Crude inventory doing surprisingly well

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, shifts focus to the somewhat surprising growth in U.S. crude inventory.

Catch up on last week’s Trader’s Corner here: Part IV: Could the inventory trend change in 2023?

In the last four Trader’s Corners, we looked at how propane inventory flipped from a setting a five-year low to a five-year high in a matter of a few months. We explored changes that could cause inventory to come down this year.

On the supply side, we mentioned that refineries could gravitate back to producing more propylene as they had been doing. We just read the transcript of an earnings call by a major propane processor that had completed a new propane dehydrogenation plant. That plant will take refinery grade propylene and turn it into polypropylene. The company says its expectation of refinery grade propylene output will be good.

We noted that drilling activity has plateaued recently, and that could lead to less growth in propane supply than we had last year. That means if demand increases, there may be less growth in supply to offset. That could lead to more calls on inventory in high-demand periods. We spent a lot of time on domestic propane demand. After four weeks of this year, it is still running 665,000 barrels per day (bpd) less than the same four weeks last year. That has kept draws on propane inventory below normal, leaving it near five-year highs and well above last year and the five-year high. If nothing else, it shows there is a lot of potential for demand to improve.

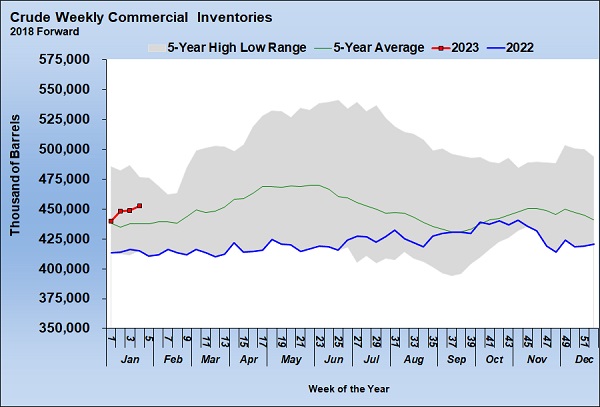

This week, we are going to shift focus to another area that is surprising us some, which is the growth in U.S. crude inventory. We had a lot of concern that when the releases from the Strategic Petroleum Reserve ended that U.S. crude supply would tighten up significantly. We worried because U.S. crude production is stubbornly stuck at 12.2 million bpd, according to weekly estimates by the Energy Information Administration. That is 900,000 bpd less than peak production set before the pandemic began. So far, the lower production has not been an issue.

U.S. crude inventories have been on the rise in 2023 – just the opposite of what we feared. Consequently, crude prices that had rallied during the front half of January have been in a downtrend since. But a look at crude imports and exports suggests change may be in the wind.

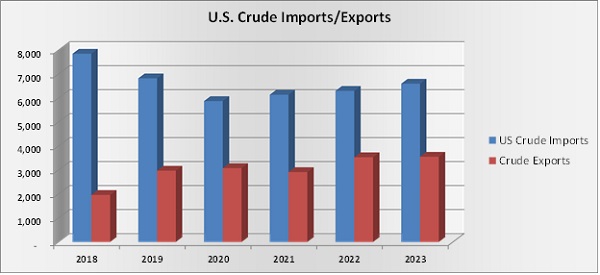

Chart 2 shows U.S. crude imports and exports. Prior to the pandemic, the U.S. was reducing its crude imports with production at 13.1 million bpd at its peak. It had also made a significant increase in exports in 2019. When the pandemic hit in early 2020, things reversed. In 2021, U.S. imports of crude increased after production plummeted. Exports decreased. In 2022, Russia invaded Ukraine. The hope was that the U.S. would import less crude and export more, helping Europe reduce its dependency on Russia. Our imports increased instead. Exports improved, but we believe only because of the release from the Strategic Petroleum Reserve that was more than 180 million barrels.

So far in 2023, our crude exports are running about what they did last year, but our imports are up. To this point, other than releasing crude from reserves, it does not look as if the U.S. is making itself less of a strain on global crude supplies in an effort to help our allies.

