Why propane prices are lower this year

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains how the recent meeting between the United States and Russia could impact propane prices.

Catch up on last week’s Trader’s Corner here: Declining crude oil supply supports higher propane prices

Last week’s Trader’s Corner focused on the negative trend in U.S. crude drilling and production for propane buyers. Less drilling and thus lower crude production could negatively impact propane supply, since a lot of propane supply is associated with production that comes from crude wells. Propane production is still good for now, so that potential problem is more long term in nature.

But this week, we are going to focus on a threat to propane buyers that is likely to be almost immediate. In fact, as you read, events may have already unfolded that have answered some of the questions we will raise below.

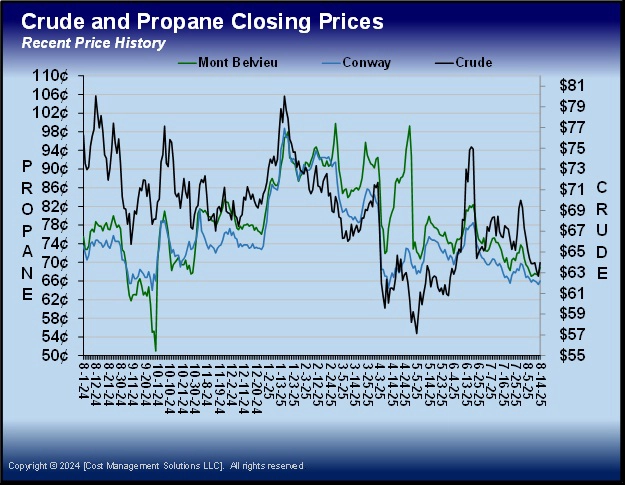

There is a significant difference in propane pricing at this point in the year compared to last year. If we take ourselves back to mid-August 2024, we find that the upcoming winter price average (October 2024-March 2025) at Mont Belvieu ETR was 80 cents. Currently, October 2025-March 2026 propane has an average value of 72 cents. At this time last year, the upcoming winter price at Conway was averaging 79 cents. This coming winter is averaging 73 cents.

The difference in the pricing environment has little to do with propane fundamentals.

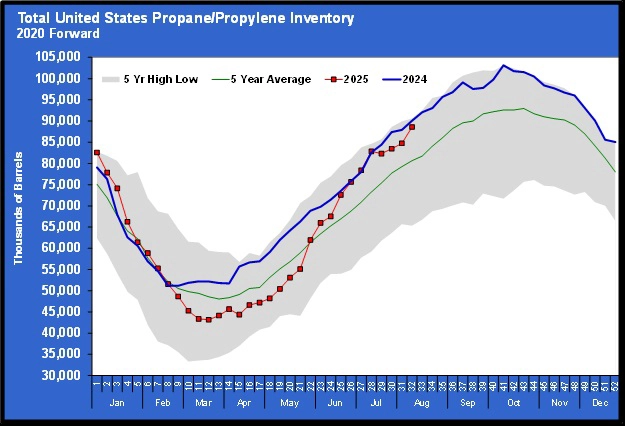

With a great propane inventory build for the week ending Aug. 8, total U.S. inventory is just under last year’s record pace. If propane fundamentals are the only factor impacting prices, the price this year should be higher than last year. August propane was valued at 68.875 cents MB and 66 cents Conway at the day’s close on Aug. 14. Last year on the same date, MB August propane was at 77.75 cents and Conway 74.25 cents.

The year-over-year difference in current propane prices for the winter is based on the difference in crude prices. On Aug. 14, 2024, WTI crude closed at $76.98. Yesterday, it closed at $63.96.

That is $13.02 per barrel, a 17 percent difference in crude pricing. The weight of falling crude has pulled propane prices down 11 percent year over year.

On the day we are writing this article, Aug. 15, there is a meeting that will take place in Alaska that is extremely important in many respects. The potential implications of the meeting between U.S. President Donald Trump and Russian President Vladimir Putin can’t be overstated. The two men will discuss what would be necessary to bring the war in Ukraine to an end, as well as trade opportunities between the two countries. If the meeting succeeds in beginning a peace process in the war between Ukraine and Russia, it is likely to have a downward impact on crude prices, which will be good for propane pricing. If the meeting fails, the United States will likely implement a plan to pressure other countries not to buy Russian crude. That could lift crude’s price and be negative for propane buyers.

Furthermore, the outcome of the meeting could have far-reaching implications for the global trade of all goods. If the United States sanctions countries for buying Russian crude and imposes high tariffs on their goods coming to the United States, it will have a huge impact on trade among all nations. For example, India and China have already set aside some of their differences and are discussing trade in response to possible U.S. tariffs imposed on their goods going to the United States. They will need each other if their exporting to the U.S. dries up. The cascading effect on relationships among nations could have far-reaching implications for a long time.

The best outcome for the United States would be for this meeting to succeed. Unfortunately, we think Russia understands the United States has more riding on the meeting than perhaps any country, and that lowers our hope that the meeting will be successful.

Conditions have been favorable for propane buyers because of high propane inventories and low crude prices. One-half of that equation is at risk. We find ourselves quite tense this morning, hoping upon hope that a legitimate path to peace can be forged, not only because of the implications for the energy markets in the short term but also for the people on both sides who are suffering in the war and the other potential negative consequences of failure.

Pricing for this coming winter and the next two remains favorable to buyers today. But buyers need to be aware that these favorable conditions could end quite quickly if the summit in Alaska is not successful. Given that crude prices could go lower if the meeting is successful, waiting for the outcome might be prudent.

However, as you read this on Aug. 18, the outcome of the meeting should be known. If it was unsuccessful, the opportunity for buyers of winter propane may already be gone. If the market has not reacted as strongly to failure as we think it will, then time will be of the essence for propane buyers. Crude is almost certainly going to be trending higher if no path for peace could be found. That means if propane prices are still favorable to buyers today, it may not last long.

We define favorable as the opportunity to buy winter price protection under the 10-year winter price average. No one knows what the value of propane will be in the future, but buying under the price it has averaged during the winter over the last 10 years lowers the risk to buyers. As we write, winter prices are just a few cents under that 73.5-cent mark. It won’t take much upward movement in crude to pull propane prices above that benchmark.

Charts and table courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.