What the future holds for crude prices

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, analyzes Goldman Sachs’ predictions for crude prices and supply.

Catch up on last week’s Trader’s Corner here: Energy demand not slowing down

Goldman Sachs is an investment bank, and its forecasts and predictions on commodities are highly respected and watched by traders and investors. In a letter to its clients this past week, Goldman said it believed that crude would be oversupplied globally by 1.8 million barrels per day (bpd) by the end of the year. As a result, it believes that the price of benchmark Brent crude could drop to near $50 per barrel.

Goldman is not alone in its expectation of oversupply. The International Energy Agency released a report where it predicted crude would be oversupplied by 1.4 million bpd. The oversupply predictions stem from a rapid increase in crude supply from OPEC+ this year of about 2.5 million bpd. Until April, OPEC+ had been limiting supply to support prices, but its market share had slowly declined as non-OPEC producers, including the United States, increased production.

Non-OPEC production has been declining with the lower prices resulting from supply increases by OPEC+, but it isn’t coming down as fast as OPEC+ production has been going up. Therefore, at least in the short term, an oversupply situation has developed.

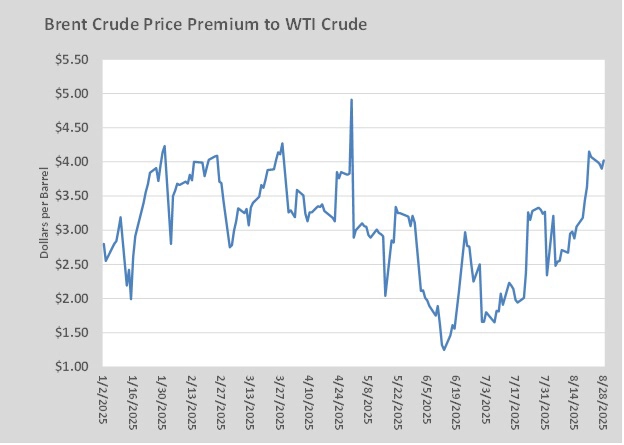

Brent crude normally trades at a premium to WTI crude, the U.S. benchmark crude that influences U.S. propane prices. Chart 1 shows the Brent premium over WTI:

In 2025, Brent has held an average $3.06 premium over WTI. As Chart 1 shows, the premium has been on the rise lately and was over $4 in the past week. If Brent continues to hold a similar premium over WTI moving forward, then Brent crude near $50 per barrel could lead to WTI crude trading in the high $40s.

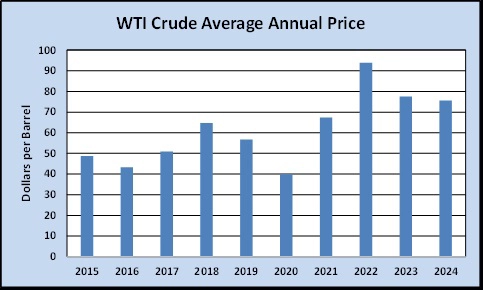

Let’s put that price in perspective by looking at WTI crude’s price history.

Chart 2 shows the average annual price for WTI crude. From 2015 to 2024, WTI crude had an average annual price that ranged from a low of $39.95 in 2020 to a high of $93.97 in 2022. The average of the 10 years is $61.92 per barrel.

If Goldman Sachs is correct on its price forecast for Brent’s price to fall toward $50 per barrel and for WTI to average $3 less than Brent, then WTI will be trading well below its 10-year average price. That is good news for propane buyers.

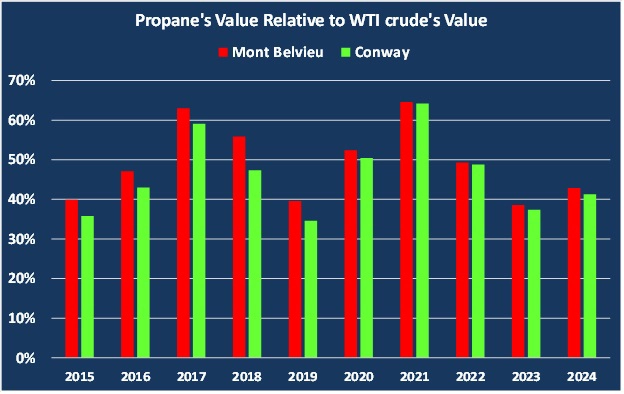

Chart 3 shows propane’s annual relative value to WTI crude’s value over the same period.

The range has been from 39 percent to 60 percent at Mont Belvieu and 36 percent to 64 percent Conway. The 10-year average value for Mont Belvieu propane is 49 percent of the value of WTI crude. The 10-year average value for Conway propane has been 46 percent of the value of WTI crude.

