Review of EIA’s Short-Term Energy Outlook

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, takes a look at the latest energy outlook released by the Energy Information Administration.

Catch up on last week’s Trader’s Corner here: Crude inventory doing surprisingly well

This past week, the Energy Information Administration (EIA) released its Short-Term Energy Outlook (STEO). The outlooks seemed fairly bearish. We thought we would review some of it to get a feel of how the government agency that provides most of the data on U.S. energy sees the short-term future in the energy marketplace.

From a macroeconomic perspective, it sees U.S. gross domestic product (GDP) contracting in the first half of this year but returning to expansion in the second half of the year. That general assumption underlies its forecasts. It had GDP growth at 2 percent in 2022, falling to just 0.8 percent growth for all of this year but recovering to 2.1 percent growth in 2024.

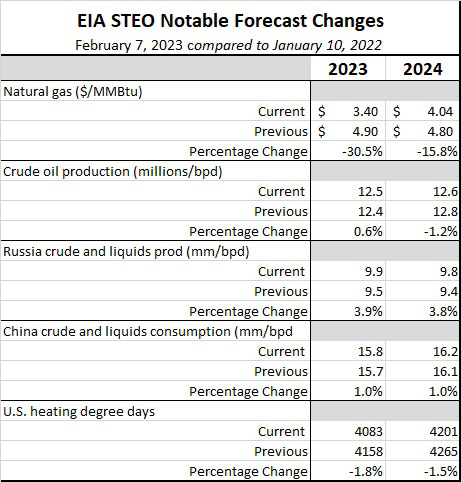

Chart 1 includes some of the other notable changes in the forecasts since its last report that most relate to propane.

The lower natural gas prices are not good for propane supply, though the EIA does expect natural gas production to be at a record high this year at 100.27 billion cu. ft. per day (bcfd), compared to 98.09 bcfd in 2022. It has production at 101.68 bcfd in 2024.

At the same time, it is forecasting U.S. domestic demand for natural gas to fall from 88.63 bcfd last year to 87.04 bcfd this year. Higher LNG exports of around 1.2 bcfd should provide some offset to the lower domestic demand. However, at some point, lower natural gas (methane) prices are likely to lead to less drilling and eventually less natural gas production, which is a negative for propane supply since about 86 percent of propane supply is coming from natural gas processing.

U.S. producers had promised coming out of the pandemic they would maintain fiscal discipline, focusing more on paying down debt and taking care of investors than higher production. They have been true to their word, keeping crude production well below its 13.1 million barrels per day (bpd) peak before the pandemic. For most of the last year, production held about a million bpd below peak. Though production will increase this year and next, the EIA does not forecast it reaching the levels seen before the pandemic. Propane is a byproduct of the refining process. U.S. domestic crude production doesn’t directly correlate to refinery throughput since a lot of supply comes from crude imports. Lower crude production does affect associated natural gas production, which can

impact propane supply.

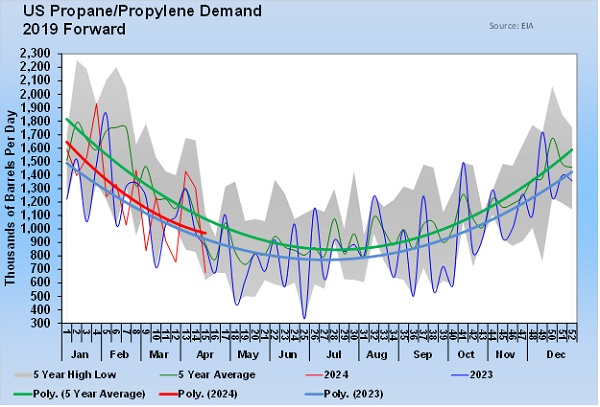

The EIA is projecting refinery throughput to increase from 15.94 million bpd to 16.19 million bpd, with a larger portion of the feedstock coming from imported crude. The higher refinery throughput could increase propane supply. But, as we pointed out recently, refiners can tweak their operations to produce more propylene and less fuel-use propane supply. That is likely as the economy improves and there is more demand for higher-valued propylene. So even though refinery throughput will likely increase this year, we could actually see less fuel-use propane than we did last year if it benefits refiners to make more propylene.

Of course, the heating degree-day downward adjustment is a direct negative impact to retail propane businesses. It is a concerning trend to be sure. The good news is that the EIA is projecting increased heating degree-days in 2024. It has heating degree-days at 4,245 for 2022, 4,083 this year and 4,201 for next year.

Russia and China will be wild cards for both energy supply and consumption. Just last week, it was reported that Russia will cut its crude output by 500,000 bpd starting in February due to Western sanctions. At the same time, China’s energy demand is expected to increase as it reopens its economy by reducing COVID-19-related mobility limitations. Overall, global oil demand is expected to rise from 99.4 million bpd last year to 102.3 million bpd in 2024.

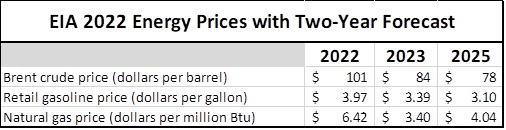

The overall energy pricing environment should improve for the consumer this year.

However, we need to remember that propane was one of the cheapest Btus in the energy complex in 2022. It largely avoided the rises seen in crude, gasoline, distillates and natural gas after Russia invaded Ukraine. That means we are much less likely to see a downward shift in propane prices this year compared to other energy sources. In fact, propane could actually go against the grain

this year and increase in value relative to falling crude.

For those interested in how the U.S. is trending in terms of environmental concerns, our carbon dioxide emissions were 4.97 billion metric tons in 2022. They will drop to 4.78 billion metric tons in 2023. The amount will only rise to 4.79 billion metric tons, even with improving economic conditions in 2024.

Between 2022 and 2024, U.S. consumption of natural gas for electrical generation will drop from 39 percent to 37 percent, and coal will drop from 20 percent to 17 percent. Coal has already dropped from around 40 percent. Renewables accounted for 22 percent of electrical generation in 2022, and EIA expects that number to reach 24 percent in 2023 and 26 percent in 2024.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.