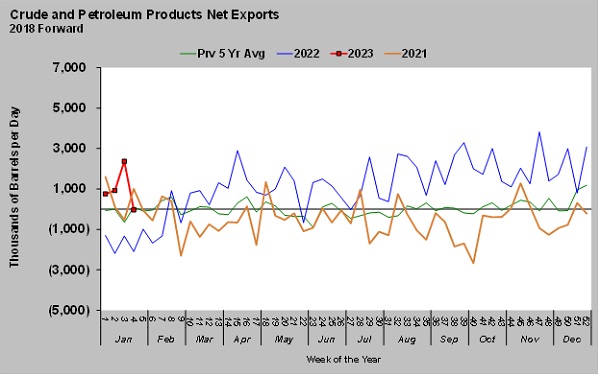

But if we consider refined fuels, we are doing better.

In 2021, the U.S. exported less crude and petroleum products than it imported. In 2022, we become a consistent net exporter of crude and petroleum products. However, the start of 2022 has not been exceptionally strong in that regard.

You have to wonder if the end of the releases from the reserve are just now starting to show up in the data. If you look at how crude is priced, it seems to suggest the market believes things will tighten up soon.

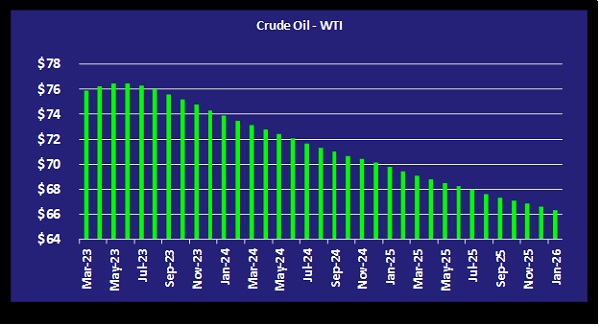

Crude is slightly contangoed in the front of the price curve. April, May and June crude are valued higher than the month in front of them, an indication of an oversupplied market that is keeping the front-month price down relative to the slightly further-out months. After June, the price curve is backwardated, with prices in the further-out months valued less than the month ahead of it. That is an indication of a balanced-to-undersupplied market, so the barrel that is needed promptly or currently is valued more than those further out. The bottom line is crude is priced as if traders believe it will be less oversupplied as the year progresses.

Remember that these price curves are in no way a prediction of where crude will be priced in the future. They are a reflection of where the market has valued crude for the various months over a three-year period. As a month gets closer to the front of the curve, the price of crude in that month will adjust based on market conditions.

Here is what we know about crude to this point. Releases from strategic reserves should be less significant than last year, probably by a large margin. If prices fall into the $65 to $70 range, the U.S. government will likely buy to refill the reserve, so there may not be a lot more downside.

U.S. producers are not aggressively increasing their production; it has been running near where it is now for months. OPEC+ has been very disciplined holding its production down to support the market. Russian crude and refined fuels have continued to move to market rather unabated to this point. However, Europe is just now imposing price caps on its Russian crude and refined fuels. There is the possibility that will tighten supply if Russia decides to cut production rather than sell at the cap, which they have pledged to do. However, there is very little indication that the world really wants to stop Russia’s energy from making it to market.

The change is more likely to be on the demand side. After three years, China has finally started opening its economy, allowing freer mobility in the country and across its borders. Some are estimating this will add 1 million bpd to crude demand. The other factor will be how well the global economy holds up to central bank efforts to slow down inflation.

Overall, it is hard to see a lot of downside for crude, maybe $65 for WTI, and that probably doesn’t last long. The upside is wider open. However, investment fund managers are back to buying crude. It is back in vogue again, and that suggests more are seeing upside potential for crude’s price. We look for the strong start to this year in terms of building crude inventory to be short-lived. The latest jobs report for the U.S. shows unemployment at a 53-year low. The economy added a remarkable 517,000 jobs in January. To this point, people are still working and traveling, so there is a good chance refined fuels demand is going to improve. That means refinery throughput will have to increase and stay at high levels for the foreseeable future. That will keep crude demand high.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.