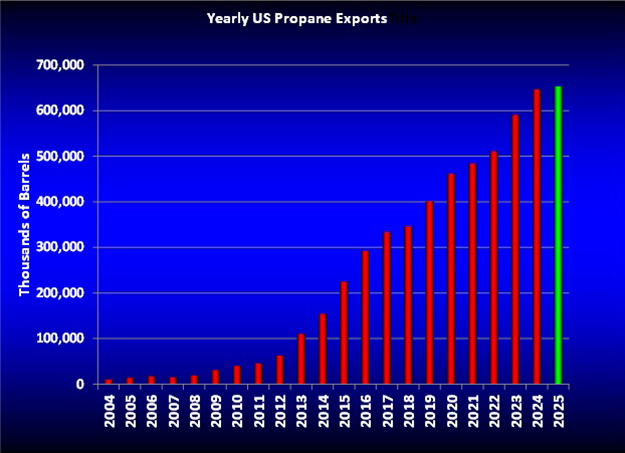

The relative value of propane to WTI crude has been coming down over the years. When we first began tracking relative value, it ran about 60 percent on average. The relative valuation changes with the strength or weakness of each commodity’s fundamentals, essentially supply versus demand. U.S. propane supply has been going up relative to its domestic demand, which has driven its relative price to crude down over the past decade.

Propane fundamentals are currently strong. As a result, Mont Belvieu is valued at 45 percent of WTI, and Conway is valued at 43 percent of WTI. That is below their 10-year averages. If propane demand were to increase relative to its supply, then the percentage would rise. But as we head into the winter of 2025-26, propane fundamentals are in great shape with inventories currently just under last year’s record pace.

If we use Goldman Sachs’ prediction about crude and consider propane’s strong fundamental situation, we might start a price forecast with WTI dropping to $50 sometime during the winter. Propane does tend to rise in value relative to WTI during the winter months. Over the last 10 years, the average has been 51 percent. Given the strong inventory position and the current relative value, there is a good chance propane will be valued below 51 percent of WTI this winter. Fifty percent is a nice round number, so let’s use that going forward. If propane is valued at 50 percent of WTI crude and WTI crude falls to $50 per barrel, then propane would be valued at 59.52 cents per gallon.

None of us knows where crude or propane will be valued this winter, but based on current conditions, the potential for being in a low-pricing environment is there. Buyers must base their decision on what is known and adjust as the reality changes. So, what does a buyer do with the current information and predictions about crude and propane?

Based on the information that is known at this point, this would be a winter when a propane retailer would want to favor getting price protection on a lower percentage of their supply. Currently, winter prices are favorable to buyers, with winter values below the 10-year average for winter prices. That provides confidence that taking a price protection position will be less likely to be a burden to the retailer. Still, the overall backdrop suggests that the buyer would not want to be overly aggressive in fixing this winter’s supply price.

Some price protection is always warranted because the future is unpredictable. Economic and geopolitical situations could develop in the coming months that could totally change Goldman Sachs’ view on crude and result in high crude prices. Just remember how Russia’s invasion of Ukraine impacted the energy landscape.

However, based on the current knowns, a buyer might want to look at fixing a price on just 40 percent of this winter’s expected sales volume. The amount will vary by each retailer’s specific situation. The price protection would be a combination of non-ratable prebuys, swaps and filling storage if available. That would leave about 60 percent of the winter supply to be bought at spot or market prices, which seems prudent based on the price forecast for crude and the fundamental conditions for propane.

Should propane inventory builds fall off their current pace, the percentage could increase. If macroeconomic or geopolitical conditions become more supportive of crude, the percentage could increase. Should OPEC+ reverse its current trend of increasing production, thereby providing price support for crude’s price, the percentage could increase. Should peace talks fail between Russia and Ukraine, and U.S. tactics for limiting Russian crude supplies from making it to market prove successful, the percentage could increase, as this would tighten global supply and reduce or eliminate the expected surplus.

On the other hand, if a retailer takes a 40 percent “hedged” position, the percentage could be lowered. This is one of the great advantages of using propane swaps as part of the supply cost management portfolio. If a retailer buys a swap position for a certain month and volume, they can easily shut that hedge down by selling a swap position for the same time and volume. This can be done to both capture gains if prices go up after a swap position is bought, or to minimize losses should prices go down or look like they could go down after a swap position is bought. Not all the positions have to be shut down.

For example, let’s say a retailer is currently 40 percent hedged (price protected) for sales expected from October 2025 through March 2026. The retailer then learns that there will be peace in Ukraine, so Russian crude will flow freely to the market. It also appears that OPEC+ is not going to cut back on production. This scenario would make the low-priced crude prediction by Goldman Sachs more likely. The retailer also sees propane inventories continuing to build, matching last year’s record pace. He therefore concludes that the need for propane price protection will be even less. Let’s say he is holding six propane swaps, one for each month of winter, with a volume of 100,000 gallons each. In response to the new information, he has decided to sell 10,000 gallons of swaps in each of the months.

So, he sells six swaps, from October through March, of 10,000 gallons. The gain or loss on those 10,000 gallons is now locked in. The 100,000 gallons of swaps bought remain, but the price movement on 10,000 gallons of it will now be offset by the swap sold. Therefore, those 10,000 gallons are essentially shut down by the offsetting positions. That leaves 90,000 gallons per month of price protection in play. Therefore, the retailer has lowered their overall price protection position in response to new market conditions.

No one can know the future. However, buyers can use what is currently known to establish an initial supply price management position that has the best chance of being balanced in a way that protects customers from higher prices and does not cause the retailer undue risk by fixing the price on too much of their supply. Additionally, if they use the right mix of tools in their supply cost management portfolio, adjustments can be made to the position that further reduces risks as current unknowns are revealed in the future.

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.