Weakening WTI fundamentals could prove positive for propane export economics

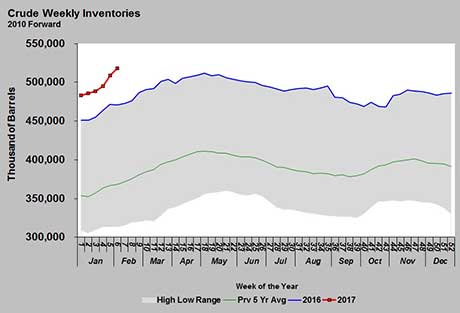

In its Weekly Petroleum Status Report, the U.S. Energy Information Administration (EIA) showed a 9.527-million-barrel build in U.S. crude inventory for the week ending Feb. 10. The build, combined with major builds the previous two weeks, pushed U.S. crude inventory to a record high of 518.119 million barrels. The previous high was 512.095 million barrels set last April.

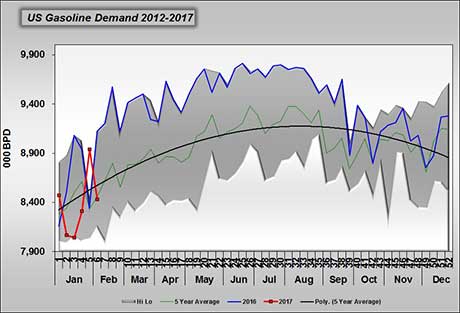

Meanwhile, U.S. gasoline demand, the primary driver for refinery throughput and crude demand, has been off to a slow start in 2017. Gasoline demand was setting new five-year highs most weeks during the first three quarters of 2016. However, starting in the fourth quarter of 2016 and carrying over to this year, gasoline demand has been slowing. This year, gasoline demand has spent more time below the five-year average than above it.

From a retailer’s perspective, this could be a good thing for propane prices. We all know that crude has a tremendous influence on propane prices, so weak crude fundamentals in general should lead to weaker propane prices. But there is another angle that must be considered.

The rally in crude prices from the $30-per-barrel range to above $50 per barrel is causing an increase in U.S. drilling activity and crude production. Of course, the increased production is contributing to record-high crude inventories.

However, while U.S. production is on the rise, 24 other producer/exporter nations have pledged to cut nearly 1.8 million barrels per day from global crude supplies. Those cuts are expected to last until the middle of this year. Last week, reports said the Organization of the Petroleum Exporting Countries (OPEC) is considering to extend the length of the cut agreement or increase the amount of the cuts.

OPEC’s goal is to bring down global crude inventory to at or below the five-year average. The International Energy Agency recently reported that global crude inventory is at around 3 billion barrels. By the agency’s estimation, that is 286 million barrels above the five-year average inventory level. It appears OPEC will stick with its production reduction program until that inventory overhang is eliminated.

The elimination of this global surplus of crude inventory is more likely to support other crude benchmarks around the world, like Brent crude, as opposed to West Texas Intermediate (WTI) crude, the U.S. benchmark crude. So, while other producers are taking measures to improve the value of crude, increased production in the U.S. is likely to put downward pressure on WTI crude’s price. The result could be WTI trading at a lower value relative to other benchmark crudes.

Again, the falling of WTI crude is a positive for propane retailers, as it is likely to lower the value of propane. However, as WTI crude becomes less expensive relative to other crudes, it could increase the export demand for other U.S. energy sources, such as propane. If U.S. propane exports remain robust, it is possible that U.S. propane inventory will not rise as much this summer as it has in recent summers. More bullish propane fundamentals could make propane prices increase in value relative to crude, thus offsetting any benefit propane retailers may have gotten from lower WTI crude prices.

As the market transitions from the winter propane inventory drawdown period to the summer inventory build period, retailers will want to watch not only the price of WTI crude, but also the price spread between WTI and other benchmark crudes, such as Brent. Currently, WTI is trading between $2 and $3 below Brent. We suggest monitoring that spread to see if it increases. If it does, monitor the impact on propane exports. If the propane exports remain strong, then track the impact on propane inventory builds. If they are lagging the builds of 2015 and 2016, next winter will likely begin with less inventory than the past couple of winters, and that could lead to higher propane prices.

Therefore, if the trends mentioned above are developing, propane retailers should consider increasing the amount of propane they hedge or pre-buy for next winter.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.