US refinery utilization, throughput kick into high gear

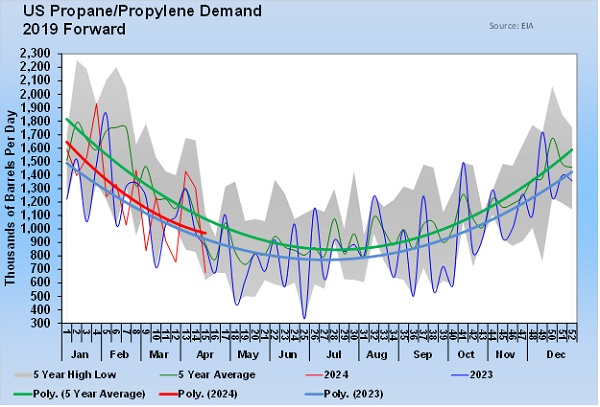

Last year, only slightly more than 20 percent of U.S. propane came from the refining of crude oil. In a recent presentation, we projected a 5,000-barrel-per-day-(bpd) increase in fuel-use propane from refineries this year, as we expected higher capacity utilization as the economy improved.

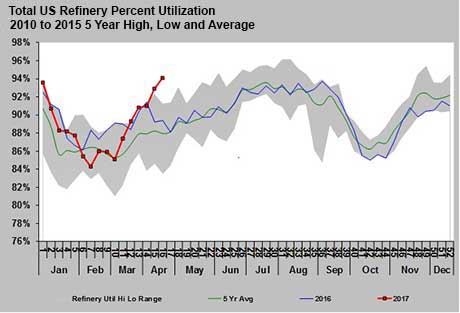

At this point, refinery throughput and utilization are cooperating with that forecast.

U.S. refining capacity is at 18.618 million bpd. That is up from 18.315 million bpd at the end of April 2016. Last week, refiners were operating at 94.1 percent capacity, a five-year high for this time of year. Refineries cranked up early this year, and they are already near the highest utilization rates we have seen historically.

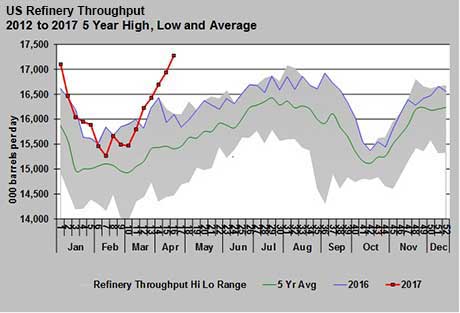

With utilization rates up, refinery throughput is going to be on the rise, as well.

Refinery throughput has been surging over the past six weeks. For five weeks, new five-year highs on throughput for the respective weeks have been established.

West Texas Intermediate (WTI) crude prices are having a hard time finding a price floor given the weak macro picture for crude fundamentals. Crude supplies in industrialized nations are about 10 percent above their five-year averages. The Organization of the Petroleum Exporting Countries and other producers have been trying to get those inventories down, but so far their efforts have come up short. In fact, inventory in the industrialized countries is now higher than it was when producers began their production cuts four months ago.

In other bearish news for global crude supplies, there were reports last week that more than 50 million bpd of crude was shipped during April. That easily broke the old record of just over 46 million bpd. With that much crude moving between sellers and buyers, it is hard to see where a shortage is developing that would support prices.

However, early-season indications show U.S. refiners are going to be doing their part to consume a lot of crude. That could certainly help bring down excess crude supplies in the U.S. and support WTI crude prices. WTI crude is struggling to stay above its 200-day moving price average, a key technical point that can often define whether crude is in shorter-term correction or a longer-term downtrend.

Last week, analysts were expecting a 1.7-million-barrel draw in U.S. crude inventory, but it declined 3.6 million barrels instead. More importantly, Cushing, Oklahoma, crude inventory declined 1.2 million barrels. Cushing is important because it is the settlement location for crude’s futures contracts. Changes in inventory levels there tend to have a disproportionate impact on prices.

If the increased utilization and throughput at U.S. refiners continue to take down U.S. crude inventory at an above-average pace, it could lead to a rebound in crude prices. That rebound would very likely be a catalyst for changing the direction of propane prices. Propane prices have been moving with crude in its recent downtrend. If anything, propane prices should have lagged the recent fall in crude prices because of tighter propane fundamentals, but they outpaced instead. Therefore, we see no reason that propane prices would be quick to recover with crude prices.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.