2024 State of the Industry: Inflection point

The forward-looking statement about propane’s growth trajectory is heard occasionally around the industry: “We’ll be at 15 billion gallons before we go back to 8 billion.”

Tucker Perkins, president and CEO of the Propane Education & Research Council (PERC), continues to stand behind his public comment about the direction of U.S. retail gallon sales, which he also says is a relevant metric of the industry’s size.

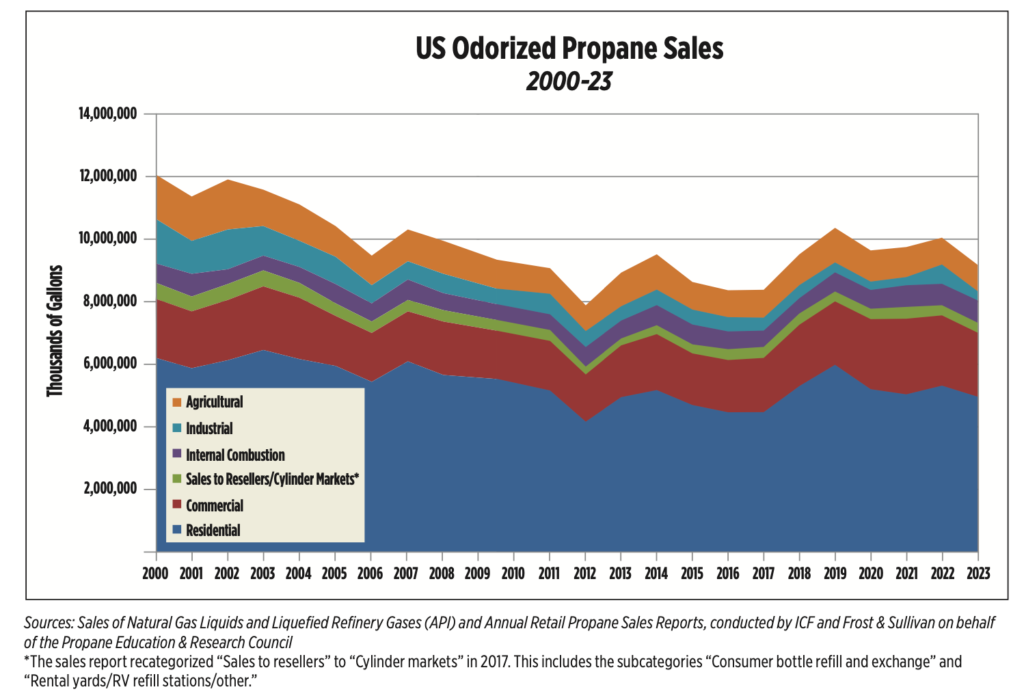

At the onset of the new millennium, in 2000, the industry appeared to be headed in that upward direction, having reached 12 billion gallons in retail sales. But over the next decade, the gallons fell significantly. Volatile energy prices, evolving environmental and energy policies, competitive technologies, customer conservation and improvements in energy efficiency all contributed to a loss of nearly 3 billion gallons by 2010, to 9.2 billion, despite the industry investing about $300 million to fuel growth.

This alarming trend was the focus of an LP Gas propane sales analysis in 2011, with the first article in a three-part series titled “Where have all the gallons gone?”

“The evolution of efficient appliances and building codes is largely what drove much of the reduction in volume from 2000 to 2009,” says Jeff Stewart, president of California-based Blue Star Gas and past chairman of the National Propane Gas Association (NPGA).

The propane industry has continued to undergo dramatic changes as it approaches the 25-year mark of the millennium. Industry leaders use terms like “inflection point” to describe propane’s current position after it’s faced both recurring and new developments over the past 15 years. A look at propane’s recent past and what lies ahead is the focus of this year’s LP Gas State of the Industry report.

Gallon trends

Propane gallon sales continued to fall after the first decade of the millennium – from the 9.2 billion in 2010 to 7.7 billion in 2012.

While industry analysts cite mild temperatures as the primary reason for the 2012 gallon total, it’s hard to ignore the industry’s 4.4-billion-gallon decline in retail sales from 2000-12.

The next couple of years saw gallon sales gains and brief up-and-down swings before gallons eclipsed 10 billion in 2019 – the first time in over a decade that sales had reached such a high. That year, most of the gains took place in the residential market, as more propane-heated households and colder weather fueled the increase.

