Expectations versus reality: How low propane prices dropped

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates how propane prices went lower and the size of the price drop.

Catch up on last week’s Trader’s Corner here: Propane price drop contributes to rejection conditions

In this Trader’s Corner, we are going to revisit our Trader’s Corner from April 11. For reference, on the day we wrote that article, Mont Belvieu ETR propane was valued at 129 cents per gallon, Conway at 128 cents per gallon, WTI crude at $98.26 per barrel and natural gas at $6.292 per MMBtu. The Russia/Ukraine war had been going on for about six weeks. U.S. propane inventory was under 44 million barrels and not far off a five-year low. It was a very bullish and uncertain environment. We presented the possibility of propane prices going lower even in that bullish environment. We began with these lists:

There are four potential scenarios that might drive propane prices lower:

- Crude prices fall.

- Propane demand decreases.

- Propane supply increases faster than domestic and export demand.

- Some combination of two or three of the above.

What could drive crude prices lower?

- The end of the Ukraine war and Europe continues buying Russian energy.

- The market becomes convinced the West will never effectively embargo Russian energy.

- The West stops taking Russian energy, but it still moves to China and India, thus not really limiting global supply.

- The U.S. and Iran finally revive the 2015 nuclear deal, allowing more Iranian crude onto the market.

- The Middle East becomes less interested in appeasing Russia and China and more interested in taking care of consumers in the West.

- Western nations become very aggressive in producing more hydrocarbons.

- A global recession.

What could cause propane demand to decrease other than high prices?

- A global recession.

One, two and three of the first list occurred. In the second list, No. 1 is partially true. The war did not end, but Europe continued to buy Russian crude. It threatened a total embargo that would take effect on Dec. 5 but settled on a price cap instead, trying to keep Russian crude flowing while at least looking like it was attempting to punish Russia. Even with that, Europe put in an exemption to allow deliveries of crude via pipeline to continue to flow. We wrote a series of articles right after the war started. We stated in those that Russia had won the energy war before invading Ukraine. We stand by that assessment. Europe had become highly dependent on Russian energy and that really hasn’t changed.

No. 2 in the second list is largely true, and China and India substantially increased purchases of Russian crude, making No. 3 mostly true as well. Nos. 4, 5 and 6 didn’t happen, but we still believe a lot more of Iran’s crude is being allowed to “leak” into the market than before.

We are not sure we can say that No. 7 is true, though many argue that it is. Even if not, the tightening of monetary policy by central banks to combat inflation is dramatically slowing economic activity.

In the April article, we focused on No. 3 in the first list, but we must add No. 2 for this discussion. U.S. crude production didn’t increase very much. It is only up 300,000 barrels per day (bpd) from when we wrote that article. That is really a shock given how much our allies in Europe need crude, which brings us to a point we didn’t have on the list: the massive releases from strategic petroleum reserves by the U.S. and our allies. That was one way to lower crude’s price, but we fear we will still have to pay the piper on that decision. Releasing the reserves, along with the government becoming adversarial with the U.S. energy industry, has discouraged what really needed to happen – increasing production.

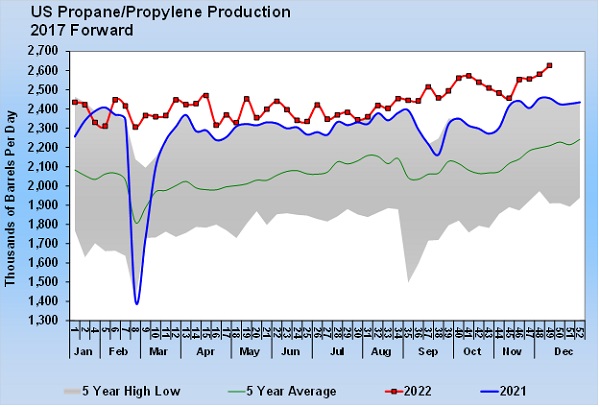

So, there has not been nearly the increased natural gas production associated with crude production that we expected. However, natural gas has still risen to record highs, with more drilling of pure natural gas wells helping, and refinery throughput has also increased. That has raised propane production to record highs.

In the latest Weekly Petroleum Status Report from the Energy Information Administration (EIA), U.S. propane/propylene production increased 45,000 bpd to a record 2.626 million bpd. That is 201,000 bpd higher than the same week last year. So far this year, propane/propylene production is 136,000 bpd higher than last year.

