US crude export opportunities leading to inventory drawdown

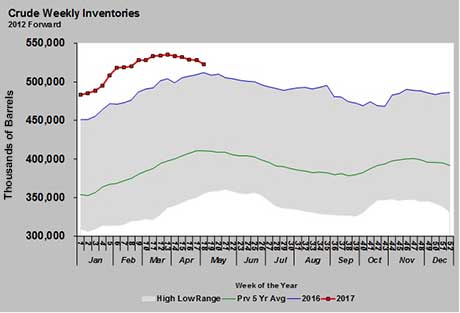

U.S. crude inventory is falling and that is helping fuel the recent uptrend in crude prices. Most of the talk surrounds the Organization of the Petroleum Exporting Countries (OPEC) and other crude producer/exporter nations’ decision to extend production cuts beyond June.

At present, it is likely the current 1.8 million barrels per day (bpd) in production controls implemented by 24 producer nations in January will be extended nine more months through March 2018. There is now some talk that the amount of production cuts could be increased as well.

Frankly, we think that is mostly talk. Many producers aren’t meeting their commitments at the 1.8-million-bpd cut level. Were it not for Saudi Arabia cutting more than it pledged, the compliance among OPEC members wouldn’t be very good. Many of the countries aren’t even meeting 50 percent of their pledged cuts.

Unfortunately for OPEC, its efforts have simply opened the door for more U.S. production.

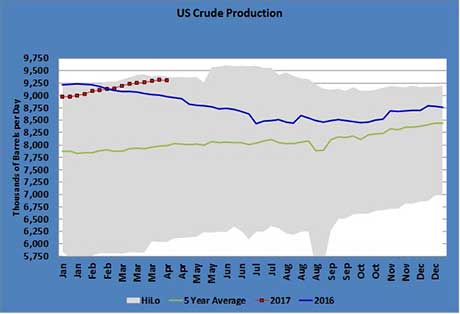

U.S. crude production is nearing its five-year highs after falling following the November 2014 decision by OPEC to no longer try and control prices by manipulating production. OPEC’s efforts to once again support prices with production controls are only fueling a resurgence in U.S. production. U.S. production is up 877,000 bpd since hitting its low last year.

So, why is U.S. crude inventory falling? Typically, there is a decline in U.S. crude inventory beginning in May extending to October as refineries ramp up throughput to meet summer gasoline demand. However, this year, the drawdown in inventory started earlier than normal, which seems odd given the rapid rise in production.

The reason for the earlier drawdown in inventory is that OPEC’s cutbacks are opening up more export opportunity for U.S. producers.

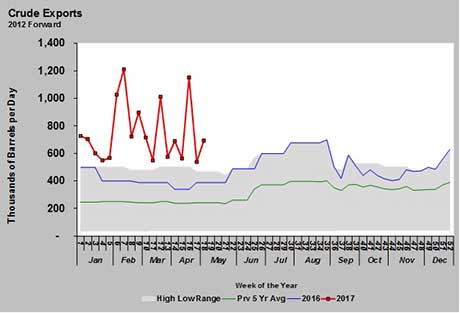

This year, U.S. crude exports are running at 749,000 bpd. That is up from 402,000 bpd from the same time frame last year. Overall, U.S. crude exports averaged 481,000 bpd in 2016. This year’s pace is showing that could nearly double. Just over the last few years, U.S. producers have been given the green light to export more crude. In 2012, U.S. crude exports averaged only 40,000 bpd.

As we looked at crude price projections for this year, there was some hope that increasing U.S. production might keep West Texas Intermediate (WTI) crude lower relative to Brent and other benchmarks. That is true to some degree, with WTI trading at just over $3 per barrel lower than Brent. However, if U.S. crude exports remain strong, the spread between the two benchmarks should remain relatively close.

It will be interesting to watch the impact on the propane export market. In general, trading WTI crude at a discount to Brent could encourage more U.S. exports of petroleum products, including propane. It is possible that increased U.S. crude exports could keep the spread tighter and slow propane exports some. However, the result could still be a wash for propane prices. If the crude exports support U.S. crude prices, those higher crude prices would likely result in higher propane prices as well.

As propane retailers, it’s a fair question to ask why all this new U.S. crude production is not driving down the price of WTI crude, and, as a result, U.S. propane prices. Part of the answer is the increase in U.S. crude exports.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.