Gallon sales remained above 9 billion from 2018 to 2022, averaging 9.6 billion during that stretch. A recently released report, for the 2023 calendar year, shows an 8.6 percent drop in sales from 2022 – to just under 9 billion.

“We’re flat,” says Blossman Gas President and CEO Stuart Weidie, of the gallon totals in recent years.

Weidie, a former chairman of PERC and NPGA, outlines three trends that he believes have impacted the industry’s gallon sales over the last 25 to 30 years:

- Tankless water heater usage. “Our industry has done extraordinarily well getting water heater market penetration, primarily through tankless water heaters,” he says. “A tankless water heater is going to use about a fourth of what a tanked water heater would use. That’s great for the consumer; it’s still good for our industry to have a product in there that’s using gas on a year-round basis.”

- Home construction. “Houses have gotten tighter, more properly insulated,” he says. “That’s had a tremendous effect, a positive effect for the consumer. It’s not doing much for the gallons.”

- Appliance and heating product efficiency gains. “A high-efficiency furnace is going to be 92 to 96 percent efficient versus 75 percent efficient,” he says.

“If you took the number of customers we have in the industry, it’s vastly more than 25 years ago,” Weidie adds, “but the products have a much higher efficiency and the houses are constructed at a much higher quality.”

American Community Survey data shows the number of propane-heated households increasing from about 5.8 million in 2010 to 6.1 million in 2022.

“There have been declines in some segments within the propane industry, due in part to external factors such as weather, regulatory actions and homebuilding trends,” says Ferrellgas President and CEO Tamria Zertuche. “However, we have the ability to grow the residential customer base, while increasing the gallons they use, by making it easy and affordable for them to include propane appliances in their decision-making.”

PERC’s role

PERC generates the collection of propane gallon sales figures to fulfill requirements of the 1996 Propane Education and Research Act. The council is mandated to allocate 20 percent of assessments collected from the industry back to the states, and its annual sales report helps to determine those allocations.

Since 2017, PERC has funded its budget with an assessment rate at the maximum five-tenths of a cent per gallon of odorized propane. The council estimates that it will receive $46 million in assessment revenue from the industry in 2025. From 2010-23, PERC’s net assessment revenue, after allocating 20 percent of the funds to the states, has averaged about $32 million a year. PERC uses this amount to fund programs and initiatives on behalf of the industry and to help carry out its strategic plan, which from 2023-25 has focused on increasing propane’s voice in the national energy conversation and educating consumers about propane’s environmental benefits, building counter-seasonal demand for propane, developing employees through safety training and education, and growing the autogas market.

LP Gas’ propane sales analysis in 2011 brought attention to the level of investment by the industry through PERC. Industry leaders such as Randy Doyle, a former PERC councilor, believe it’s important that councilors, staff and industry members review the numbers closely, and challenge the spending practices and overall strategies to achieve results.

Doyle has often cited the lack of growth in the autogas market, wondered why rental equipment companies still offer mainly diesel units and questioned the overall impacts of PERC’s environmental messaging campaigns.

Perkins says PERC examines the numbers monthly, correlating gallon sales to factors such as degree-days (for heating demand) and agriculture production (for crop drying demand), and working within each market segment. The council sets its annual budget based on estimated assessments through gallon sales.

“We continue to be diligent about monitoring our assessment collections,” PERC says in its proposed budget for 2025.

Whether PERC’s investments in projects and programs on behalf of the industry are netting the desired results for propane marketers is a topic worth delving deeper. Propane sales still decreased about 196 million gallons from 2010-23 despite the industry investing more than $400 million in programs.

“PERC has done an excellent job in supporting, through incentives, new markets, new technologies,” Stewart of Blue Star Gas says. “My company certainly has benefited from them. I am very satisfied as an industry member about the stewardship of the funds that are being spent today compared to 10 years ago.”

The industry netting flat gallon sales after investing hundreds of millions of dollars doesn’t look good, Weidie admits, “but we also have to acknowledge the good work PERC has done.”

He cites the council’s efforts with safety and education programs – though important are not designed to grow gallons – and advancing the new homebuilding market.