But that number can be misleading. It is widely used because it is available every week. To understand how propane inventory has increased so much, we must take out the propylene and just look at the amount of fuel-use propane. Unfortunately, that official fuel-use propane production from gas plants and refineries comes out in arrears. The latest data is for September. Through September, fuel-use propane is up 157,000 bpd more than through September of last year.

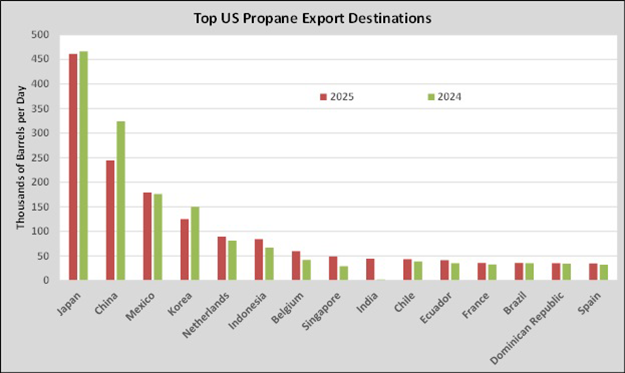

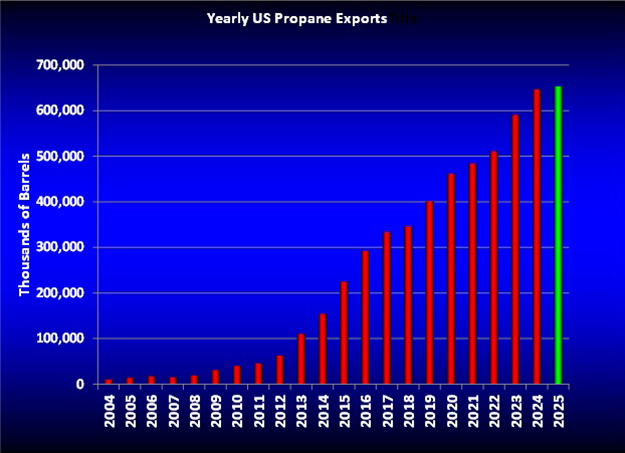

What you notice when you look deeper into the fuel-use numbers is that refineries have significantly cut back on propylene production and increased fuel-use propane production. In September, refineries yielded 27,000 bpd less propylene than the same month last year, and 23,000 bpd more fuel-use propane. For the year through September, there has been about 15,000 bpd less propylene production and 9,000 bpd more fuel-use production. More fuel-use production from natural gas processing and refineries has outpaced strong propane exports, lower domestic propane demand and fewer propane imports, allowing the big flip in propane inventory that has driven propane prices lower.

Propane inventory is at 16.543 million barrels, 23.3 percent higher than last year. The fact that refineries are focusing less on propylene production could be telling us that indeed the economy is impacting propane fundamentals. Frankly, when we considered a weaker economy, we were thinking more a reduction in propane demand and not so much the improvement on the supply side from refineries. Yes, we expected more refinery throughput but not so much the change in the yields of propane versus propylene.

The lack of domestic propane demand, down 122,000 bpd from last year, has certainly played its part, though. We struggled understanding that level of demand drop given that heating degree-days are up over last year and that propane prices are lower. So, propane prices themselves should not be leading to demand destruction. From the consumer perspective, the demand destruction may simply be from the overall effect of inflation on consumer spending habits. The refinery changes could also tell us demand from the commercial and industrial side is getting hurt more than we perceived.

We will readily admit when we discussed in April the potential for propane fundamentals to improve and crude’s price to become less bullish, we envisioned perhaps a 30-cent drop in propane to around a dollar if some of what was on our list occurred. When propane began approaching that price level, we still believed propane bought at a dollar would be a good value. A lot of the things on the list came to fruition, causing the drop in propane to far exceed our expectation.

There is a current song out by country artist Jelly Roll called “Son of a Sinner.” A lyric of that song is “Yeah, I’m somewhere in the middle, I guess I’m just a little right and wrong.” When we look back at that April article, we realize that we were a little right and wrong. We saw the potential for lower prices, but we significantly underestimated the potential size of the drop.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.