New propane export capacity coming online amid tariff policy swings

Import and export markets have been a key topic of discussion so far this year amid the Trump administration’s wide-ranging tariff policies.

While much of the focus has been on tariffs levied on U.S. imports, some countries have fought back with their own tariffs on U.S. goods.

At one point, a U.S.-China trade duel had the countries imposing 145 percent and 125 percent tariffs, respectively, on the other before they struck a deal in mid-May that reduced tariffs and eliminated retaliation – at least for now. Consistent with the constantly changing tariff situation, just last week, a U.S. trade court blocked the Trump administration from imposing the tariffs; then, just one day later, a federal appeals court temporarily reinstated them.

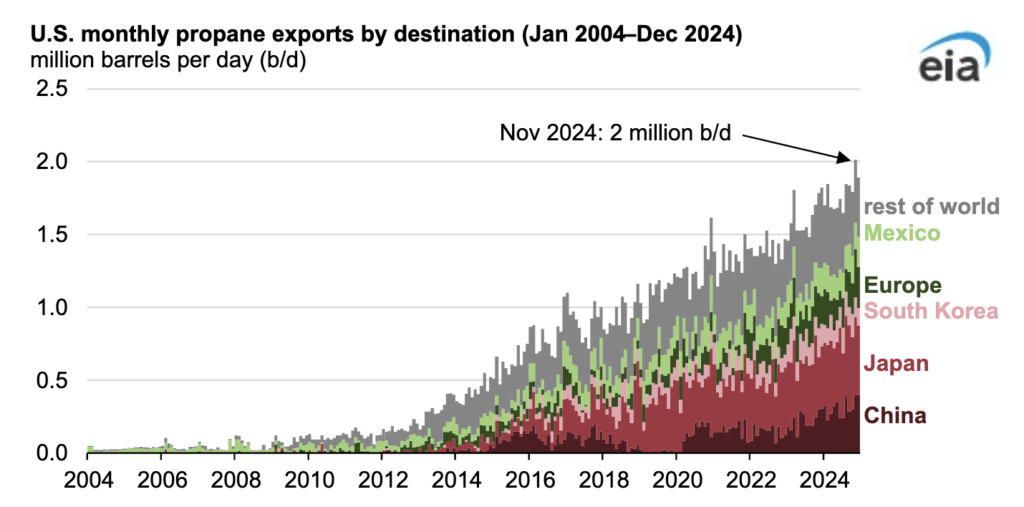

Analysts have wondered to what extent the escalation with China would impact U.S. propane export volumes to that country, a major buyer of U.S. propane, as well as the potential for volumes to build up back home at U.S. terminals. In 2018, China imposed retaliatory tariffs on U.S. propane, and China’s propane imports from Iran, Qatar and the United Arab Emirates (UAE) increased, displacing imports from the United States, according to the U.S. Energy Information Administration (EIA).

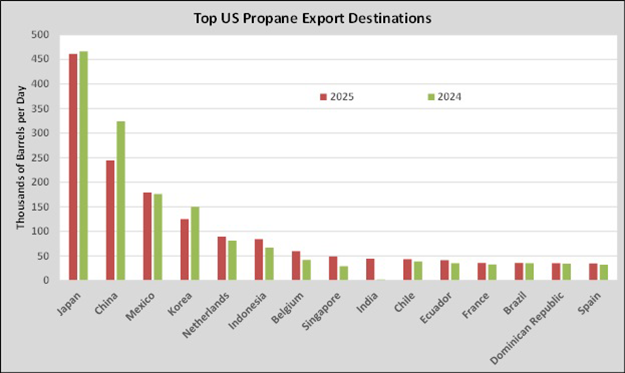

China has become one of the top destinations for U.S. propane, which is used in propane dehydrogenation facilities for plastics production. In fact, in 2024, most of the propane imports into China originated from the United States (32 percent), followed by Iran (17 percent), Qatar (7 percent) and the UAE (3 percent), the EIA reports. With the United States and China strongly linked through their propane deals, this will be a trade partnership worth watching under the Trump administration.

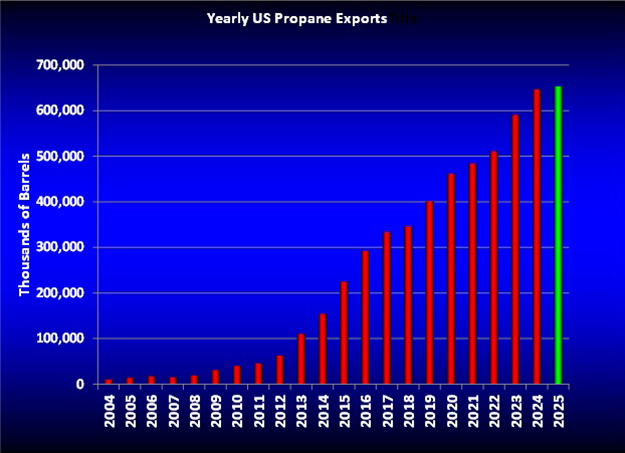

No matter what the future holds, the topic has underscored how important U.S. propane exports are to the global markets. As we reported in our 2024 State of the Industry report, advancements in hydraulic fracturing techniques around 2007 helped unlock vast natural gas liquids (NGL) reserves in the nation’s shale plays.