“PERC doesn’t sell anything, but it can create awareness,” he says. “There’s a responsibility of the propane marketers out there to grow their businesses, and PERC is an enabler of that through their marketing and awareness programs.”

Leslie Woodward, president and CEO of Fairview Ltd. and a PERC councilor, even wonders whether the industry should judge its success based on another metric besides gallon sales.

“You can be more efficient, you can make more money in your business by using all the technology and systems that we now have, that we wouldn’t have had 25 years ago,” she says. “People sometimes don’t talk about that; they just talk about gallons. If I sold the same [number] of gallons now that I did in 2000, maybe I’m making more money.”

Supply boom

As gallon sales were headed downward in the first decade of this millennium, another trend was taking shape in the United States – a surge in domestic propane supplies from the shale oil and gas production boom.

Advancements in hydraulic fracturing techniques around 2007 helped unlock vast natural gas liquids reserves in the nation’s shale plays. They helped transform the U.S. propane industry from a net importer of propane into the world’s largest producer and a net global exporter, beginning in 2011. Now, two-thirds of U.S. propane production is exported overseas.

Pat Hyland, the former editor of LP Gas who spent 12 years with PERC, calls the U.S. shale oil and gas boom, and the accompanying growth in propane supply, one of the most dramatic changes ever for the industry.

“Gone is the desperate reliance on imports and slow summer stock builds ahead of peak season demand,” Hyland says. “The simple flip of the switch in terms of supply has mitigated all of that.”

In the process, the change in market dynamics has stabilized the propane pricing environment and moved the industry away from the fluctuations it used to experience.

“That means there’s plenty of supply for any additional growth and consumption that we can generate here in the United States,” Hyland explains. “That’s pretty important.”

Market opportunities

U.S. propane production, which has been setting five-year highs and measured more than 2.7 million barrels per day in November, is providing the industry with opportunities to grow markets.

Weidie sees a slowdown in subsidized natural gas expansion in the Southeast and mid-Atlantic and “a lot of growth in rural areas beyond the natural gas lines. We have more customers using less gas.”

Beyond those natural gas lines, Weidie adds, the industry is doing better with new construction accounts.

“Forty years ago, almost two-thirds of our residential volume was going into manufactured homes,” he says. “Now it’s going into regular dwellings, 90 percent, and 60 percent of the tanks we set are underground tanks to nice, newly constructed homes. That’s a big trend change.”

In addition to homeowners and builders having a positive perception of propane beyond the mains, Perkins says, opportunities exist for propane to replace diesel fuel for on- and off-road engine applications, home heating oil in the residential and commercial spaces, and across the power generation market.

The diesel fuel market for on- and off-road applications in the United States totals 80 billion gallons a year, Perkins says.

“I’m quite convinced that our market trends are going to go significantly upward when propane marketers take advantage of the opportunity in power generation and diesel displacement,” he says.

Stewart says the opportunities available to the industry today are unlike any it’s seen in the last 60 years. Even amid the electrification-of-everything movement and threats from regulators who seek to eliminate gas, the rising cost of electricity – and the realization of electricity’s constraints – could position propane as a saving energy source for homes and businesses.

“We must as an industry continue to maintain our core market, understand that volumes are not going to be what they used to be, and we must diversify,” says Stewart, citing resiliency in power generation as one of the keys to future success.

Doyle sees reason for gallon sales to tick upward in the coming years in saying, “Our industry’s gallon-growth opportunity for the next decade is the best in 25 years.”

He cites diesel’s emissions challenges in applications such as power generation and school buses, as well as grid resilience concerns and rising electricity costs, as opportunities for propane.

“The question is: Can the propane industry seize this gallon-growth opportunity?” he adds.

Whether the propane industry is on track toward 15 billion gallons instead of reverting back to 8 is open for debate.

For that type of aggressive growth to happen, Weidie points to one of two needed developments: a resurgence in the autogas market, which he says the industry has not exploited, or more product development in power generation – for homes, small businesses and rental yards.

Perkins says the industry may need five to 10 years to achieve those results, but he remains optimistic.

“Take the blinders off,” Stewart advises the industry. “The industry needs to think differently. The future growth of our industry will not look like it has for the last 10 or even 25 years.”

State of the Industry report brought to you by: Matrix Capital Markets Group

Related Articles

2023 State of the Industry: Moving molecules

2022 State of the Industry: Propane retailers face raging forces