see this as an opportunity to approach it like we do with autogas,” says Jessie Johnson, vice president of sales and marketing at Blossman Gas, parent company of propane fleet vehicle solutions provider Alliance AutoGas.

“We’re a distribution company, and that same thing could apply with DME,” Johnson adds. “As the market develops over the next 10 years, there’s going to be a role for the propane industry to become a distribution arm for DME because it’s compatible with propane.”

DME has “wonderful characteristics” as an engine fuel, which piqued Blossman Gas’ interest, Johnson says. He views DME as a propane industry partner to target diesel engine market applications.

“It’s going to take a few years yet to fully develop,” Johnson says. “It’s in its infancy, but a lot of companies like Oberon are gearing up to take advantage.”

Want to learn more about dimethyl ether (DME)? Visit:

Very interesting innovation and can be change the rural fuel economy considerably, more information and technical details should be circulate through LP Gas association.

Have tested DME. Vapor-lock in diesel injection systems is a major problem. Incompatibility with Viton seals would disallow using LPG containers “as – is”. Viton seals swell more than 50%. Mixing DME w/LPG has major effects on knock ratings.

DME is vastly superior to diesel in really cold weather .