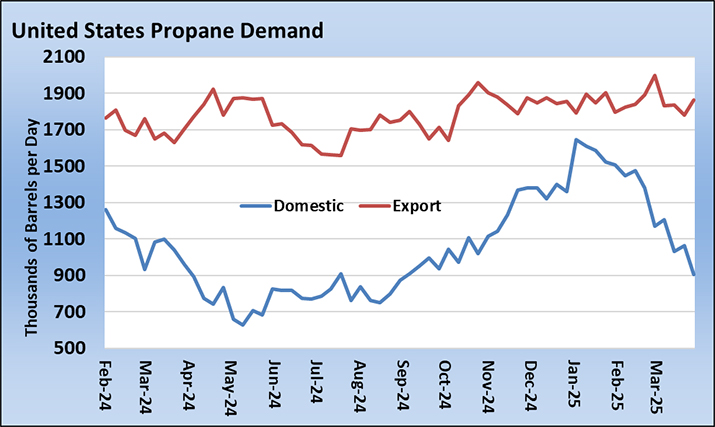

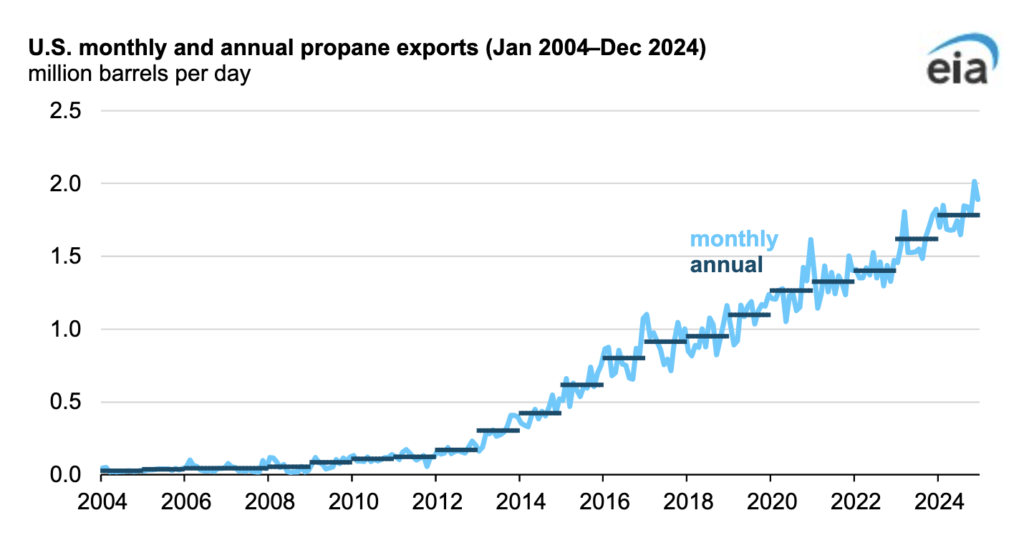

U.S. propane exports have increased every year since 2007, the EIA notes, and have transformed the United States from a net importer of propane into the world’s largest producer and a net global exporter. U.S. propane exports averaged a record 1.8 million barrels per day (bpd) in 2024.

Also adding to the interest factor is how the new export capacity coming online is expected to take the United States from 1.8 million bpd of capacity to 2.4 million bpd, according to Mark Rachal of Cost Management Solutions. It makes one wonder how the tariff policies will impact these companies’ long-running plans from an infrastructure investment standpoint.

Among the expansion projects in the works:

- Energy Transfer is close to completing its Nederland Terminal expansion, which will add 250,000 bpd of NGL export capacity in Texas this year.

- Enterprise Products Partners is planning a key expansion project along the Houston Ship Channel. At the Enterprise Hydrocarbons Terminal, the company is adding refrigeration capacity that will increase propane and butane export capabilities by about 300,000 bpd. The expanded service is expected to begin by the end of 2026. The company is also building out flexible product capacity at its Neches River Terminal in Orange County, Texas. Phase 2 of this project, expected to begin service in the first half of 2026, will allow Enterprise to load up to 180,000 bpd of ethane, 360,000 bpd of propane or a combination of the two.

- Range Resources has secured 20,000 bpd of new NGL takeaway and export capacity utilizing a new East Coast terminal, expected to start in 2026.

- Targa Resources is expanding LPG export capabilities at its Galena Park Marine Terminal, near Houston, which will increase its export capacity to 19 million barrels per month in the third quarter of 2027.

- ONEOK Inc. and MPLX LP agreed to form joint ventures to construct a 400,000-bpd LP gas export terminal in Texas City, Texas, and a 24-in. pipeline from ONEOK’s Mont Belvieu, Texas, storage facility to the new terminal. It’s expected to be completed in early 2028.

We can’t imagine these companies anticipated the highly volatile nature of U.S. tariff policy when they drew up these expansion plans.

It’s unlikely we’ve seen the last of these trade policy swings, but it’s also hard to imagine anything truly stopping U.S. propane exports.

To subscribe to LP Gas’ weekly Trader’s Corner eNewsletter, click here.

Read more Trader’s Corner: