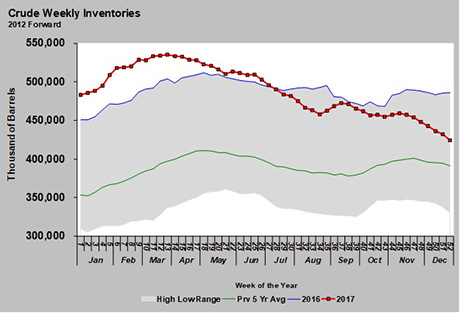

Why are US crude inventories falling when they are normally building?

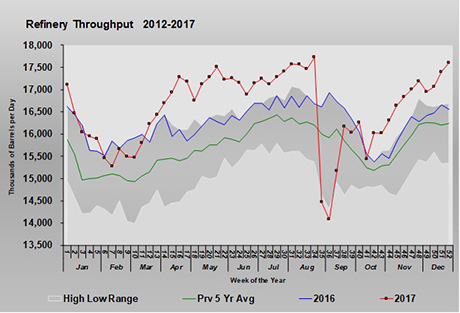

With the recent extreme cold, the warmth of summer seems a long way off. Summer warmth and school holidays result in vacations and more travel. Otherwise known as the summer driving season, this time period results in high refinery throughput to keep up with gasoline demand.

At this time of year, we expect refinery throughput to be lower, resulting in crude inventory building in preparation for high summer demand.

However, as the chart above shows, inventory has continued to fall this winter at a sharp pace. That put U.S. crude inventory to end 2017 at 61.6 million barrels below the same point last year. This is surprising to a lot of folks, given the talk about record U.S. crude production in 2017, which averaged 559,000 barrels per day (bpd) more than in 2016.

Perhaps with all of the new U.S. production, there wasn’t as much need for U.S. crude imports. Surprisingly, however, U.S. crude imports were up 9,330 bpd in 2017.

One of two reasons for the lower crude inventory is that refinery throughput ran higher in 2017 than it did in 2016.

Hurricane Harvey disrupted refinery throughput in late summer, which helped crude inventory briefly. For the most part, though, throughput was up in 2017, and the fourth quarter saw significantly higher throughput than last year. Throughput in 2017 averaged 329,000 bpd more than in 2016.

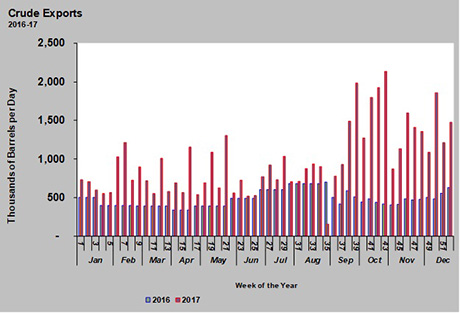

But the primary culprit of the counter seasonal draws on U.S. crude inventory has been the increase in U.S. crude exports, especially in the winter months.

The United States changed its laws concerning crude exports in the last couple of years, and that has increased U.S. crude export volumes. For example, in 2013, U.S. crude exports averaged just 50,000 bpd. By 2016, they had jumped to an average of 481,000 bpd.

Exports doubled in 2017 from 2016 levels. The average for 2017 was 978,000 bpd. More importantly, for the counter-seasonal draw in crude inventory, was an export rate of 1.470 million bpd in the fourth quarter.

It looks like traders are intent on bringing U.S. crude inventories down to their five-year average. Certainly, the Organization of the Petroleum Exporting Countries’ (OPEC) objective has been to see crude inventory of industrialized nations return to its five-year average after being well above that level for years. This study suggests they’re closer to reaching this goal, which is a key reason crude prices are outperforming what was projected.

Of course, higher crude prices support higher propane prices, which in turn encourages more drilling for natural gas to increase propane production. Free markets are dynamic and elastic and will always work toward balancing supply and demand. It is difficult for commodities to remain overvalued or undervalued for too long. We saw a few years of propane being undervalued, which felt like an eternity. The market has been busy making corrections to resolve those imbalances and we have seen the result in price over the last couple of years. The same type of action is currently occurring with crude to remove the oversupply.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.