Part IV: Could the inventory trend change in 2023?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, continues to focus on possible changes in propane demand and how it could impact inventory.

Catch up on last week’s Trader’s Corner here: Part III: Could the inventory trend change in 2023?

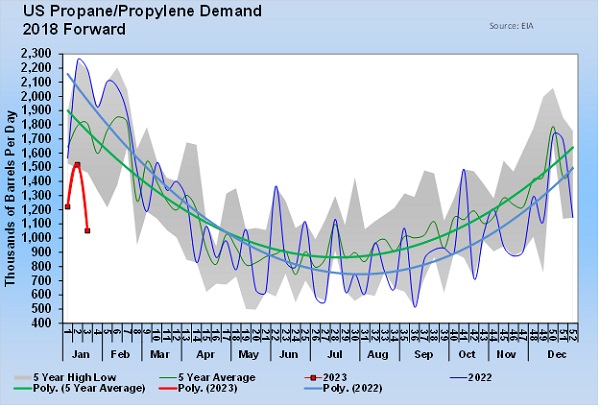

This week, we are going to revisit much of what we discussed last week because the latest data only caused us to shake our heads even more. For the week ending Jan. 20, the Energy Information Administration reported U.S. demand for propane dropped 466,000 barrels per day (bpd) to 1.052 million bpd. That was an astounding 1.138 million bpd less than the same week last year.

During the first 20 days of this year, U.S. propane demand was 1.264 million bpd on average. During the same period last year, it was 2.002 million bpd. That is a 739,000-bpd difference that amounts to 14.780 million barrels less demand during the first 20 days of 2023 than in the same period in 2022.

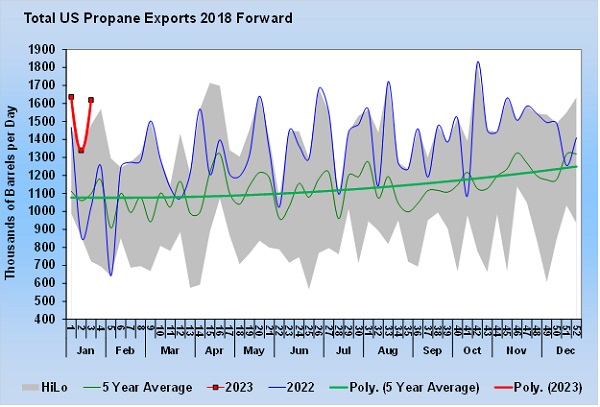

The lack of domestic demand has been largely offset by strong export demand.

Though up by 415,000 bpd over the first 20 days of last year, exports do not offset the drop in domestic demand of 739,000 bpd. Thus, we have seen U.S. propane inventories have much smaller-than-normal draws during the first three weeks of this year, keeping them near five-year highs.

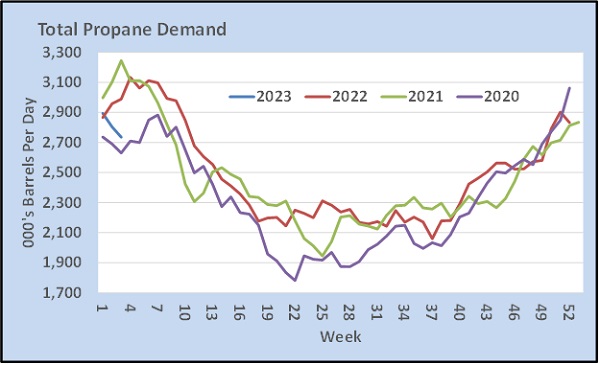

Chart 3 shows year-by-year combined (domestic and export) demand for U.S. propane. This year is a major departure from the past two years, but it is not unprecedented. Demand during the start of 2020 was similar to this year.

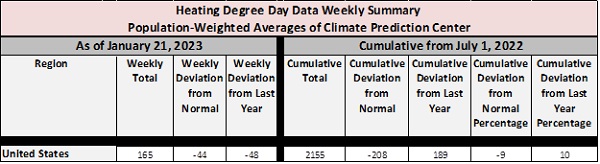

What has baffled us is that heating degree-days this winter are higher than they were last year.

From July 1, 2022, through Jan. 21, 2023, there were 189 more heating degree-days on a population-weighted average than the same period a year ago. That is a 10 percent increase. Yet, over that same period, U.S. primary (at the hubs) inventory has gone from 170,000 barrels below the previous year to 21.542 million barrels above the previous year. As an industry, we keep saying that increased production is the reason. That is certainly a factor, but the year-over-year increase in production from July 1 to Jan. 21 was 81,000 bpd. The bigger impact has been that domestic demand is down 275,000 bpd during that time frame year over year.

As we showed last week, petrochemicals are using a little less propane as a feedstock, but the industry data we see only shows it down about 8,000 bpd. So, we keep coming back to where in the heck is retail domestic demand given that heating degree-days are slightly higher than last year?

We proposed the theory last week that perhaps secondary (retailer) and tertiary (consumer) inventories have been pulled down during this time frame, resulting in less call-on supply from primary storage. Unfortunately, we have no way to quantify secondary and tertiary storage. Also part of the equation is that more fuel-use propane is being produced at the expense of propylene. But this seeming black hole in domestic demand keeps us up at night. It just feels like, somehow, we are working from a propane supply credit card, and at some point, the bill is going to come due.

We will admit that we are always worried about propane retailers and their customers getting blindsided by a rapid shift in market conditions that puts them behind in preparing for higher prices. Those situations can give our industry a black eye. Perhaps those worries make us see black holes that don’t really exist. Let’s hope.

Read the rest of this four-part series:

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.